Investing in Avenue Supermarts (NSE:DMART) five years ago would have delivered you a 45% gain

Avenue Supermarts Limited (NSE:DMART) shareholders might be concerned after seeing the share price drop 17% in the last quarter. But the silver lining is the stock is up over five years. Unfortunately its return of 45% is below the market return of 136%.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

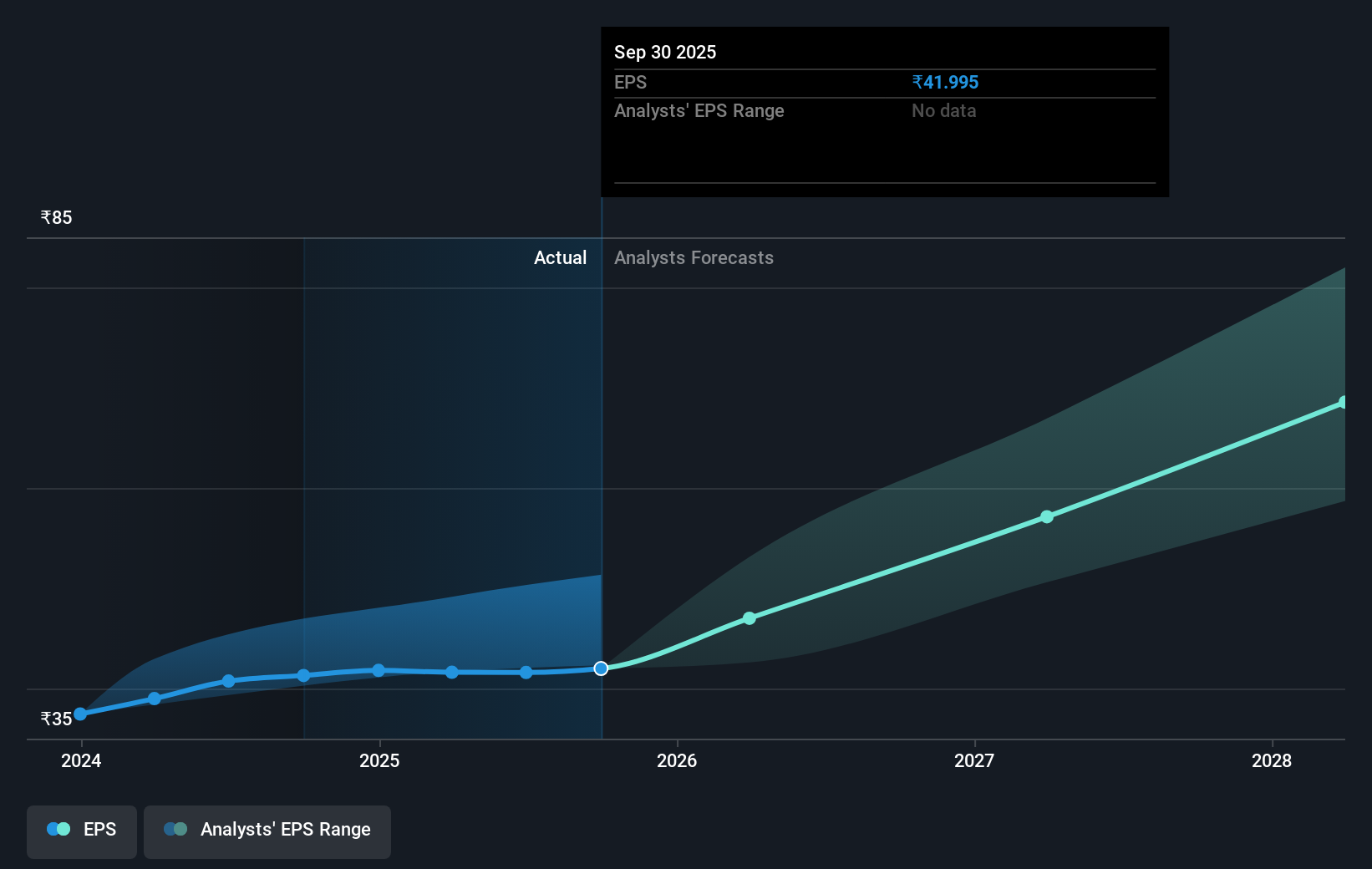

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Avenue Supermarts managed to grow its earnings per share at 25% a year. This EPS growth is higher than the 8% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. Of course, with a P/E ratio of 90.88, the market remains optimistic.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Avenue Supermarts' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Avenue Supermarts shareholders have received a total shareholder return of 2.9% over the last year. However, that falls short of the 8% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Before spending more time on Avenue Supermarts it might be wise to click here to see if insiders have been buying or selling shares.

We will like Avenue Supermarts better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報