3 ASX Penny Stocks With Market Caps Under A$2B

Australian shares are poised for a robust start, with a projected 0.75% increase following the Federal Reserve's decision to trim U.S. rates for the third consecutive time. In this context, penny stocks—despite their somewhat outdated moniker—remain an intriguing investment area due to their potential for significant returns when backed by solid financials. This article explores three ASX penny stocks that exhibit strong financial foundations and could offer investors hidden value and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.385 | A$121.8M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.605 | A$72.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$439.55M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.21 | A$240.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Steadfast Group (ASX:SDF) | A$5.03 | A$5.52B | ✅ 5 ⚠️ 3 View Analysis > |

| West African Resources (ASX:WAF) | A$2.74 | A$3.17B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.90 | A$139.61M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 424 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Wildcat Resources (ASX:WC8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wildcat Resources Limited is a mineral exploration company based in Australia with a market capitalization of A$422.87 million.

Operations: The company's revenue segment includes A$1.53 million from its operations in Australia.

Market Cap: A$422.87M

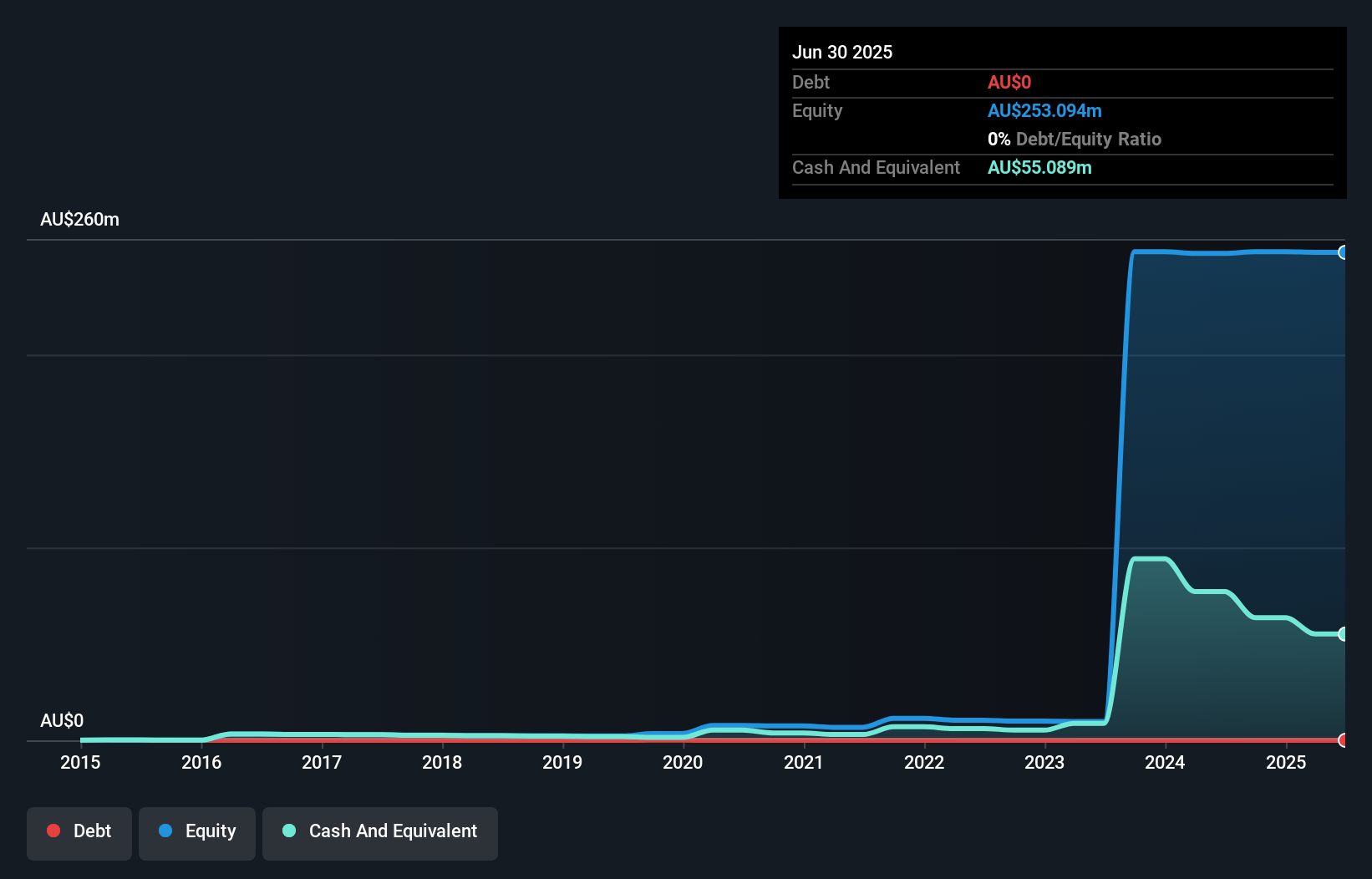

Wildcat Resources, with a market cap of A$422.87 million, remains pre-revenue despite reporting A$1.53 million in revenue for the year ending June 30, 2025. The company is unprofitable and has seen increasing losses over the past five years. However, it benefits from a strong cash position with short-term assets significantly exceeding liabilities and no debt on its balance sheet. The board is experienced but the management team is relatively new, which could impact strategic execution. Despite stable weekly volatility, earnings are forecast to decline by an average of 32.4% annually over the next three years.

