Do Systemair’s (OM:SYSR) Steady Q2 Gains Quietly Reframe Its Long-Term Growth Trade-Offs?

- Systemair AB (publ) has reported past second-quarter 2025 results, with sales rising to SEK 3,271 million and net income reaching SEK 265 million, both higher than a year earlier.

- Over the first six months, sales and earnings per share from continuing operations edged higher year on year, underlining steady, profitability-supportive progress rather than rapid expansion.

- We’ll now examine how this modest uptick in quarterly sales and earnings shapes Systemair’s existing investment narrative around growth and risks.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Systemair Investment Narrative Recap

To own Systemair, you need to believe in steady, profitability-focused growth in ventilation and indoor climate solutions rather than dramatic expansion. The latest quarter’s modest uplift in sales and earnings supports this gradual progress, but does little to change the near term picture where the key catalyst remains execution on international projects, while exposure to weaker large European markets still looks like the biggest swing factor.

The recent earnings release for the second quarter and first half of 2025 is the clearest reference point here, confirming slightly higher sales and earnings per share from continuing operations versus a year earlier. That kind of incremental improvement may help Systemair absorb volatility from project-driven and regional mix effects, but it does not yet resolve the risk that slower conditions in mature Western European markets could cap revenue growth if activity remains muted.

Yet behind these steady numbers, investors should still be aware of...

Read the full narrative on Systemair (it's free!)

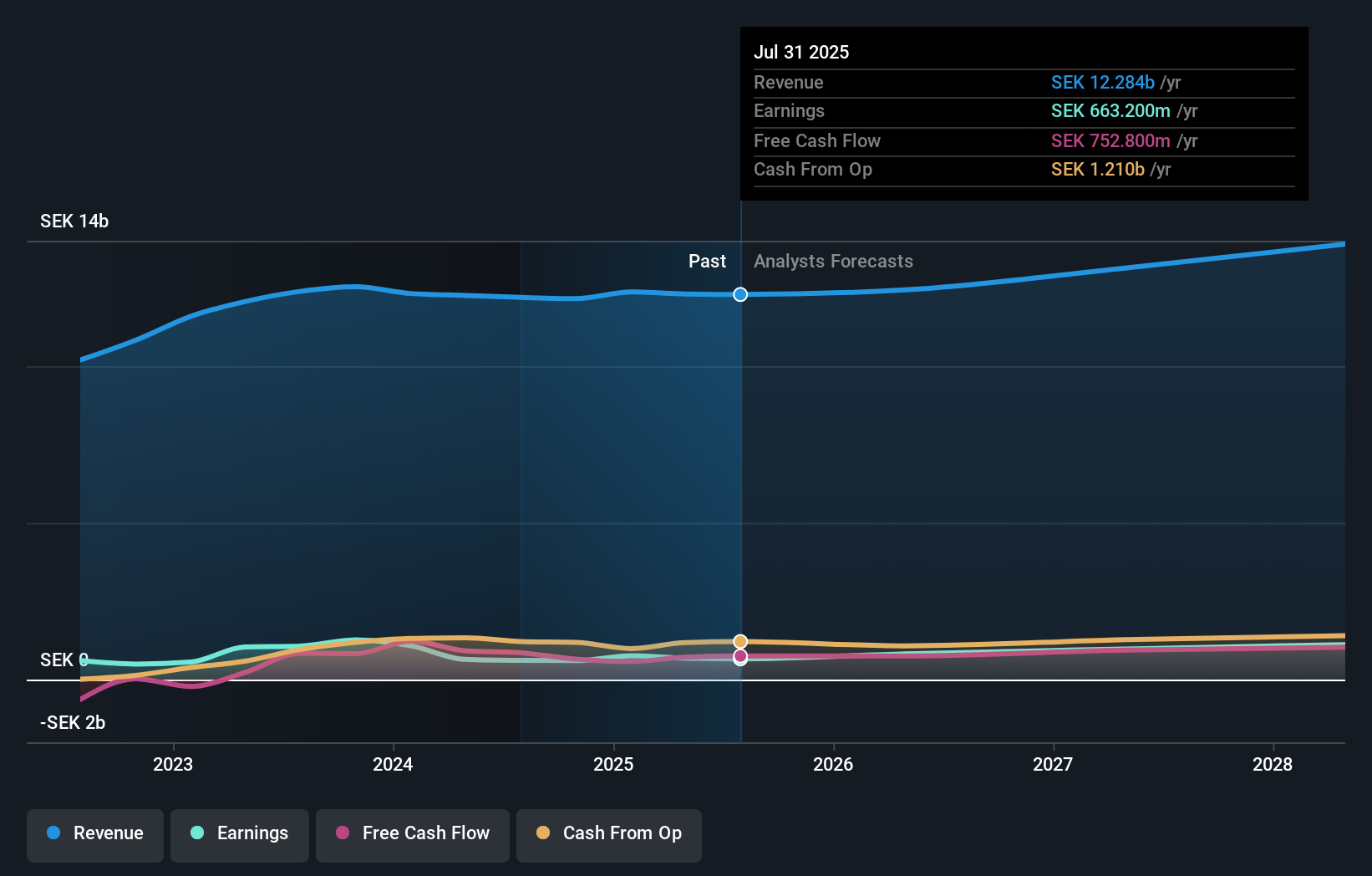

Systemair's narrative projects SEK13.9 billion revenue and SEK1.2 billion earnings by 2028. This requires 4.2% yearly revenue growth and an earnings increase of about SEK500 million from SEK663.2 million today.

Uncover how Systemair's forecasts yield a SEK95.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have only two fair value estimates for Systemair, between SEK95.33 and SEK105.49, showing how even a small sample can span a meaningful range. When you weigh these views against Systemair’s reliance on project-driven sales that can amplify regional demand swings, it underlines why exploring several perspectives on potential returns and risks can be helpful.

Explore 2 other fair value estimates on Systemair - why the stock might be worth just SEK95.33!

Build Your Own Systemair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Systemair research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Systemair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Systemair's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報