Assessing PTC’s 2025 Valuation After Share Price Pullback and DCF Upside Potential

- If you are wondering whether PTC is quietly becoming a bargain or if the market is rightly cautious at today’s price, you are in the right place to unpack what the numbers are really saying about its value.

- Despite a solid 40.6% gain over three years and 53.2% over five years, the stock is down 12.6% over the last year and 4.7% year to date, suggesting sentiment has cooled even as the longer term picture still looks constructive.

- Recent headlines have focused on PTC’s continued push in product lifecycle management and industrial IoT software, alongside strategic partnerships that aim to deepen its footprint in manufacturing and engineering workflows. At the same time, investors are debating whether this innovation pipeline and recurring revenue profile justify the current valuation after the share price pullback.

- On our framework, PTC scores a full 6 out of 6 on undervaluation checks, which makes it a candidate to test across multiple valuation approaches. We will also finish by looking at another way to think about its worth in a real world portfolio.

Find out why PTC's -12.6% return over the last year is lagging behind its peers.

Approach 1: PTC Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For PTC, the latest twelve month Free Cash Flow is about $846.6 Million, and analysts plus Simply Wall St projections see this rising to roughly $2.3 Billion by 2030, with further growth extrapolated beyond the initial analyst horizon.

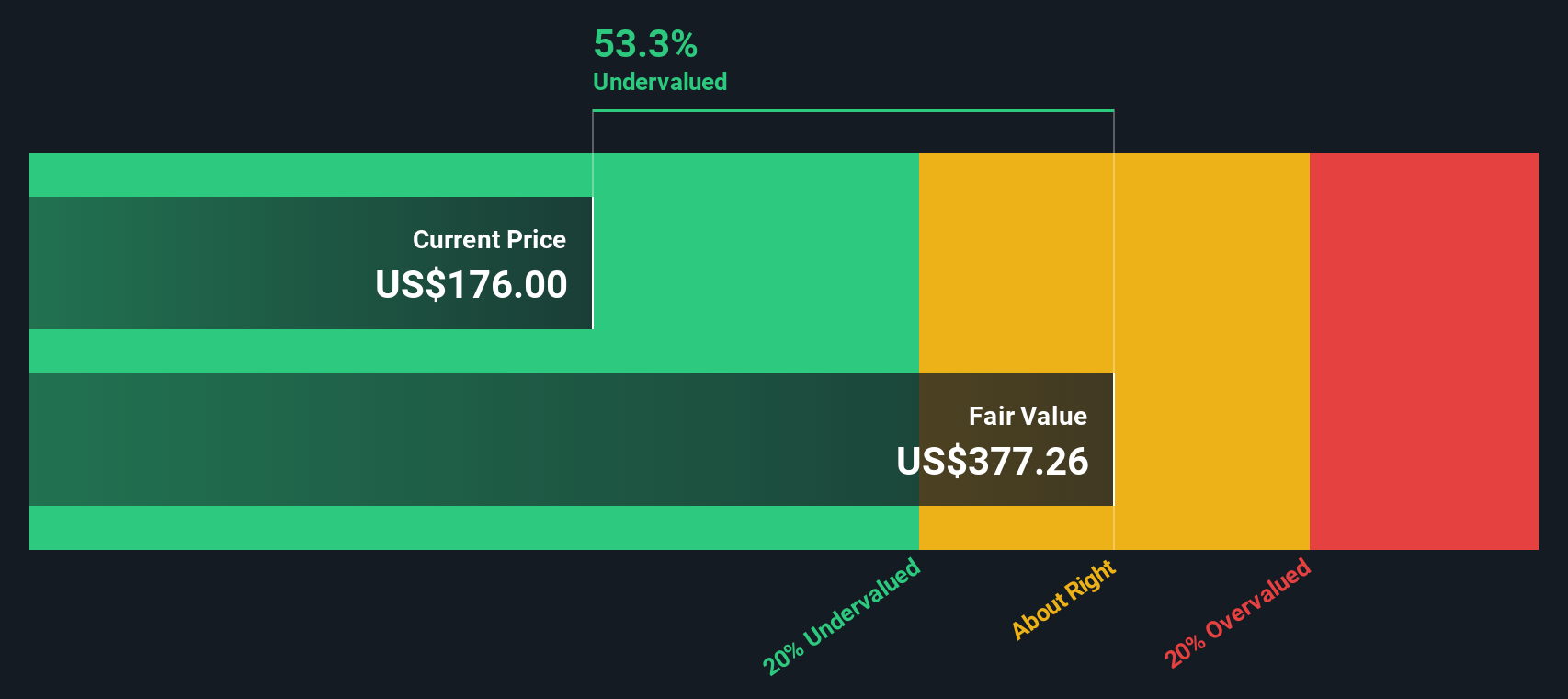

Using a 2 Stage Free Cash Flow to Equity model, these growing cash flows are converted into a present value of about $374.93 per share. Compared with the current share price, this implies the stock is trading at roughly a 53.5% discount to its estimated intrinsic value, indicating the market is pricing in a much weaker future than the cash flow forecasts suggest.

