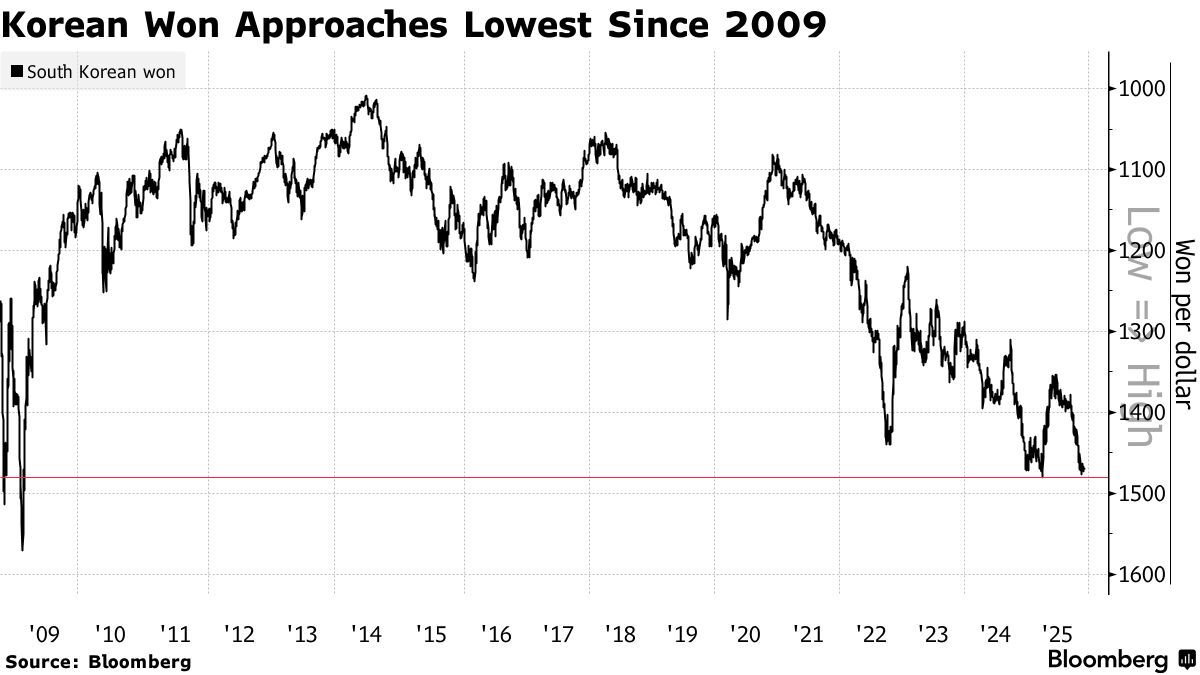

The USD/KRW exchange rate is approaching the 1500 red line! The South Korean authorities may vigorously intervene to protect the local currency

The Zhitong Finance App learned that some analysts pointed out that if the exchange rate of the won falls to the psychologically significant mark of 1 US dollar to 1,500 won — the highest level since 2009, the South Korean authorities may step up their efforts to defend the Korean won. Minhyeok Lee, an economist at Kookmin Bank of Korea, said that the state-owned National Pension Fund (NPS) has restarted the operation of selling US dollars to support the won. Once the exchange rate of the US dollar against the won is close to the 1480 to 1500 range, the agency may be more active. As of press release, the USD/KRW exchange rate was reported at 1471.55.

The Korean won has depreciated by more than 4% since the fourth quarter due to the continued sell-off of domestic stocks by foreign investors and the increase in overseas investment by residents. As a result, the South Korean authorities are under pressure to defend the local currency. South Korean government officials expressed concern over the growing uncertainty in the foreign exchange market, saying that the continued imbalance in residents' overseas investment may reinforce expectations that the Korean won will weaken, and agree that it is necessary to actively use all available tools to deal with it.

In response to this rapidly changing foreign exchange market situation, various departments of the South Korean government held an emergency meeting on November 24 to discuss specific measures to stabilize the market. According to reports, the meeting was led by the Ministry of Finance, and the Bank of Korea, the Ministry of Health and Welfare, and the National Pension Service participated. The conference focused on how to effectively ease the depreciation pressure of the Korean won and evaluate possible intervention measures.

Although the sharp depreciation of the Korean won has benefited exporters to a certain extent, it has also increased the upward pressure on import costs and may drive up domestic inflation. In particular, it has a conductive effect on the prices of people's livelihood necessities such as energy and food. Against the backdrop of increasing polarization in global monetary policy and rising geo-economic uncertainty, the policy challenges facing the Korean financial authorities have increased markedly.

As Korea's largest institutional investor (with about 545 billion US dollars in overseas assets), the National Pension Fund often helps ease depreciation pressure on the Korean won through hedging and foreign exchange operations. For example, the agency sold dollars and bought Korean won between January and May of this year.

EJ Ethan Seo, head of global marketing at BNP Paribas Seoul, said: “Recent reports on the National Pension Fund's foreign exchange hedging seem to have had a signal effect on the market. The market generally believes that the South Korean authorities will defend the 1500 mark.”

The National Pension Fund caps its hedging ratio at around 15% of its global assets and enforces it through a variety of methods, including selling forward contracts in US dollars. In the latest round of dollar sales, the fund used its “tactical hedging” (tactical hedging) program, which allows it to hedge up to 5% of overseas assets.

Woori Bank economist Gyeong-won Min said that as liquidity becomes tight at the end of the year, market expectations that the South Korean authorities may carry out year-end foreign exchange management are heating up, and “fund hedging operations may have some weight.”

Nasdaq

Nasdaq 華爾街日報

華爾街日報