Syndax Pharmaceuticals (SNDX) Valuation After Strong New Revuforj Data at Major Hematology Meeting

Syndax Pharmaceuticals (SNDX) just put fresh Revuforj data center stage at the ASH meeting, and that updated efficacy and safety picture is exactly what has investors rethinking the stock’s longer term potential.

See our latest analysis for Syndax Pharmaceuticals.

The stock has quietly rerated on the back of this steady clinical drumbeat, with a 1 month share price return of 24.11 percent and a year to date share price return of 38.57 percent, even though the 3 year total shareholder return remains negative. This suggests momentum is rebuilding as investors reassess both the growth runway and risk profile.

If Revuforj’s story has you looking more broadly at oncology and rare disease names, it could be a good moment to explore other potential winners among healthcare stocks.

Yet with shares still trading at a steep intrinsic discount to analyst targets despite Revuforj’s growing clinical validation, is Syndax an underappreciated growth story, or are investors already baking in the next leg of upside?

Most Popular Narrative Narrative: 50.4% Undervalued

With the narrative fair value set near $39 against a last close of $19.51, the spread highlights how aggressively future growth is being modeled.

Late-stage pipeline advancements (including frontline trials, lifecycle management, and expansion into new indications like IPF for Niktimvo), coupled with strong clinical data and market-leading positions in precision oncology, provide robust long-term growth avenues aligned with surging demand for innovative, targeted therapies, supporting sustained multi-year earnings momentum.

Curious what kind of revenue surge and margin reset could justify that kind of upside, and which future earnings multiple ties it all together? The full narrative breaks it down.

Result: Fair Value of $39.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative hinges on flawless Revuforj and Niktimvo execution, where safety perceptions, label delays, or stronger competitors could quickly erode that upside.

Find out about the key risks to this Syndax Pharmaceuticals narrative.

Another Way to Look at Value

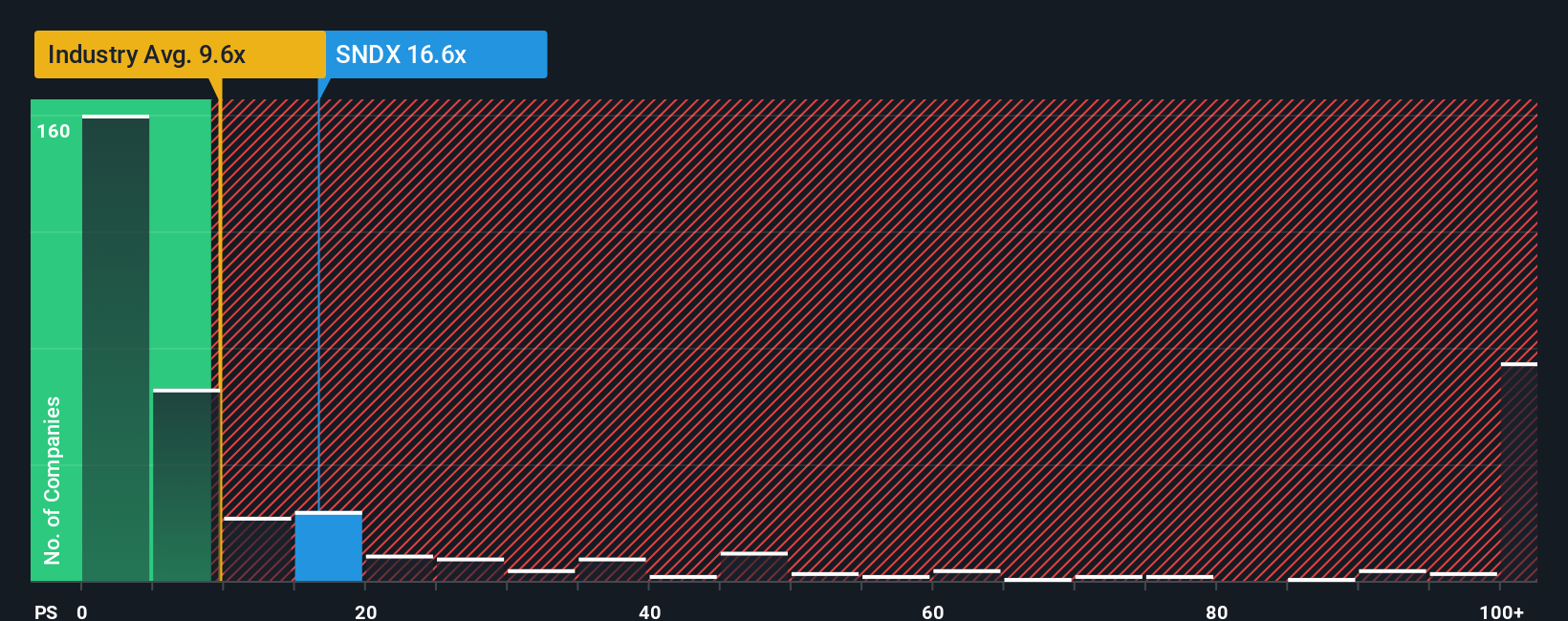

While the narrative framework flags Syndax as significantly undervalued, a simple sales based lens tells a very different story. At 15.2 times sales versus 12.1 times for the US Biotechs industry and 11.1 times for peers, the stock looks stretched, especially against a fair ratio of just 1.3 times sales.

That gap suggests investors are already paying a rich premium for future growth. This raises the question: is this a mispriced gem or a crowded momentum trade waiting for a setback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Syndax Pharmaceuticals Narrative

If this perspective does not line up with your own view, or you would rather lean on your own analysis, you can craft a fresh narrative in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syndax Pharmaceuticals.

Looking for more investment ideas?

Do not stop with one compelling thesis when the market is full of mispriced opportunities. Use these focused tools to sharpen your next move.

- Capture potential multi baggers early by scanning these 3595 penny stocks with strong financials that already pair tiny share prices with balance sheet strength and improving fundamentals.

- Ride structural tech tailwinds by targeting these 26 AI penny stocks positioned at the crossroads of artificial intelligence breakthroughs and scalable business models.

- Explore potential future cash flow engines by filtering for these 900 undervalued stocks based on cash flows that trade at meaningful discounts to their intrinsic value estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報