Assessing CoreCivic (CXW) Valuation After Expanded $575 Million Revolving Credit Facility Boosts Liquidity

CoreCivic (CXW) just expanded its credit firepower by amending its existing facility to lift revolving commitments by $300 million to $575 million, giving the company more room to maneuver on future projects and refinancing.

See our latest analysis for CoreCivic.

The move comes as CoreCivic’s share price sits at $18.78, with a solid 1 month share price return of 10.8% but a weaker year to date share price return and a negative 1 year total shareholder return, suggesting near term momentum is improving even as the longer term picture remains mixed.

If this credit upgrade has you thinking about balance sheet strength and growth potential, it could also be a good moment to explore fast growing stocks with high insider ownership.

With liquidity strengthened, a discounted share price versus analyst targets, and mixed longer term returns, is CoreCivic quietly undervalued after recent weakness, or are investors already pricing in the next leg of growth?

Most Popular Narrative: 37.1% Undervalued

Compared with the last close at $18.78, the most widely followed narrative pegs CoreCivic’s fair value much higher, implying a sizable upside if its long range plan plays out.

The unprecedented increase in mandatory government funding for federal detention and border security (notably, $75 billion for ICE and multi-year appropriations through 2029) is catalyzing rapid contracting activity, reactivation of idle facilities, and will significantly boost CoreCivic's recurring revenue and occupancy rates in future quarters.

Pressing demand for secure and reliable detention capacity due to record high ICE populations and anticipated increases in U.S. Marshals Service detainees is driving new and expanded contracts. This will lift utilization rates at CoreCivic's facilities, with high incremental margins as idle beds are filled.

Curious how this narrative stretches today’s earnings into a much bigger business, with fatter margins and a richer future multiple, all discounted at 7.6%? The blueprint blends accelerating revenue, rising profitability, and shrinking share count into one aggressive fair value call. Want to see exactly how those moving parts stack up over the next few years?

Result: Fair Value of $29.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on continued federal detention funding, and any policy shift or loss of key ICE or Marshals contracts could quickly unwind expectations.

Find out about the key risks to this CoreCivic narrative.

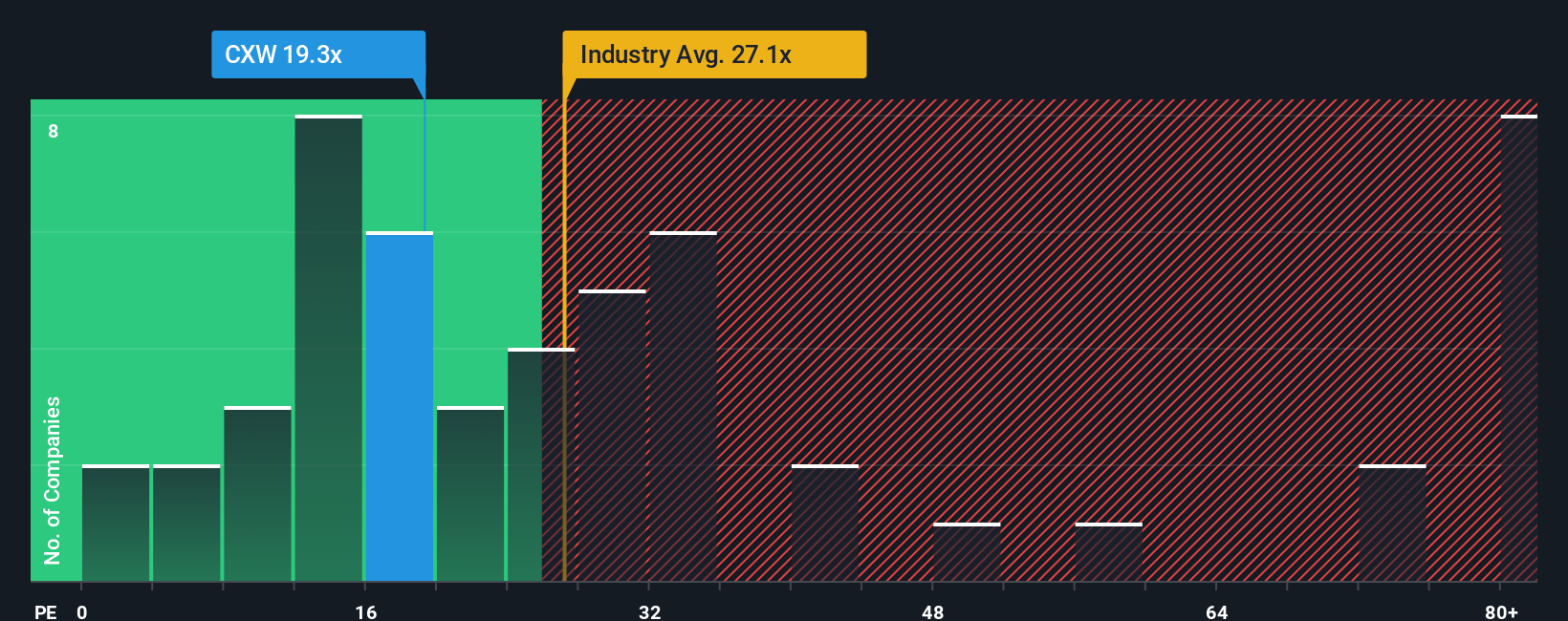

Another View: Market Ratios Tell a Different Story

Our SWS fair ratio approach suggests CoreCivic’s 18x price to earnings looks modest beside its 28.3x fair ratio estimate and the broader industry’s 23.4x. That gap hints at meaningful upside if sentiment shifts. How comfortable are you betting the market will close it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CoreCivic Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your CoreCivic research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunities by using the Simply Wall St screener to uncover focused ideas that most investors overlook.

- Target reliable cash generators by reviewing these 15 dividend stocks with yields > 3% for companies that can potentially support income and long term stability in your portfolio.

- Capitalize on breakthrough innovation by scanning these 27 AI penny stocks where early leadership in artificial intelligence could translate into outsized future returns.

- Hunt for mispriced opportunities through these 894 undervalued stocks based on cash flows, where strong cash flows and conservative expectations may leave meaningful upside on the table.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報