Taking Stock of Mitsui (TSE:8031): Is There Still Upside After Its Strong Recent Run?

Mitsui (TSE:8031) has quietly pushed higher, with the share price up about 7% over the past month and nearly 19% in the past 3 months, rewarding patient long term holders.

See our latest analysis for Mitsui.

Those recent gains sit on top of a much stronger backdrop, with a year to date share price return above 30% and a three year total shareholder return over 130% signaling solid, building momentum rather than a short lived bounce.

If Mitsui’s run has you thinking more broadly about Japanese cyclicals and global supply chains, it could be a good moment to explore fast growing stocks with high insider ownership.

With Mitsui now trading close to analyst targets and its fundamentals still grinding higher, investors face a key question: is there still upside left to capture, or has the market already priced in most of the future growth?

Most Popular Narrative Narrative: 2.9% Undervalued

With Mitsui last closing at ¥4,308 against a narrative fair value of about ¥4,438, the story leans toward modest upside grounded in measured expectations.

The ability to balance disciplined capital allocation maintaining a low net debt/equity ratio while considering shareholder returns with expenditures for digital transformation and supply chain innovation is likely to drive long term efficiency gains and margin expansion through operational improvement.

Curious how steady, low single digit growth, slimmer margins, and a richer future earnings multiple can still justify a higher valuation? The full narrative explains the math, the assumptions, and the quiet capital allocation moves that support this fair value.

Result: Fair Value of ¥4,438.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper commodity downturn or missteps in sprawling global investments could quickly pressure margins and challenge the more optimistic valuation path.

Find out about the key risks to this Mitsui narrative.

Another Way To Look At Value

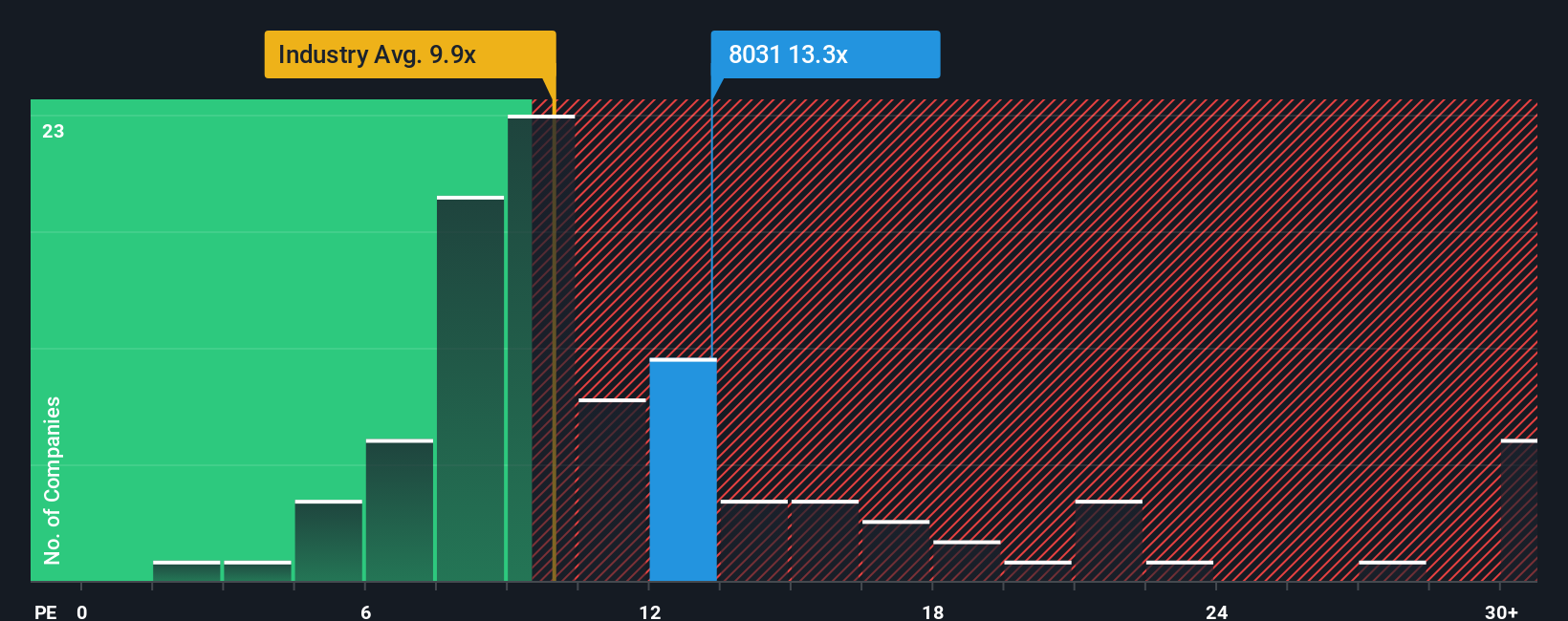

Using earnings multiples, Mitsui looks like a mixed bag. Its 13.6x P/E is cheaper than the wider JP market at 14.1x and peers at 14.4x, yet noticeably richer than the Trade Distributors industry at 9.9x. With a fair ratio nearer 22.1x, one question is whether the market is still underestimating how far sentiment could stretch in a bull phase.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsui Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a fresh, personalized view in minutes: Do it your way.

A great starting point for your Mitsui research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Mitsui, you could miss out on other powerful setups, so let Simply Wall St’s screener help you spot the next compelling opportunity.

- Capture potential multi baggers early by scanning these 3588 penny stocks with strong financials that already show strong financial underpinnings, not just speculative hype.

- Position yourself at the heart of the tech shift by reviewing these 27 AI penny stocks poised to benefit from accelerating demand for intelligent automation.

- Lock in value focused opportunities by targeting these 899 undervalued stocks based on cash flows where robust cash flows are not yet fully reflected in the current share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報