On this DCF view alone, PTC appears meaningfully undervalued rather than fully priced or expensive.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PTC is undervalued by 53.5%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: PTC Price vs Earnings

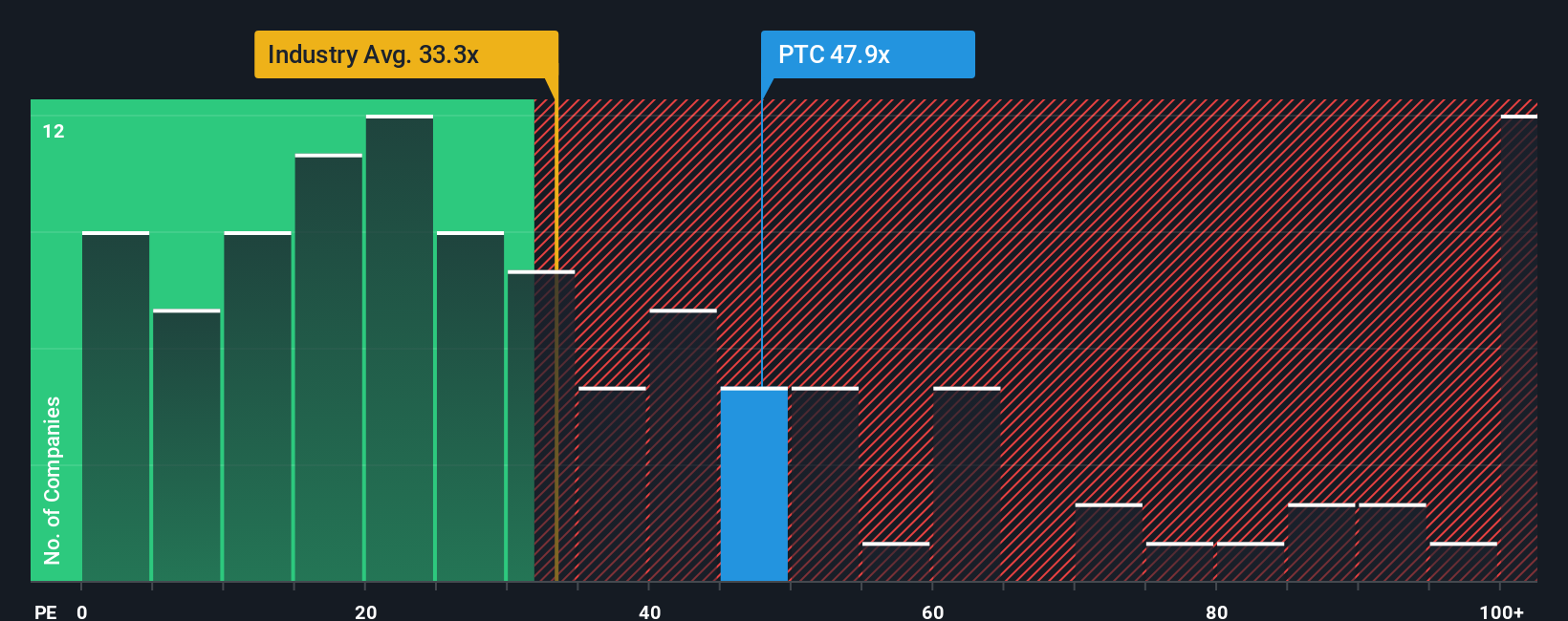

For profitable software companies like PTC, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. A higher PE can be justified when a business has strong, visible growth prospects and relatively lower risk, while slower or more volatile growers typically deserve a lower, more conservative multiple.

PTC currently trades on a PE of about 28.4x, which sits slightly below the broader Software industry average of around 32.0x and well below its peer group average of roughly 77.0x. On the surface, that suggests the market is valuing PTC more cautiously than many of its faster growing or more speculative software peers.

Simply Wall St’s Fair Ratio framework estimates that, given PTC’s earnings growth profile, margins, industry position, market cap and risk characteristics, a more appropriate PE would be about 29.9x. This Fair Ratio is more tailored than simple peer or industry comparisons because it explicitly adjusts for company specific fundamentals and risk, rather than assuming all software stocks deserve similar multiples. Since the Fair Ratio is modestly above the current PE, this lens points to PTC being somewhat undervalued on an earnings multiple basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PTC Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of PTC’s business with a set of numbers for future revenue, earnings, margins and, ultimately, fair value. A Narrative is your story about the company, translated into a forecast and a fair value estimate. Instead of only relying on static ratios, you can see how your expectations about things like AI adoption, SaaS transition and competitive risk feed directly into a valuation. On Simply Wall St, Narratives live in the Community section, where millions of investors can quickly choose or tweak a Narrative, then compare its Fair Value to today’s share price to help decide whether PTC looks like a buy, hold or sell. These Narratives also update dynamically when new information, such as earnings or product news, arrives, keeping your view current without extra effort. For example, one PTC Narrative might assume strong AI driven growth and assign a fair value closer to the most bullish target of about $250, while a more cautious Narrative might sit near the $190 end of the range.

Do you think there's more to the story for PTC? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報