Royal Bank of Canada (TSX:RY): Valuation Check After Strong Earnings, Rising NII and Dividend Hike

Royal Bank of Canada (TSX:RY) is back on investors’ radar after a strong full-year earnings print, rising net interest income, and an increased quarterly dividend that underlines management confidence in the bank’s capital position.

See our latest analysis for Royal Bank of Canada.

The strong full year earnings, dividend hike, and ongoing capital actions such as buybacks and preferred share redemptions appear to be feeding into positive sentiment. Royal Bank of Canada’s 1 month share price return of 10.64 percent has contributed to a 5 year total shareholder return of 162.33 percent, suggesting momentum is still building rather than fading at the current CA$227.75 share price.

If this kind of steady compounder appeals to you, it could be a good moment to look beyond the big banks and explore fast growing stocks with high insider ownership as potential next candidates for your watchlist.

But with Royal Bank of Canada now trading near analyst targets despite a sizable estimated intrinsic discount, should investors view the recent surge as leaving upside on the table, or as the market fully pricing in future growth?

Most Popular Narrative: 40% Undervalued

With Royal Bank of Canada closing at CA$227.75 versus a most popular narrative fair value of CA$228.60, the story leans on upgraded earnings power and durable profitability rather than a simple momentum trade.

The analysts have a consensus price target of CA$207.929 for Royal Bank of Canada based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$227.0, and the most bearish reporting a price target of just CA$169.0.

Want to see what is hiding behind that tight analyst range and higher fair value, including the long term revenue path, margin reset, and future earnings multiple assumptions?

Result: Fair Value of $228.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated credit losses and lingering macro uncertainty, especially around Canadian real estate and consumer health, could quickly challenge today’s growth and valuation assumptions.

Find out about the key risks to this Royal Bank of Canada narrative.

Another Way to Look at Value

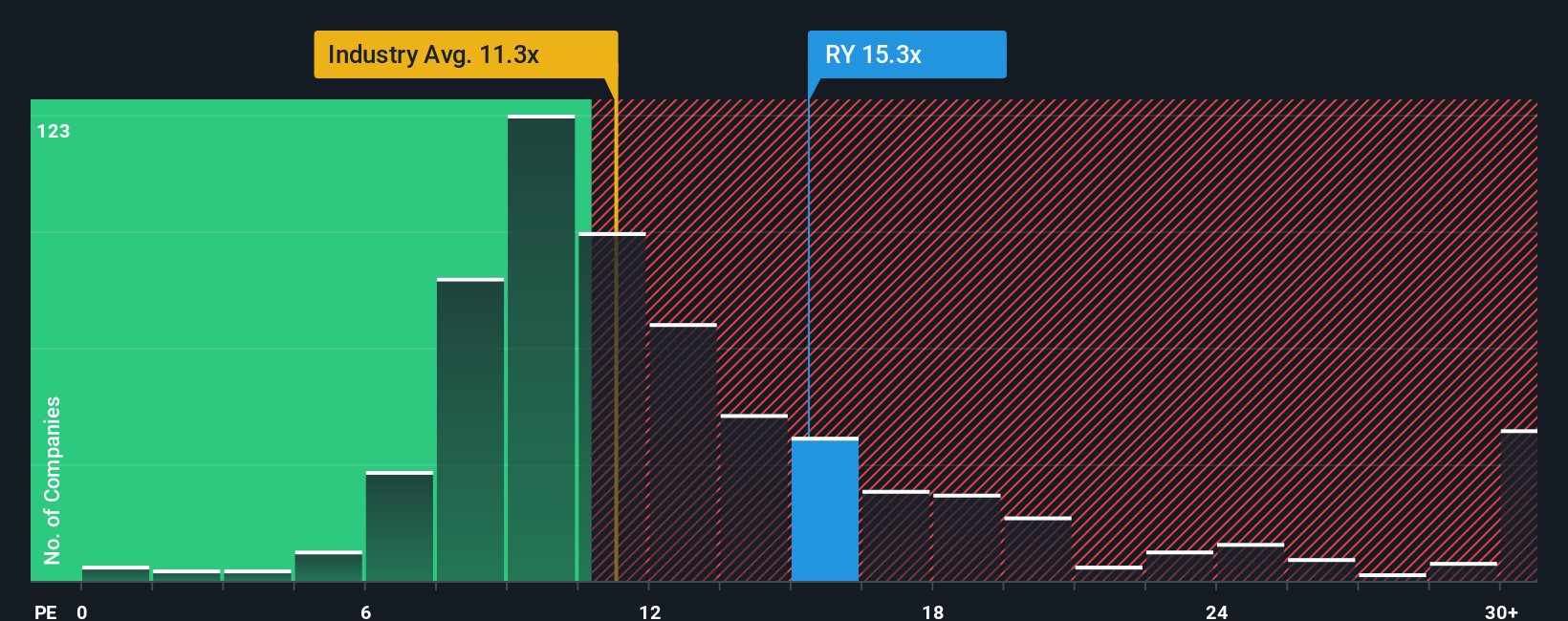

Royal Bank of Canada screens as expensive on earnings, with a price to earnings ratio of 16.1 times versus 14.4 times for peers and a fair ratio of 15 times. This suggests the market is already paying up for quality and growth. If sentiment cools, that premium could become a downside risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Bank of Canada Narrative

If you see things differently or simply prefer to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Royal Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential win by using the Simply Wall Street Screener to uncover opportunities you might otherwise overlook.

- Capitalize on mispriced quality by scanning these 906 undervalued stocks based on cash flows that look attractive based on future cash flows and fundamentals, before broader markets fully catch on.

- Ride structural growth trends by targeting these 30 healthcare AI stocks positioned at the intersection of medicine, data, and automation, where long runways can support outsized returns.

- Amplify your income strategy with these 12 dividend stocks with yields > 3% offering yields above 3 percent, so your portfolio works harder for you in every market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報