European Penny Stocks: Lucisano Media Group And 2 Other Promising Picks

As the European market experiences mixed returns, with indices like the STOXX Europe 600 showing modest gains on hopes of interest rate cuts, investors are keenly watching for opportunities that can weather economic fluctuations. Penny stocks, though often seen as relics of past market eras, remain relevant due to their potential for growth at lower price points. These stocks typically represent smaller or newer companies and can offer a blend of affordability and upside when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.74 | €84.18M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.985 | €14.63M | ✅ 4 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.21 | €42.64M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.98 | €27.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.02 | €64.06M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.335 | €383.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.24 | €309.61M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.83 | €27.79M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 279 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lucisano Media Group (BIT:LMG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lucisano Media Group S.p.A. is involved in film production and cinema management in Italy, with a market cap of €14.63 million.

Operations: The company's revenue is primarily derived from its operations in Italy, amounting to €50.99 million.

Market Cap: €14.63M

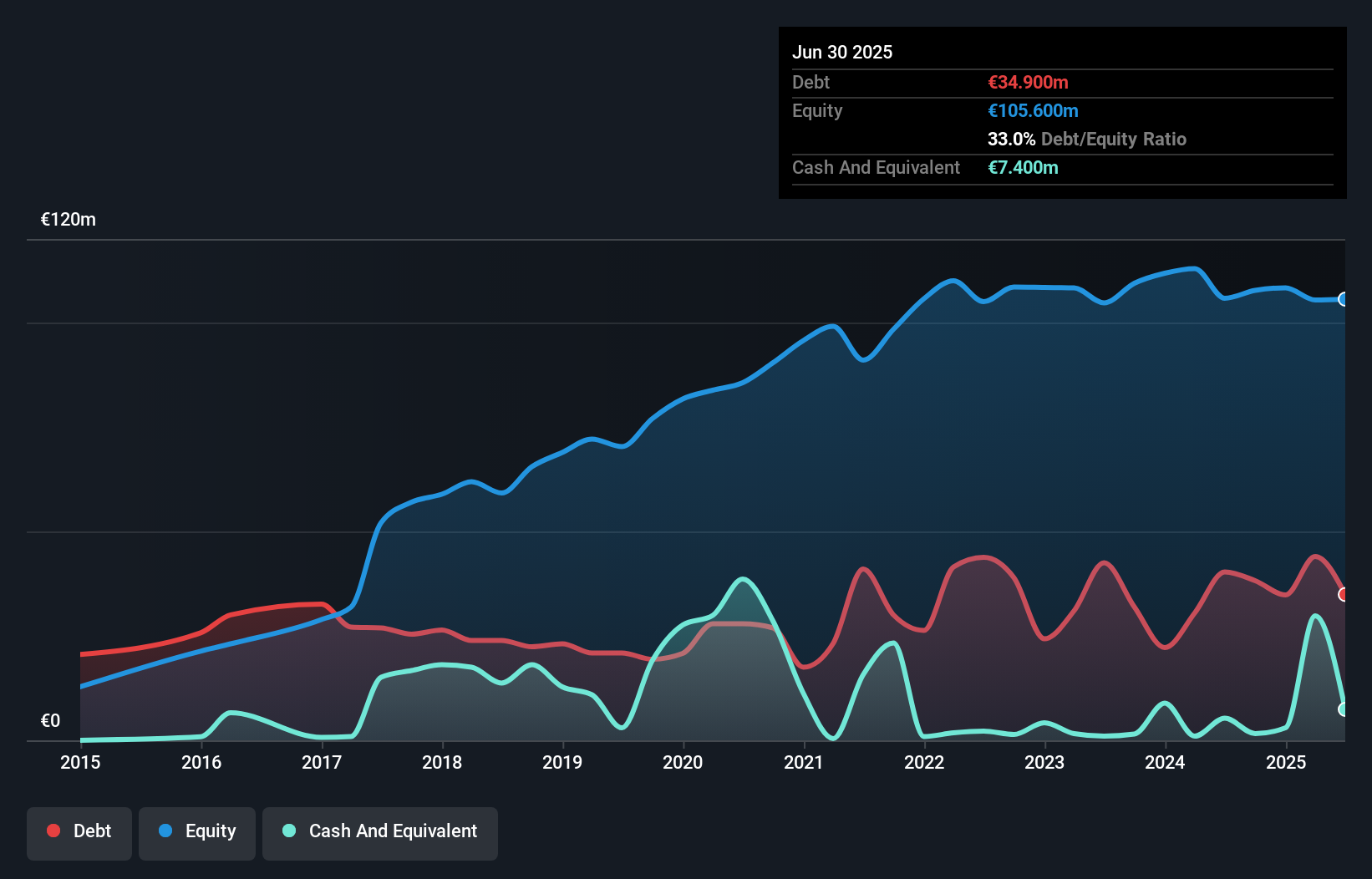

