Mesoblast (ASX:MSB) Valuation Check as Investors Eye Piper Sandler Healthcare Conference Update

Mesoblast (ASX:MSB) steps into the spotlight this week as CEO Silviu Itescu presents at the Piper Sandler 37th Annual Healthcare Conference, and traders are watching for fresh color on strategy and late stage trials.

See our latest analysis for Mesoblast.

That anticipation has arrived on the back of a strong near term rebound, with a 1 month share price return of 27.03 percent and a 1 year total shareholder return of 65.88 percent, even though the year to date share price return remains negative.

If Mesoblast’s story has you watching the biotech space more closely, this is also a good moment to explore other healthcare stocks that could benefit from shifting sentiment in healthcare.

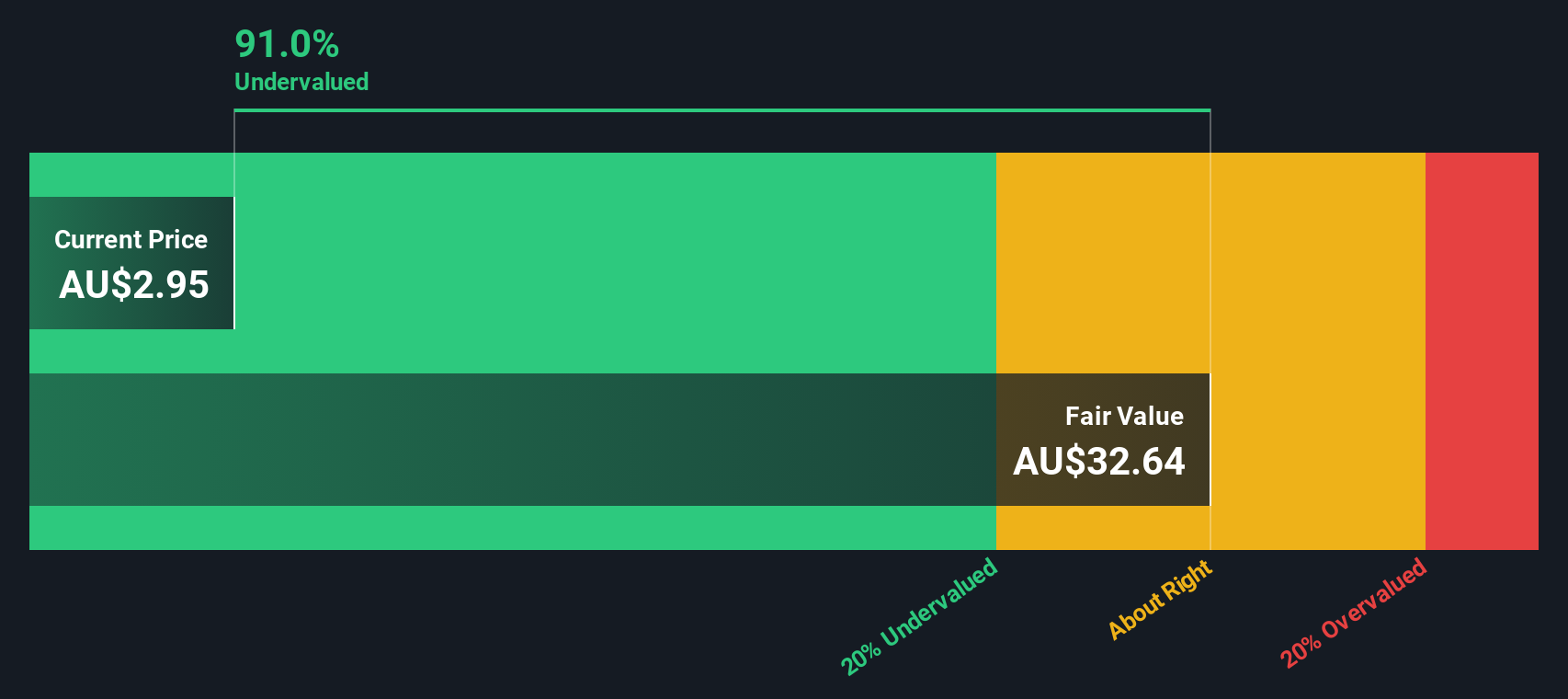

With analyst targets still sitting well above the current price and years of volatile returns behind it, the key question now is whether Mesoblast remains undervalued or if the market is already pricing in future growth?

Price-to-Book of 4x: Is it justified?

On a price-to-book ratio of 4 times at the last close of A$2.82, Mesoblast screens as cheaper than many local biotech peers on this metric.

The price-to-book ratio compares a company’s market value to its net assets. This can be a useful lens for asset heavy, early stage or loss making biotechs where earnings are not yet a reliable guide.

For Mesoblast, this suggests investors are not paying an extreme premium over the company’s balance sheet, even though the business remains unprofitable and is still funding late stage trials with higher risk borrowing rather than customer deposits.

Compared with the Australian Biotechs industry average of 6.7 times and a peer average of 4.7 times, Mesoblast’s 4 times multiple represents a material discount. This indicates the market is valuing its assets more conservatively than many rivals despite stronger recent share price performance.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 4x (UNDERVALUED)

However, several risks remain, including ongoing losses and funding needs, as well as potential clinical or regulatory setbacks that could quickly reverse sentiment.

Find out about the key risks to this Mesoblast narrative.

Another view from our DCF model

Our DCF model presents a far more dramatic picture, suggesting Mesoblast is trading about 90.8 percent below its estimated fair value of A$30.53, which would indicate a deep undervaluation if those long term growth forecasts hold up. Is the market still skeptical, or simply late to the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mesoblast for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mesoblast Narrative

If you would rather dive into the numbers yourself and shape a different view, you can build a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mesoblast.

Looking for more investment ideas?

Before you move on, consider scanning targeted stock ideas on Simply Wall St’s screener so potential opportunities do not slip past you.

- Target consistent income by reviewing these 15 dividend stocks with yields > 3% that may help support your portfolio with steadier cash returns.

- Look for possible market mispricing by assessing these 894 undervalued stocks based on cash flows, which may have more room to move if sentiment changes.

- Explore innovation trends by evaluating these 27 AI penny stocks involved in the real world adoption of AI.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報