- Jump into the full analysis health report here for a deeper understanding of Wildcat Resources.

- Understand Wildcat Resources' earnings outlook by examining our growth report.

Web Travel Group (ASX:WEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Web Travel Group Limited operates as an online travel booking service provider in Australia, the United Arab Emirates, the United Kingdom, and internationally with a market cap of A$1.74 billion.

Operations: The company generates revenue of A$362.6 million from its Business to Business Travel (B2B) segment.

Market Cap: A$1.74B

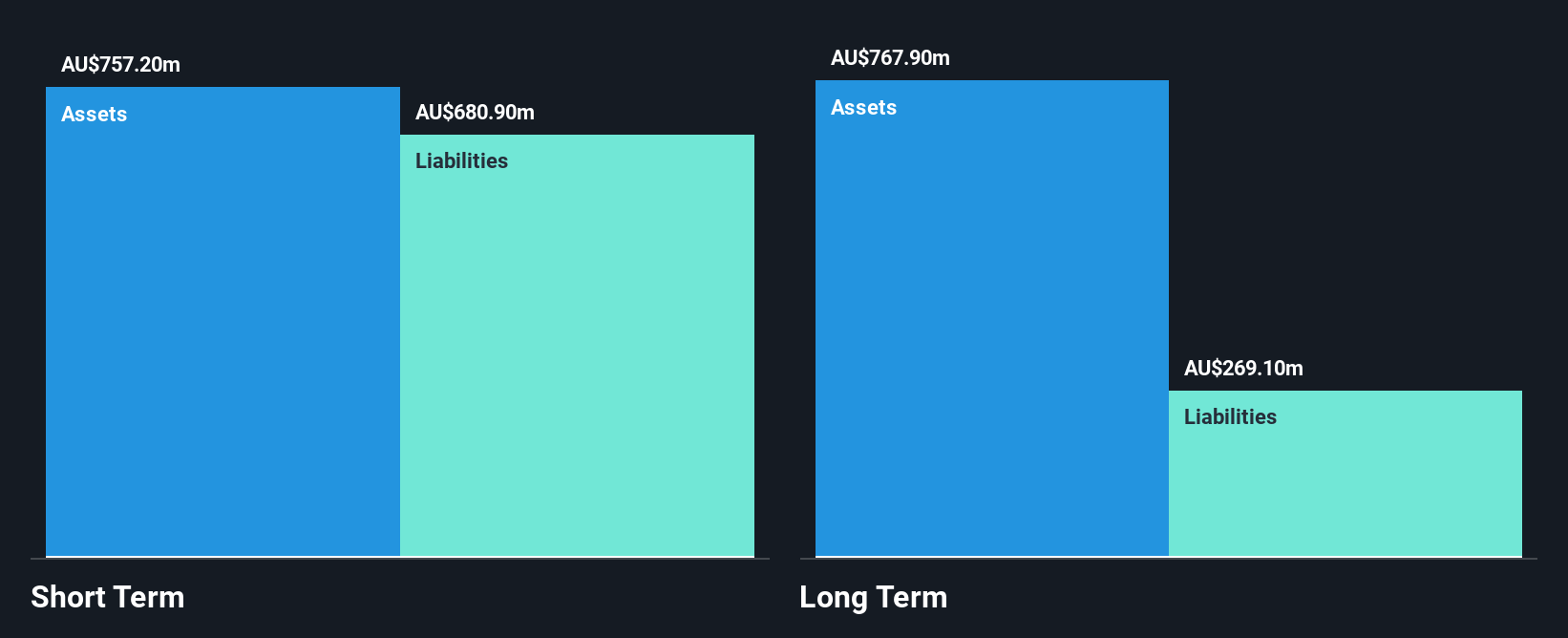

Web Travel Group Limited, with a market cap of A$1.74 billion, is navigating a challenging period marked by significant one-off losses impacting its financial results. Despite this, the company has shown resilience by reducing its debt to equity ratio over five years and maintaining strong interest coverage with EBIT at 8.1 times interest payments. Short-term assets exceed long-term liabilities significantly, although they fall short of covering short-term liabilities fully. Recent executive changes include the CFO's resignation, which may affect continuity in financial strategy execution as the company seeks new leadership amidst these transitions.

- Click here and access our complete financial health analysis report to understand the dynamics of Web Travel Group.

- Assess Web Travel Group's future earnings estimates with our detailed growth reports.

