Is MDA Space Still Attractive After Recent Contract Wins and Sharp Multi Year Rally?

- If you are wondering whether MDA Space is still a smart way to get exposure to the space economy or if the market has already priced in the upside, this breakdown will help you assess whether the current share price makes sense.

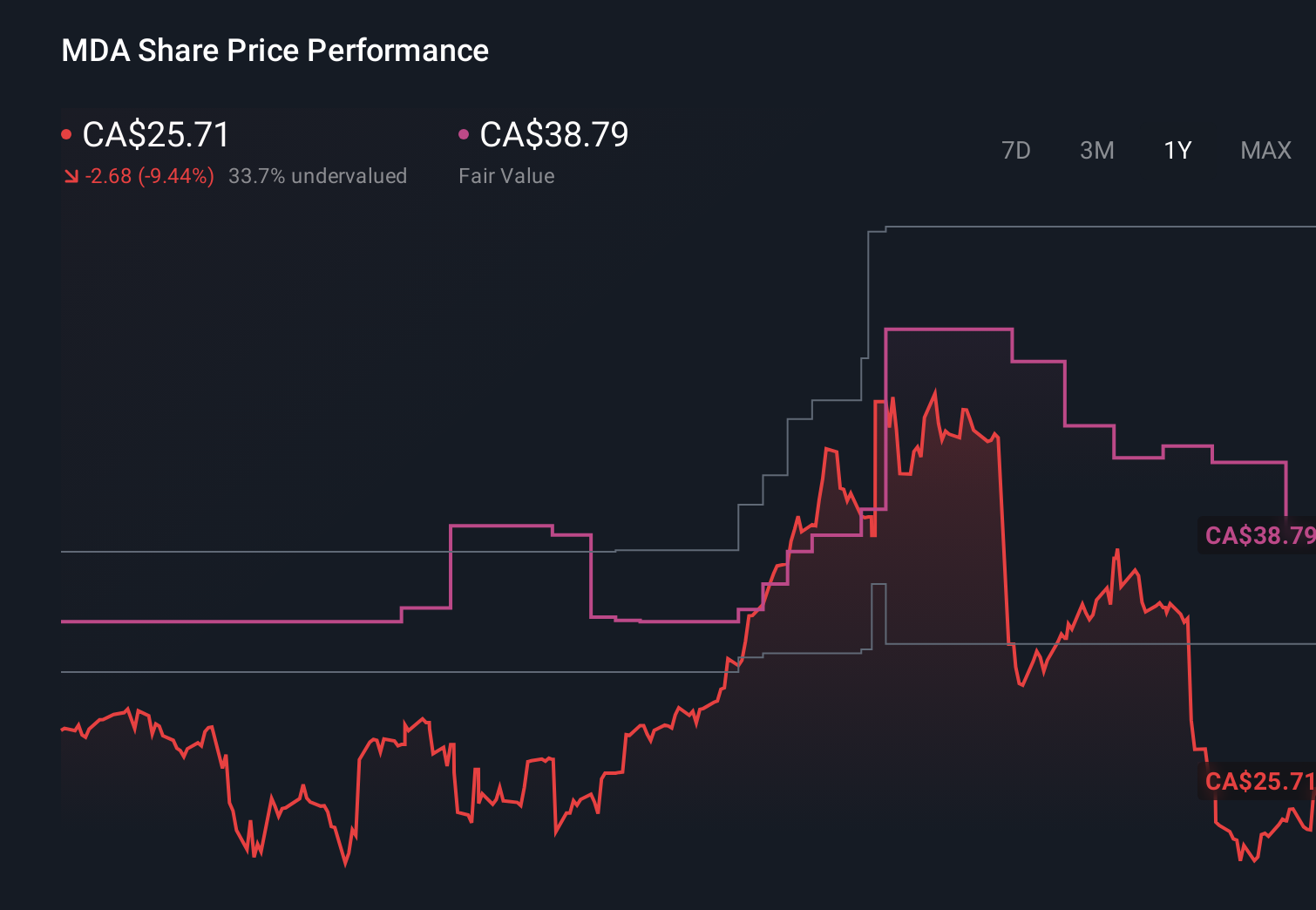

- The stock has bounced 9.8% over the last week and 8.9% over the past month, even though it is still down 10.9% year to date after a 345.4% gain over three years. This pattern suggests investors are actively reassessing both its growth potential and risk profile.

- Recent headlines have focused on MDA Space winning new satellite and robotics contracts and deepening its role in key government and commercial space programs, reinforcing the idea that it is becoming a critical infrastructure player. At the same time, coverage around national space strategy and increased sovereign spending has highlighted how MDA could be a long term beneficiary of structural tailwinds rather than just a short term trade.

