Ciena (CIEN) Is Up 14.7% After New AI Backbone Wins and 1 Tbps India Trial Success

- In early December 2025, Constl announced it had deployed Ciena’s WaveLogic 6 Extreme solution in India after a live 1 Tbps trial over the 1,450 km Mumbai–Chennai route, doubling wavelength capacity while lowering cost per bit and power use, alongside Ciena’s role in a major North American AI network deal and a quantum-secured metro fiber trial in the US.

- Together, these developments underscore how Ciena’s high-capacity, power-efficient optics and quantum-ready transport are increasingly embedded in critical cloud, AI, and carrier networks across multiple regions.

- We’ll now examine how Ciena’s expanded role in AI infrastructure, highlighted by its North American AI project win, affects its investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Ciena Investment Narrative Recap

To own Ciena, you need to believe it can stay at the center of high-capacity, AI-ready networking while protecting margins in a competitive market. The Constl WL6e deployment, North American AI win, and quantum-secured trial all support that thesis, but they do not change the key near term catalyst, which is execution and visibility around large AI infrastructure contracts, or the main risk, which remains Ciena’s reliance on a concentrated set of hyperscaler and carrier customers.

Among recent developments, the North American AI infrastructure project stands out as most relevant, because it directly ties Ciena’s WaveLogic 6 and high-capacity optics to the AI network buildout that underpins the current growth story. As these large AI and cloud projects scale, the same deep integration with hyperscalers that supports revenue visibility can also amplify the impact if any of those customers shift spending or diversify suppliers.

Yet while AI wins are encouraging, Ciena’s dependence on a handful of large cloud and carrier customers is something investors should be aware of if...

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028. This requires 12.5% yearly revenue growth and about a $449.6 million earnings increase from $140.9 million today.

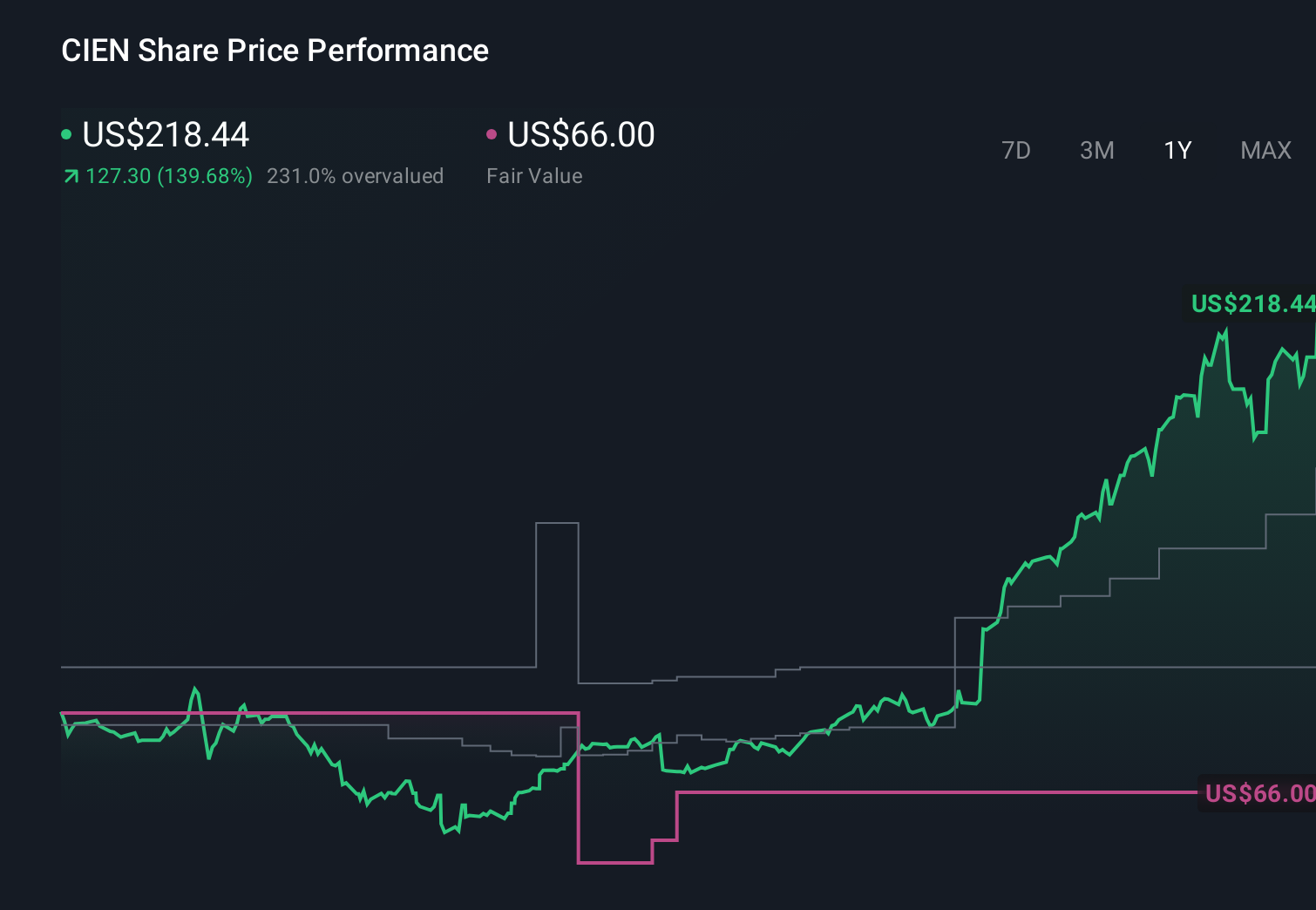

Uncover how Ciena's forecasts yield a $167.00 fair value, a 25% downside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$68 to US$167 per share, showing wide disagreement on upside. Against that backdrop, Ciena’s growing role in AI networks and deeper hyperscaler ties could magnify both the benefits of strong demand and the impact if those customers reassess spending, so it makes sense to compare several viewpoints before forming your own.

Explore 6 other fair value estimates on Ciena - why the stock might be worth less than half the current price!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報