Asian High Growth Tech Stocks to Watch

As global markets navigate the anticipation of interest rate adjustments, Asian tech stocks are gaining attention, driven by a mix of economic indicators and regional developments. In this dynamic environment, identifying high-growth opportunities requires focusing on companies that demonstrate strong innovation potential and resilience amidst evolving economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Bromake New Material Co., Ltd. focuses on the research, development, production, and sale of consumer electronics protective and functional products with a market capitalization of CN¥4.44 billion.

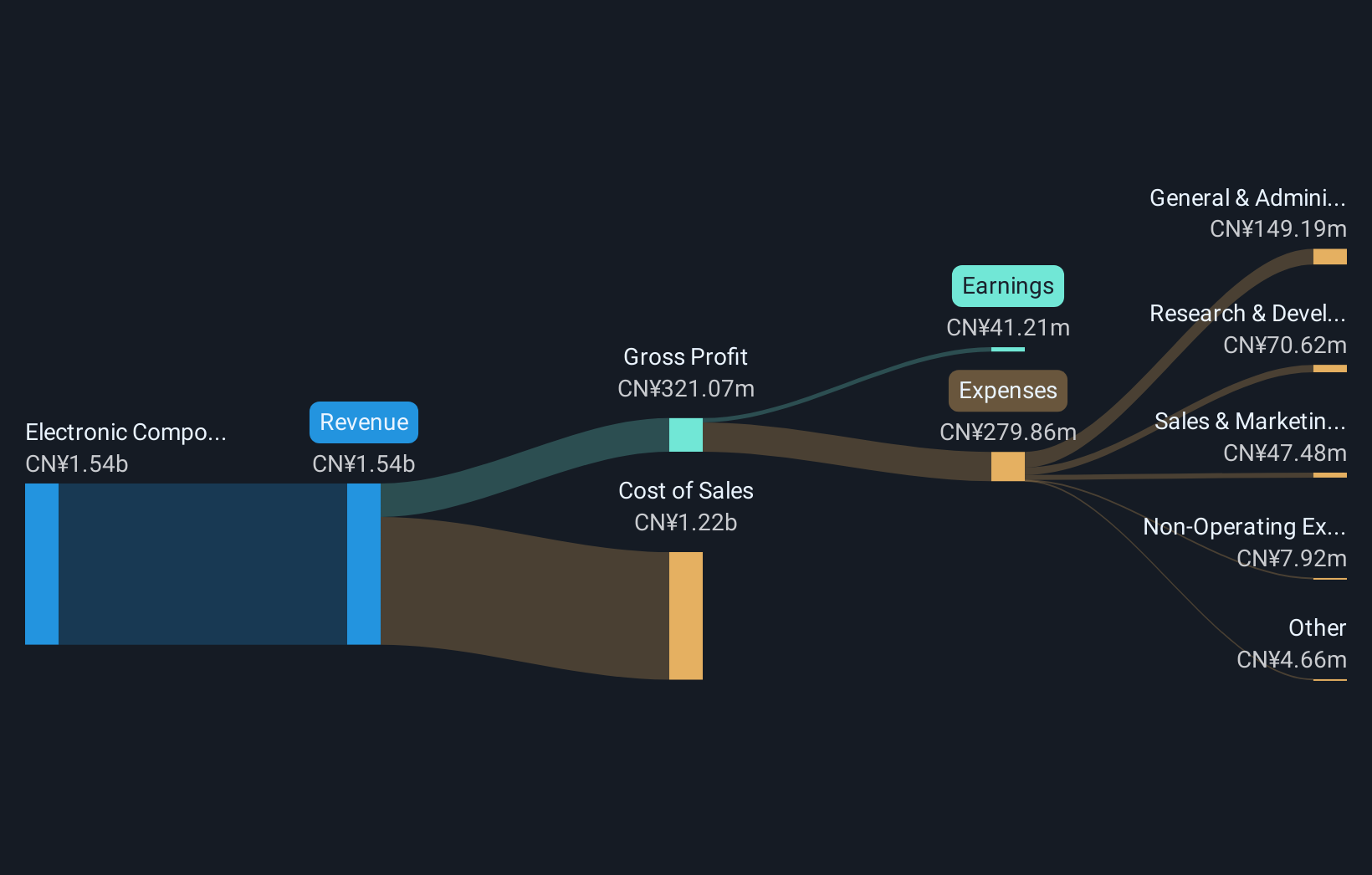

Operations: Shenzhen Bromake New Material Co., Ltd. generates revenue primarily from the sale of electronic components and parts, totaling CN¥1.54 billion. The company's focus on consumer electronics protective and functional products is central to its operations.