Lucisano Media Group S.p.A. has demonstrated strong earnings growth, with a 107.6% increase over the past year, significantly outpacing its five-year average of 25.3% annually. Despite this growth, the company faces challenges such as a high net debt to equity ratio of 43.2%, although its debt is well covered by operating cash flow at 70.5%. The company's price-to-earnings ratio of 2.6x suggests it is trading at good value compared to peers in the Italian market (16.5x). Recent earnings results showed net income rising to €4.12 million for the half-year ended June 2025 from €0.984 million previously, indicating improved profitability despite concerns over dividend sustainability and low return on equity (10.7%).

- Take a closer look at Lucisano Media Group's potential here in our financial health report.

- Gain insights into Lucisano Media Group's outlook and expected performance with our report on the company's earnings estimates.

Impact Developer & Contractor (BVB:IMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impact Developer & Contractor S.A. is a Romanian real estate developer with a market capitalization of RON467.08 million.

Operations: The company generates revenue primarily through the sale of residential properties, amounting to RON302.65 million, and construction services, contributing RON143.47 million.

Market Cap: RON467.08M

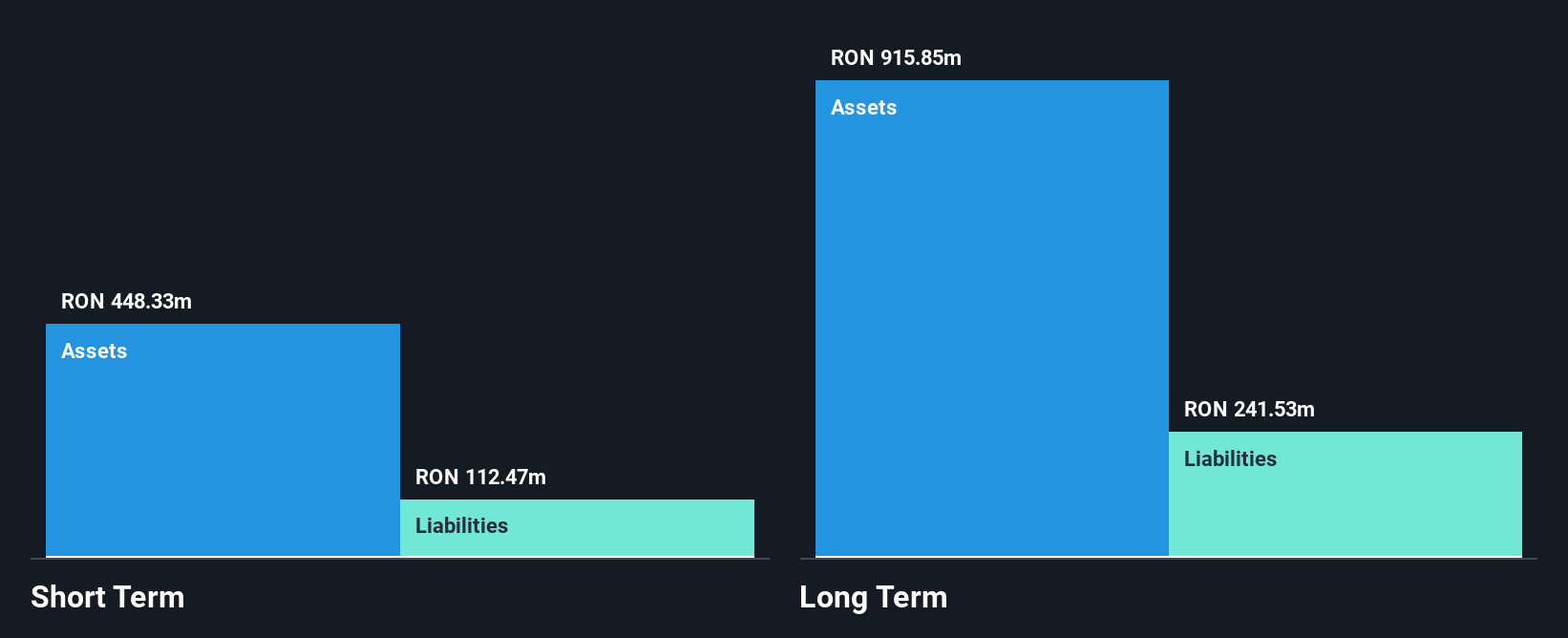

Impact Developer & Contractor S.A. has recently turned profitable, reporting a net income of RON54.55 million for the nine months ended September 30, 2025, compared to a net loss in the previous year. The company's revenue from residential sales and construction services has increased significantly to RON280.67 million from RON137.89 million year-on-year. Despite this growth, earnings were impacted by a large one-off gain of RON84.6 million, raising concerns about the sustainability of its profitability without such items. However, with short-term assets exceeding liabilities and debt well-covered by cash flow, financial stability appears solid for now.