- On our numbers, MDA Space scores a 3/6 valuation check. This means it looks undervalued on half of the metrics we track, but not cheap across the board. Next, we will unpack what each valuation approach is really saying about the stock and finish by exploring a more powerful way to think about fair value altogether.

Find out why MDA Space's -10.9% return over the last year is lagging behind its peers.

Approach 1: MDA Space Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in CA$, adjusting for risk and the time value of money.

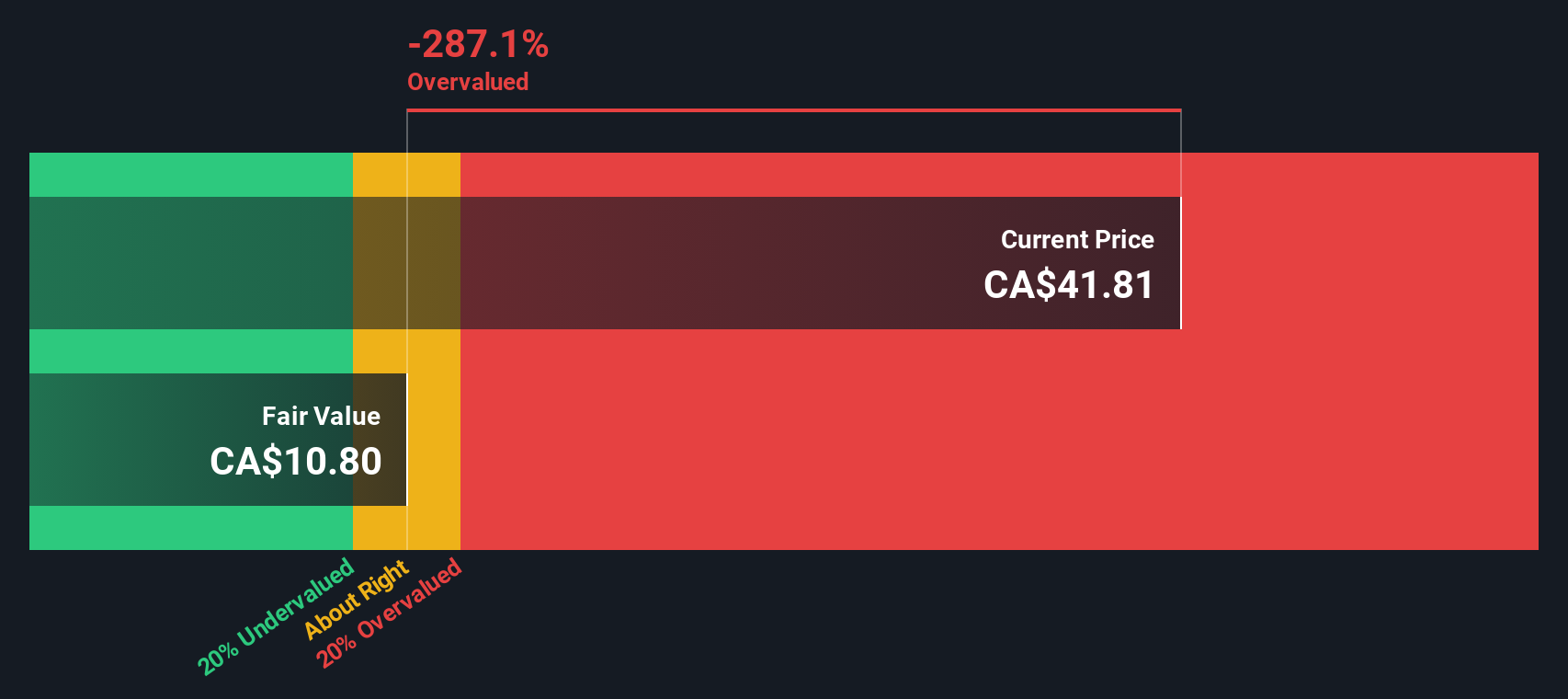

For MDA Space, the 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about CA$443.8 million, then applies analyst forecasts and longer term extrapolations. Analyst estimates see free cash flow rising to roughly CA$140.0 million by 2027, before Simply Wall St extends the projections further, with cash flows gradually tapering off over the following years as growth normalizes.

