Hindware Home Innovation Limited (NSE:HINDWAREAP) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Hindware Home Innovation Limited (NSE:HINDWAREAP) shares have had a horrible month, losing 25% after a relatively good period beforehand. The recent drop has obliterated the annual return, with the share price now down 7.1% over that longer period.

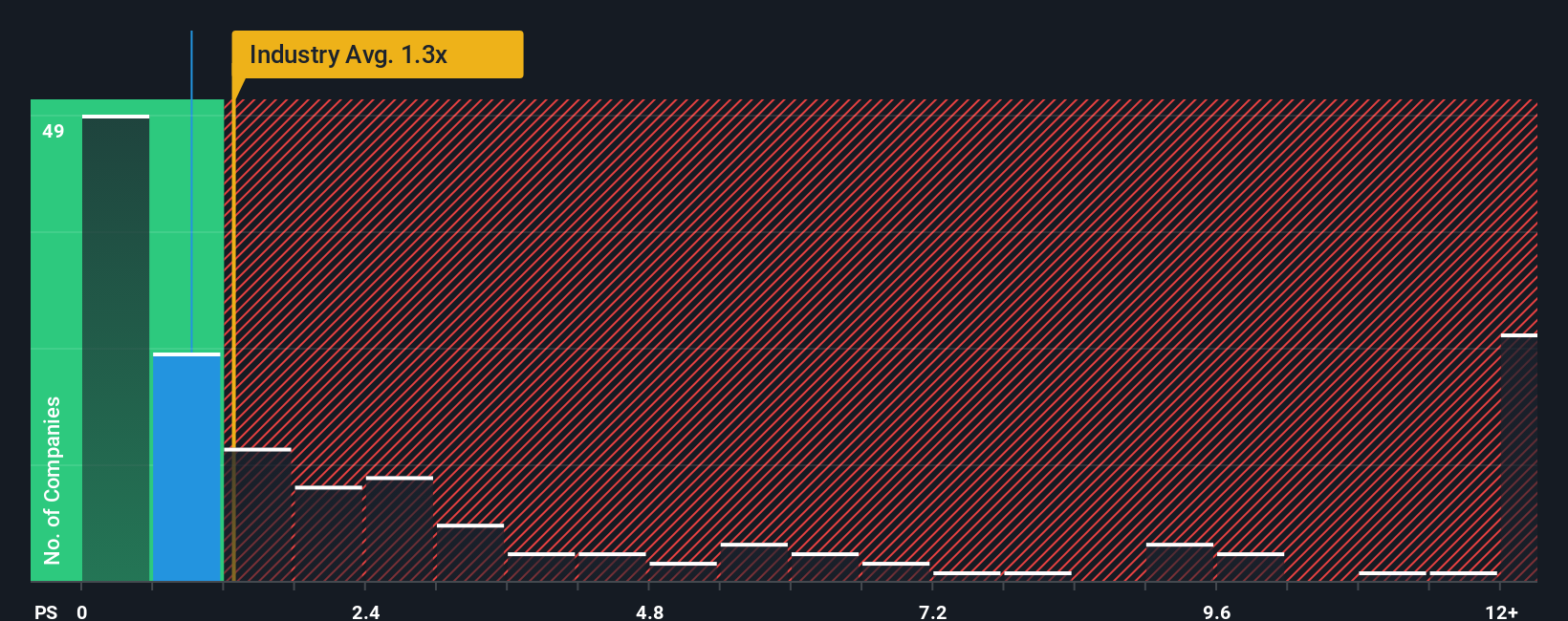

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Hindware Home Innovation's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Trade Distributors industry in India is also close to 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hindware Home Innovation

What Does Hindware Home Innovation's P/S Mean For Shareholders?

Hindware Home Innovation hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Hindware Home Innovation's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hindware Home Innovation's Revenue Growth Trending?

In order to justify its P/S ratio, Hindware Home Innovation would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.2%. This means it has also seen a slide in revenue over the longer-term as revenue is down 8.3% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.1%, which is noticeably less attractive.

With this information, we find it interesting that Hindware Home Innovation is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Hindware Home Innovation's P/S

With its share price dropping off a cliff, the P/S for Hindware Home Innovation looks to be in line with the rest of the Trade Distributors industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Hindware Home Innovation's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Hindware Home Innovation that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報