- Jump into the full analysis health report here for a deeper understanding of Impact Developer & Contractor.

- Understand Impact Developer & Contractor's earnings outlook by examining our growth report.

Kamux Oyj (HLSE:KAMUX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kamux Oyj operates in the wholesale and retail sectors of used cars across Finland, Sweden, and Germany, with a market capitalization of €81.32 million.

Operations: The company generates €907.5 million in revenue from its retail gasoline and auto dealership segment.

Market Cap: €81.32M

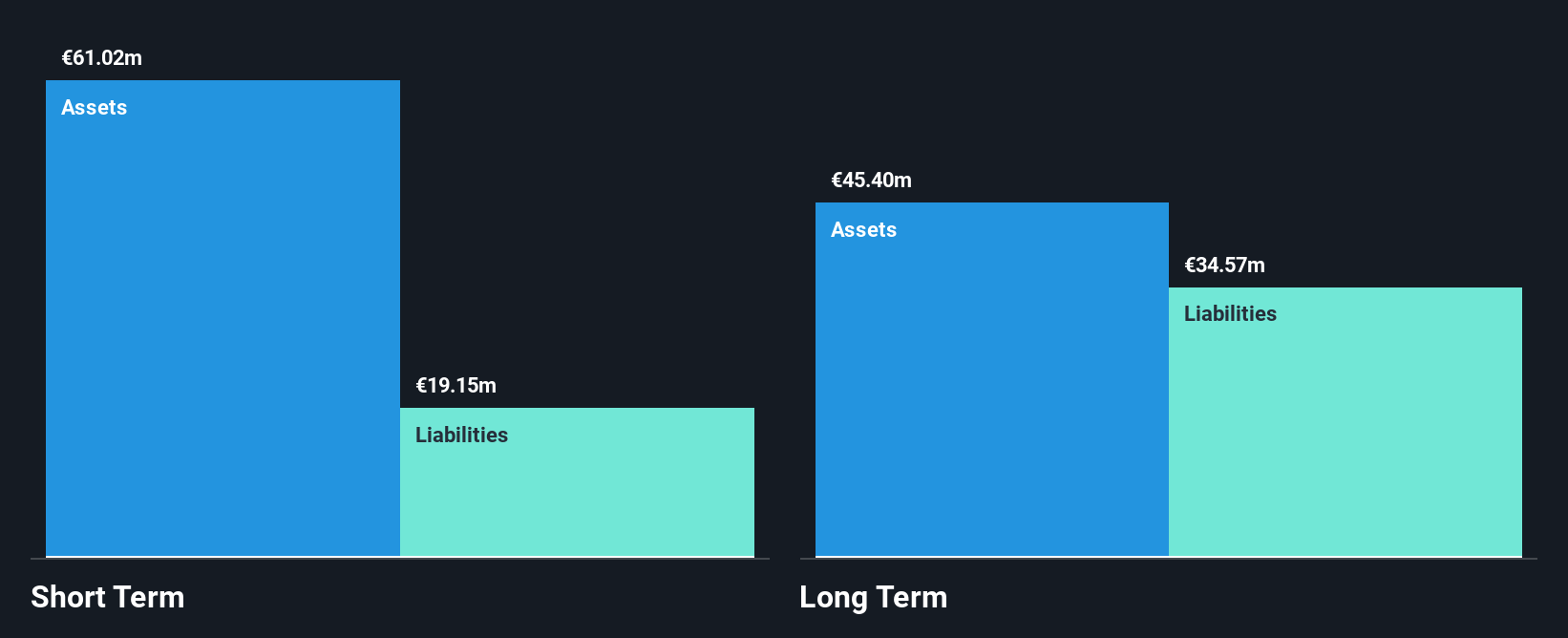

Kamux Oyj, a used car retailer in Finland, Sweden, and Germany, faces challenges despite trading at an attractive valuation 51.9% below its estimated fair value. The company is currently unprofitable with losses increasing over the past five years by 41.3% annually and has issued guidance for weaker-than-expected full-year results for 2025. Recent management changes include the reappointment of founder Juha Kalliokoski as CEO amid struggles in Swedish and German markets. Kamux's financials show short-term assets exceeding liabilities and satisfactory net debt to equity ratio of 14%, yet interest coverage remains weak at just 0.7x EBIT.

- Navigate through the intricacies of Kamux Oyj with our comprehensive balance sheet health report here.

- Gain insights into Kamux Oyj's future direction by reviewing our growth report.

Summing It All Up

- Click here to access our complete index of 279 European Penny Stocks.

- Ready For A Different Approach? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報