When all these projected cash flows are discounted back, the model arrives at an intrinsic value of about CA$6.43 per share. Compared with the current market price, this implies the stock is about 294.8% above its DCF based fair value, suggesting investors are paying a steep premium for long term growth and strategic positioning.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MDA Space may be overvalued by 294.8%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: MDA Space Price vs Earnings

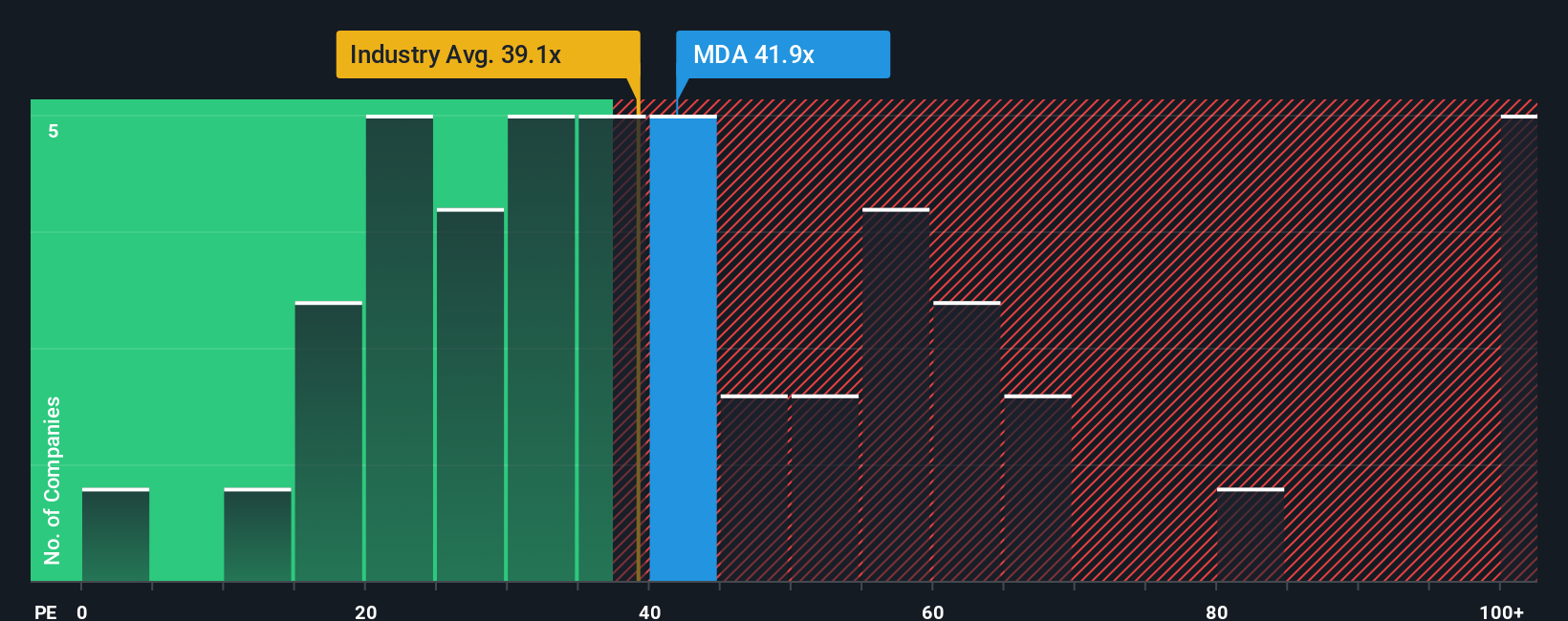

For a profitable company like MDA Space, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying today for each dollar of current earnings. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty should translate into a lower, more conservative multiple.

MDA Space currently trades on a PE of about 29.3x. That is below the broader Aerospace and Defense industry average of roughly 46.0x, and broadly in line with its direct peer group at around 29.8x, suggesting the market is pricing MDA as a solid but not extreme growth story. Simply Wall St goes a step further with its Fair Ratio, a proprietary PE estimate of 25.1x that reflects MDA Space’s specific earnings growth outlook, margins, industry positioning, market cap and risk profile. This tailored benchmark is more insightful than simple peer or industry comparisons because it adjusts for what actually drives a justified multiple for this business rather than assuming one size fits all.

With the current PE of 29.3x sitting above the Fair Ratio of 25.1x, the multiple analysis points to MDA Space being modestly overvalued on earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MDA Space Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple tool on Simply Wall St’s Community page that lets you turn your view of MDA Space’s business into a story that links its strategy and risks to specific forecasts for revenue, margins and earnings, and then to a fair value you can directly compare with today’s share price. Instead of only leaning on static multiples or a single DCF, a Narrative captures your assumptions in one place, updates dynamically as new news or earnings come in, and stays easy to follow so you can see exactly why your estimated fair value moved. For example, one MDA Space Narrative might assume revenue growth above 26% a year and justify a fair value around CA$44 per share, while a more cautious Narrative might use mid teens growth and assign fair value closer to CA$39, showing how different perspectives on the same company translate into different but transparent price targets.

Do you think there's more to the story for MDA Space? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報