Assessing LPL Financial (LPLA) Valuation as 2026 Outlook and Leadership Changes Signal Continued Growth

LPL Financial Holdings (LPLA) is back in focus as the firm pairs strong organic growth with fresh leadership, appointing Matthew Morningstar as chief legal officer to help steer an increasingly policy driven market backdrop.

See our latest analysis for LPL Financial Holdings.

The leadership refresh comes as momentum in LPL’s shares has been quietly building, with a 7 day share price return of 7.14 percent and a year to date share price return of 17.99 percent, supported by a 5 year total shareholder return of 288.95 percent that reflects investors rewarding its steady asset growth and improving profitability.

If this kind of steady compounding appeals to you, it may be an appropriate time to explore fast growing stocks with high insider ownership as potential next wave candidates for your watchlist.

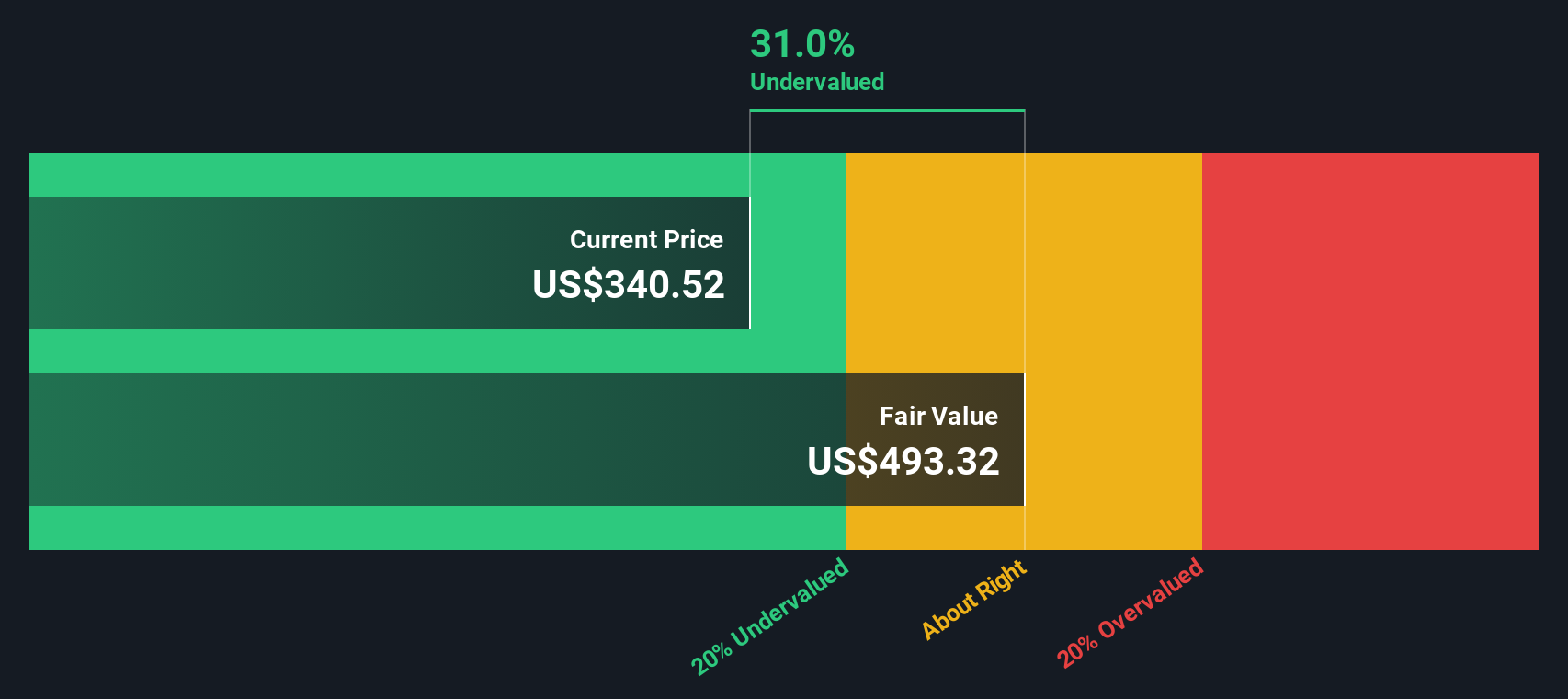

Yet with revenue and earnings compounding rapidly and shares already up strongly, the question now is whether LPL’s current valuation still leaves room for upside or if the market is already pricing in the next phase of growth.

Most Popular Narrative: 13.7% Undervalued

With LPL Financial Holdings last closing at $387.02 against a most popular narrative fair value near $448, the story hinges on sustained growth and margin expansion.

The acquisition and successful integration of platforms like Atria and Commonwealth, combined with industry-leading asset retention, are enabling LPL to further leverage economies of scale and expand its market share, positioning the firm for stronger long-term earnings growth as these integrations are completed.

Curious how ambitious revenue growth, rising margins, and a richer earnings multiple all connect to that higher fair value tag? The full narrative lays out the step by step financial roadmap, including how future earnings power and a premium valuation multiple interact to justify this upside view.

Result: Fair Value of $448.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on rate sensitive revenues and smooth M&A integration; any stumble there could quickly challenge the bullish margin expansion story.

Find out about the key risks to this LPL Financial Holdings narrative.

Another Lens On Valuation

Analyst narratives see LPL as roughly 14 percent undervalued, but our DCF model tells a different story, flagging the shares as overvalued versus an estimate of fair value around $359. If cash flow assumptions prove too rosy, today’s price may be incorporating more growth than is realistic.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own LPL Financial Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can shape a personalized narrative in just a few minutes: Do it your way.

A great starting point for your LPL Financial Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, put Simply Wall Street’s powerful screener to work and line up your next opportunities with clear data and focused themes.

- Capture potential mispricings by reviewing these 905 undervalued stocks based on cash flows that may offer stronger upside based on fundamentals than the broader market appreciates.

- Capitalize on innovation tailwinds by scanning these 26 AI penny stocks that could benefit from accelerating adoption of machine learning across industries.

- Strengthen your income strategy by targeting these 12 dividend stocks with yields > 3% that can help support a more reliable cash flow from your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報