Shenzhen Bromake New Material has demonstrated robust financial performance, with a notable increase in sales from CNY 841.36 million to CNY 1,159.33 million and net income surging from CNY 7.41 million to CNY 28.16 million over the past nine months. This growth trajectory is supported by an annual revenue growth rate of 32.3% and earnings expected to climb by an impressive 96.2% annually, outpacing both the electronic industry's and the broader Chinese market's growth rates of 9% and 27.3%, respectively. The company’s commitment to innovation is evident from its recent corporate actions aimed at enhancing operational capabilities and governance structures, positioning it well for sustained expansion within Asia’s high-growth tech landscape.

- Get an in-depth perspective on Shenzhen Bromake New Material's performance by reading our health report here.

Learn about Shenzhen Bromake New Material's historical performance.

Kurashiru (TSE:299A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kurashiru, Inc. is a company that specializes in planning, developing, managing, and operating various smartphone apps and web media with a market capitalization of ¥51.04 billion.

Operations: Kurashiru, Inc. focuses on the development and management of smartphone applications and web media. The company generates revenue primarily through its digital platforms, leveraging technology to engage users effectively.

Kurashiru has been navigating the competitive landscape of Asia's tech sector with notable agility, evidenced by its revenue growing at 19.3% annually. This growth is complemented by an even more impressive annual earnings increase of 21.1%, signaling robust operational efficiency and market demand for its offerings. The firm's commitment to innovation is underscored by substantial R&D investments, which have recently amounted to $120 million, representing a significant proportion of their revenue. Such strategic allocation towards R&D not only enhances Kurashiru’s product offerings but also solidifies its standing in a region ripe with technological evolution and increasing digital consumption patterns. With these dynamics at play, Kurashiru appears well-positioned to capitalize on future market opportunities in Asia’s bustling tech scene.

- Unlock comprehensive insights into our analysis of Kurashiru stock in this health report.

Examine Kurashiru's past performance report to understand how it has performed in the past.

Kohoku KogyoLTD (TSE:6524)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kohoku Kogyo CO.,LTD. is engaged in the manufacturing and sale of lead terminals for aluminum electrolytic capacitors, optical components and devices for optical fiber communication networks, and precision components using quartz glass materials across various international markets, with a market capitalization of ¥84.58 billion.

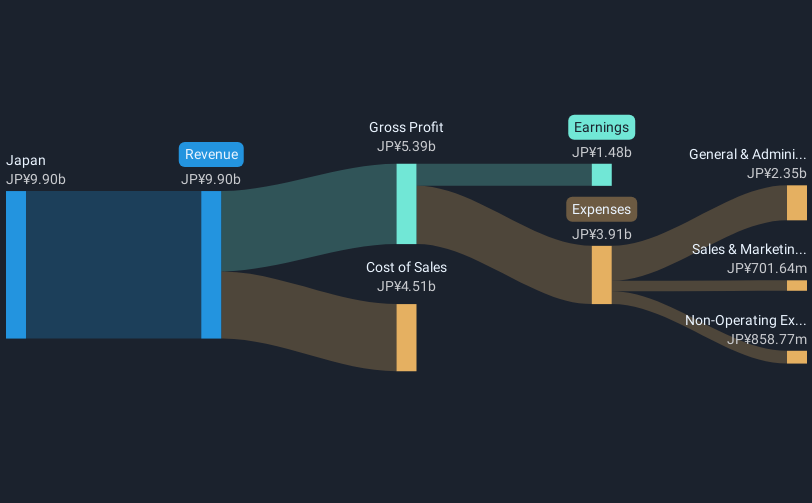

Operations: Kohoku Kogyo generates revenue primarily from its Lead Terminal Business and Optical Components and Devices Business, with revenues of ¥8.48 billion and ¥7.79 billion, respectively. The company operates across various international markets including Japan, China, the rest of Asia, England, and the United States.

Kohoku Kogyo CO., LTD. stands out in the electronic industry with its earnings growth surpassing the sector's average, climbing by 15.7% over the past year against an industry benchmark of 8.7%. This performance is bolstered by a forecasted annual earnings increase of 23.8%, significantly outpacing the broader Japanese market's growth rate of 8.3%. The firm's strategic emphasis on R&D is evident from its robust investment, which not only fuels innovation but also aligns with evolving market demands in high-tech sectors. With revenue expected to grow at a rate of 11.7% annually, faster than Japan’s market average of 4.6%, Kohoku Kogyo is poised to maintain its competitive edge and capitalize on emerging opportunities within Asia’s dynamic tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Kohoku KogyoLTD.

Assess Kohoku KogyoLTD's past performance with our detailed historical performance reports.

Next Steps

- Delve into our full catalog of 188 Asian High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報