WIA Gold (ASX:WIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WIA Gold Limited, with a market cap of A$649.25 million, is involved in the exploration and evaluation of mineral properties in Namibia and Côte d’Ivoire through its subsidiaries.

Operations: WIA Gold Limited has not reported any revenue segments.

Market Cap: A$649.25M

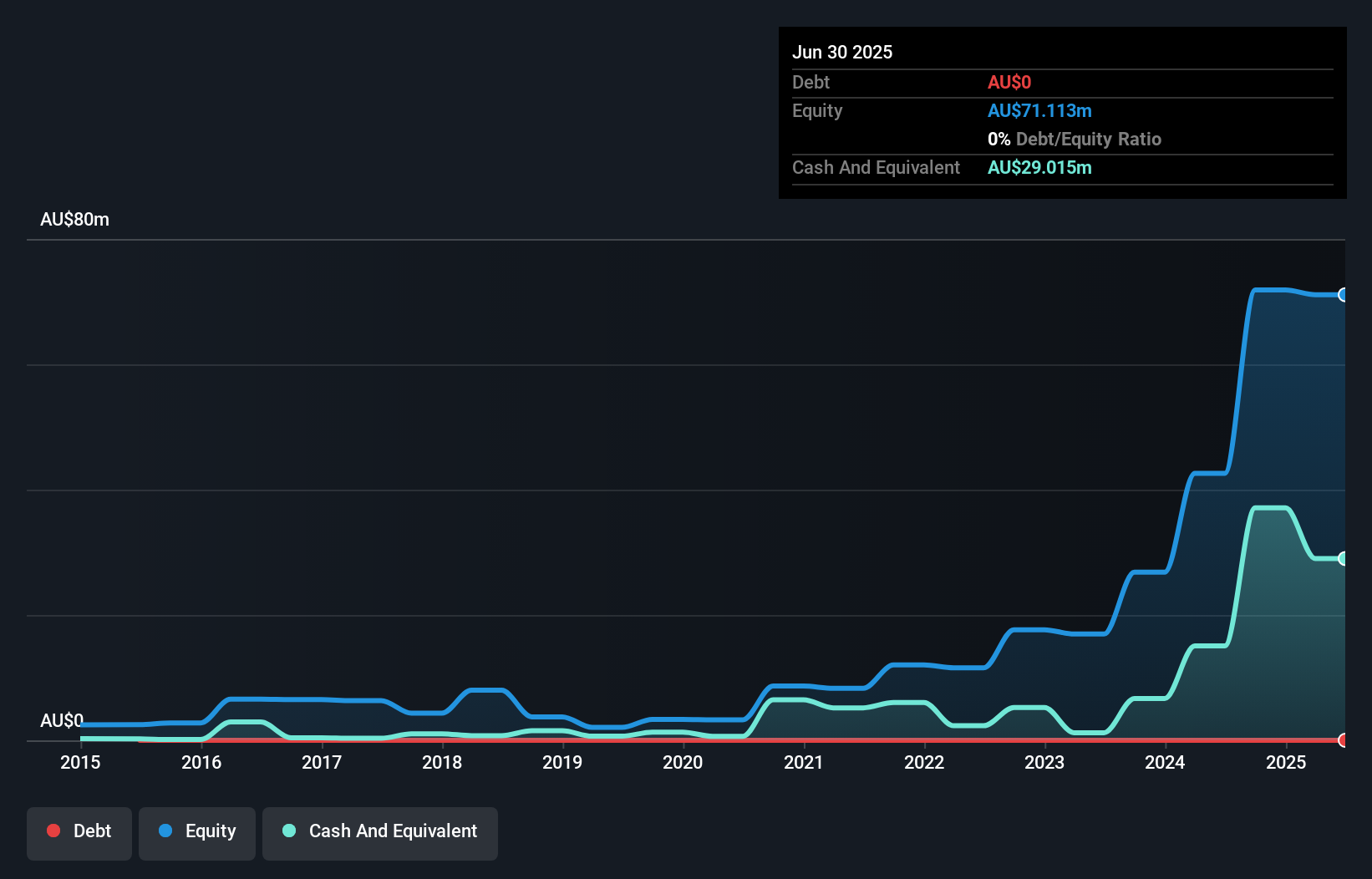

WIA Gold Limited, with a market cap of A$649.25 million, is pre-revenue and focuses on exploration activities in Namibia and Côte d'Ivoire. The company remains debt-free but faces challenges with increasing losses, reporting a net loss of A$5.09 million for the year ended June 2025. Despite sufficient short-term assets (A$29.6M) to cover liabilities (A$1.3M), its cash runway extends just over a year if current free cash flow trends persist. Management and board tenure are relatively new at under two years, indicating potential strategic shifts ahead as they navigate this early stage of development without significant revenue streams yet established.

- Click to explore a detailed breakdown of our findings in WIA Gold's financial health report.

- Gain insights into WIA Gold's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Click this link to deep-dive into the 424 companies within our ASX Penny Stocks screener.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報