Village Farms (NasdaqCM:VFF) Valuation After Texas License Setback and New Securities Law Investigation

Village Farms International (NasdaqCM:VFF) is back in the spotlight after disclosing it failed to secure a conditional medical cannabis license in Texas, a setback that was quickly followed by a securities law investigation announcement.

See our latest analysis for Village Farms International.

Despite the Texas licensing setback and fresh legal scrutiny, Village Farms International’s share price has still logged a powerful year to date, with a 316.78 percent year to date share price return and a 309.52 percent one year total shareholder return. This signals strong, if volatile, momentum off a still depressed five year total shareholder return base of negative 65.63 percent.

If this kind of high risk rebound story has your attention, it might be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

With revenue and profits now growing again and the share price still trading below the average analyst target, is Village Farms an overlooked turnaround candidate, or is the market already baking in a full cannabis fueled recovery?

Most Popular Narrative: 28.2% Undervalued

With Village Farms International last closing at $3.53 against a narrative fair value of $4.92, the valuation lens shifts firmly toward upside potential.

The company's ability to focus resources on cannabis, following the strategic privatization of produce operations and a robust cash position, allows it to pursue high margin opportunities and self fund growth projects, positively impacting future net margins and earnings quality.

Want to see how shrinking low growth revenue, surging profitability, and a reset earnings multiple can still support a higher fair value? The narrative leans on bold margin expansion, aggressive profit compounding, and a valuation framework that looks more like a quality compounder than a troubled turnaround. Curious which assumptions do the heavy lifting in that calculation and how sensitive the outcome is to even small changes? Read on to unpack the full logic behind this price target.

Result: Fair Value of $4.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story could unravel if international cannabis regulations stall or Canadian oversupply persists, compressing margins just as expansion investments ramp up.

Find out about the key risks to this Village Farms International narrative.

Another Angle on Valuation

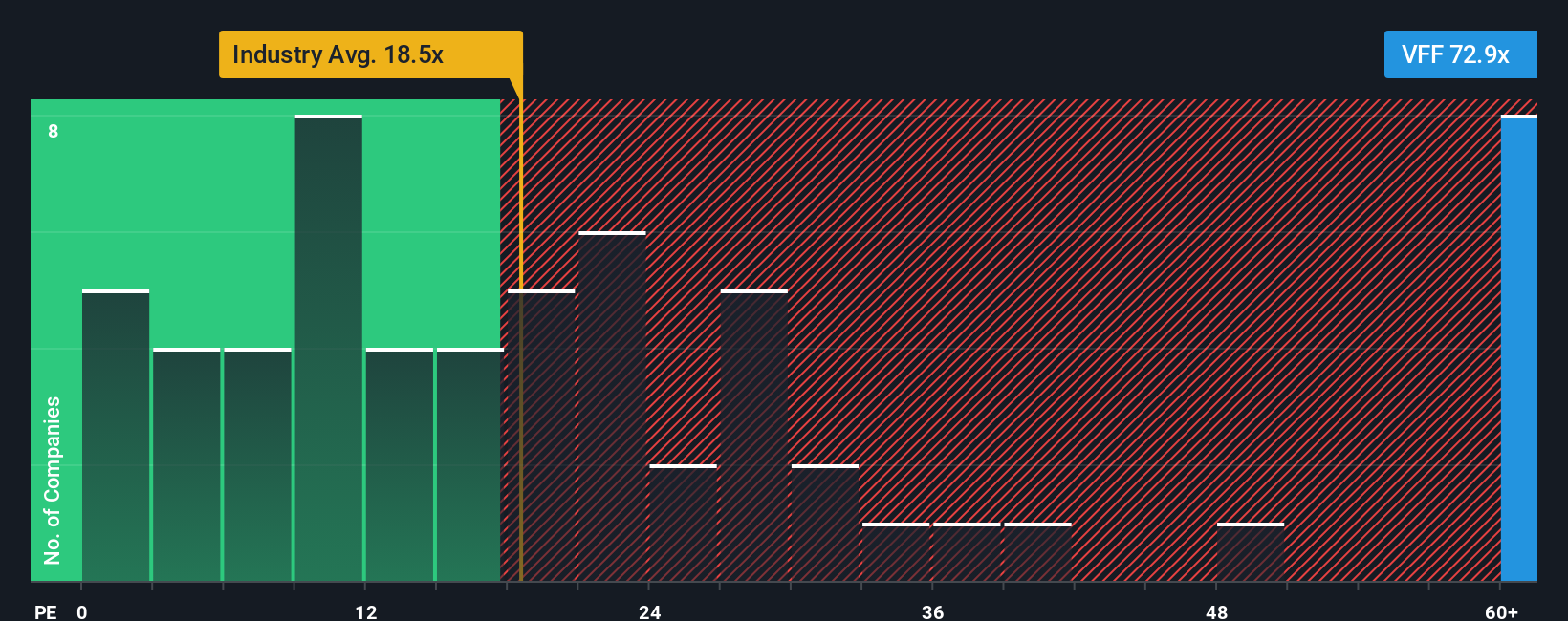

While the narrative fair value suggests upside, our earnings based lens flashes a warning. At about 72.7 times earnings versus a fair ratio of 52.8 times and a 21.5 times industry average, Village Farms screens expensive. Is the market paying up too far, too fast?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Village Farms International Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Village Farms International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking For Your Next Big Opportunity?

Do not stop at one turnaround story when you can quickly scan fresh ideas on Simply Wall Street and position yourself ahead of the next major move.

- Capture potential mispricings early by targeting these 906 undervalued stocks based on cash flows that may be trading well below their long term cash flow potential.

- Tap into structural growth by focusing on these 30 healthcare AI stocks that blend defensiveness with powerful innovation trends.

- Ride high risk, high reward momentum by zeroing in on these 81 cryptocurrency and blockchain stocks shaping the future of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報