Yelp (YELP) Valuation Revisited as Discounted Multiples and Takeover Speculation Draw Investor Attention

Yelp (YELP) heads into its Raymond James TMT and Consumer Conference appearance next week with investors suddenly rethinking the story, as discounted valuation, Apple ties, and activist potential all bubble to the surface.

See our latest analysis for Yelp.

At around $29.91, Yelp’s year to date share price return of negative 23.45 percent and one year total shareholder return of negative 26.35 percent show a name that has lagged, even as talk of discounted valuation, strategic optionality, and activism starts to stir early momentum.

If this kind of setup interests you, it might be worth scanning fast growing stocks with high insider ownership to see which other companies combine growth potential with insiders who are heavily invested in the outcome.

With Yelp now trading at what looks like a steep intrinsic discount yet carrying only modest growth, are investors being handed a mispriced local advertising platform, or is the market already discounting everything its next chapter can deliver?

Most Popular Narrative: 13.2% Undervalued

With Yelp’s last close around $29.91 versus a narrative fair value near $34.44, the valuation gap narrows once you see what underpins the forecast.

The rapid adoption and expansion of AI-powered features like Yelp Assistant and the rollout of new entry points (including to logged-out users) are expected to boost overall user engagement and the stickiness of the platform, which should contribute to increased lead generation and higher advertising revenues over time. Strong momentum in AI search API usage and data licensing revenue demonstrates Yelp's growing value as a data partner for emerging AI-powered search players. The company has already achieved a $10 million annual run-rate, which is presented as evidence of significant potential for diversifying and expanding revenue streams.

Curious how modest top line growth, rising margins, and shrinking share count can still add up to an upside valuation story for Yelp? See what assumptions drive that price.

Result: Fair Value of $34.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural softness in core restaurant and retail categories, along with intensifying competition from larger digital platforms, could quickly undermine the upside case.

Find out about the key risks to this Yelp narrative.

Another Angle on Valuation

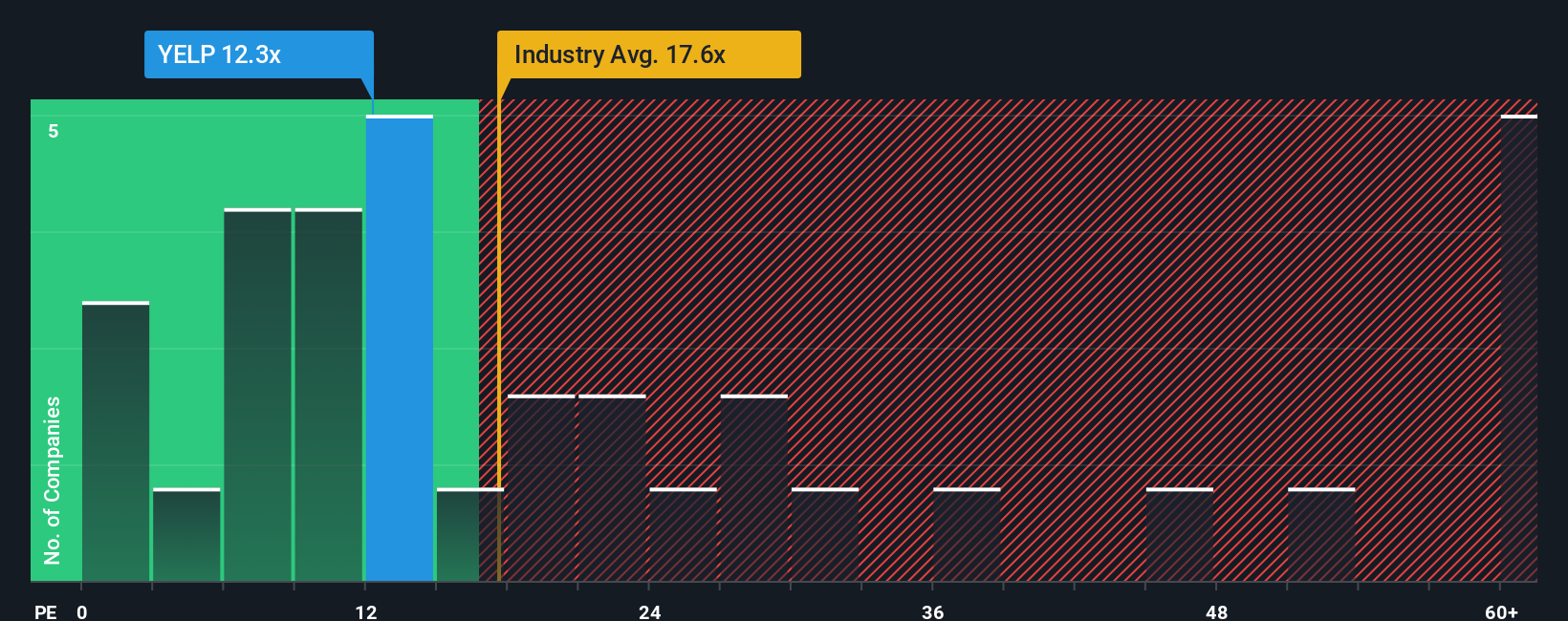

While the narrative fair value points to just 13.2 percent upside, our SWS model using the price to earnings ratio paints a starker picture. Yelp trades on 12.3 times earnings versus a fair ratio of 16 times, an industry on 17.1 times and peers on 11.9 times. This raises the question of whether sentiment has swung too far or the risk profile is still underpriced.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yelp Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Yelp.

Looking for more investment ideas?

Before you move on, scan handpicked opportunities that match your style so you can stay on top of potential opportunities.

- Explore potential market mispricings by reviewing these 895 undervalued stocks based on cash flows that may still be flying under the radar.

- Focus on structural growth trends by targeting these 30 healthcare AI stocks shaping the future of medicine and patient care.

- Consider cutting edge innovation by looking at these 27 quantum computing stocks working on breakthroughs that could redefine computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報