Toyota (TSE:7203) Valuation Check After Recent Pullback and Strong 1-Year Shareholder Returns

Toyota Motor (TSE:7203) shares have been quietly repricing as investors weigh steady earnings growth against a modest pullback over the past month, creating an interesting setup for anyone tracking long term auto leaders.

See our latest analysis for Toyota Motor.

That modest 30 day share price return setback of roughly 2% comes after a solid run, with the 1 year total shareholder return above 18% signaling that long term momentum is still intact rather than stalling.

If Toyota has you rethinking the auto space, this is a good moment to see what else is on the move among auto manufacturers.

With earnings still grinding higher and the share price sitting around an 11% discount to analyst targets, investors now face a key question: is Toyota undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 8% Undervalued

Compared with Toyota Motor's most widely followed fair value estimate of ¥3,324.71, the last close at ¥3,066 suggests the market is applying a noticeable discount while still acknowledging its global auto leadership.

Toyota's investment in internal battery production, including various types of batteries for electric and hybrid vehicles, could bolster long term revenue and margins. By optimizing battery production and technology, Toyota positions itself competitively in the growing electrified vehicle market.

Curious why a mature automaker is being priced closer to a growth story? The narrative leans on modest revenue expansion, shifting margins, and a future earnings multiple that challenges the usual auto playbook. Want to see which assumptions really power that valuation gap?

Result: Fair Value of ¥3,324.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several unresolved risks, particularly renewed production halts and intensifying price competition in China, could quickly undermine the current undervaluation thesis.

Find out about the key risks to this Toyota Motor narrative.

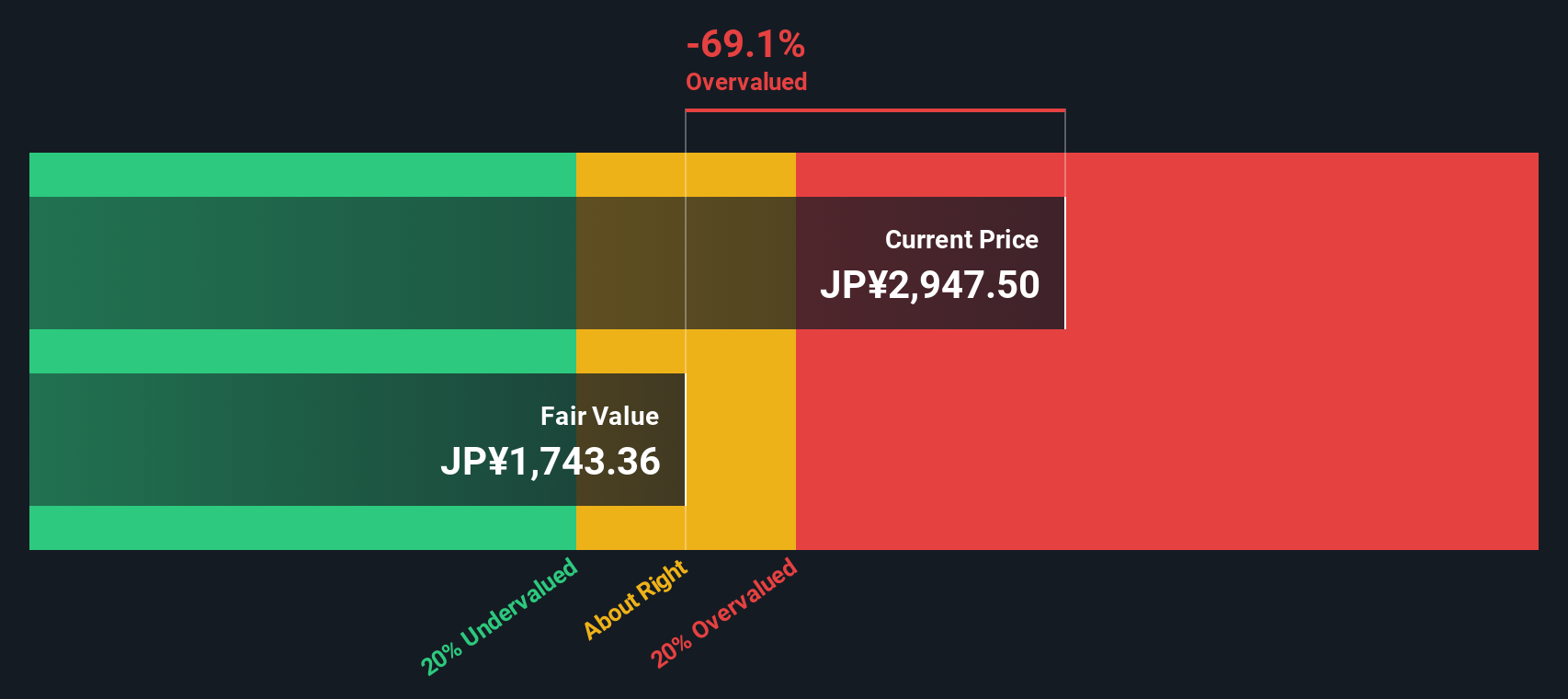

Another View: Cash Flows Paint a Stricter Picture

While the narrative fair value points to modest undervaluation, our DCF model is far more conservative and suggests Toyota is trading above its estimated fair value of ¥1,721. This implies the shares may actually be overvalued today. Is the market overestimating the durability of those cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyota Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyota Motor Narrative

If this perspective does not fully align with yours, or you prefer hands on research, you can build a custom view in just minutes: Do it your way

A great starting point for your Toyota Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, put Toyota in context by scanning fresh opportunities that match your style and could help refine your portfolio for the next market shift.

- Explore underpriced potential by reviewing these 904 undervalued stocks based on cash flows that may be offering strong cash flow characteristics before the broader market recognizes them.

- Follow structural shifts in healthcare by targeting breakthrough innovators across these 30 healthcare AI stocks that are transforming diagnostics, treatment, and patient outcomes.

- Look into high conviction opportunities with these 3595 penny stocks with strong financials, focusing on companies that combine solid financials with meaningful growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報