Reassessing Kuraray (TSE:3405) Valuation After New PFAS Water Treatment Patent Win

Kuraray (TSE:3405) just gained fresh attention after its subsidiary Calgon Carbon secured a new U.S. patent for using reactivated carbon to remove PFAS from water, strengthening its position in regulatory driven treatment demand.

See our latest analysis for Kuraray.

That patent win lands at a tricky time for Kuraray, with the share price down sharply year to date but still supported by a solid three year total shareholder return. This suggests long term holders have not lost faith even as short term momentum has cooled.

If this shift in sentiment has you reassessing your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as you search for the next wave of potential compounders.

With the share price sliding this year despite robust multi year returns, and analyst targets sitting well above today’s level, is Kuraray quietly undervalued or is the market already baking in the next leg of growth?

Price-to-Earnings of 61x: Is it justified?

On a price-to-earnings basis, Kuraray looks expensive at a 61x multiple, with a share price of ¥1558.5 and peers trading on far lower earnings multiples.

The price to earnings ratio compares the company’s market value to its current earnings and is a common way to judge how much investors are willing to pay for each unit of profit. For a diversified chemicals and materials group like Kuraray, this multiple often reflects expectations around future margin recovery and earnings growth rather than just today’s compressed profitability.

Here, the high 61x multiple suggests the market is pricing in a sharp rebound in earnings. That premium stands out given Kuraray’s current 1 percent return on equity and thin profit margins after recent one off impacts. Versus an estimated fair price to earnings ratio of 24.6x, the current valuation implies the share price could have a long way to fall if earnings do not ramp fast enough to meet those expectations.

Relative to the wider Japanese chemicals industry on 12.5x earnings and a peer average of 20.7x, Kuraray’s 61x multiple is not just a modest premium. It is a striking outlier that demands a robust earnings turnaround to be sustainable.

Explore the SWS fair ratio for Kuraray

Result: Price-to-Earnings of 61x (OVERVALUED)

However, slowing revenue growth or weaker than expected PFAS treatment demand could quickly challenge the premium multiple and the analyst optimism built into Kuraray’s valuation.

Find out about the key risks to this Kuraray narrative.

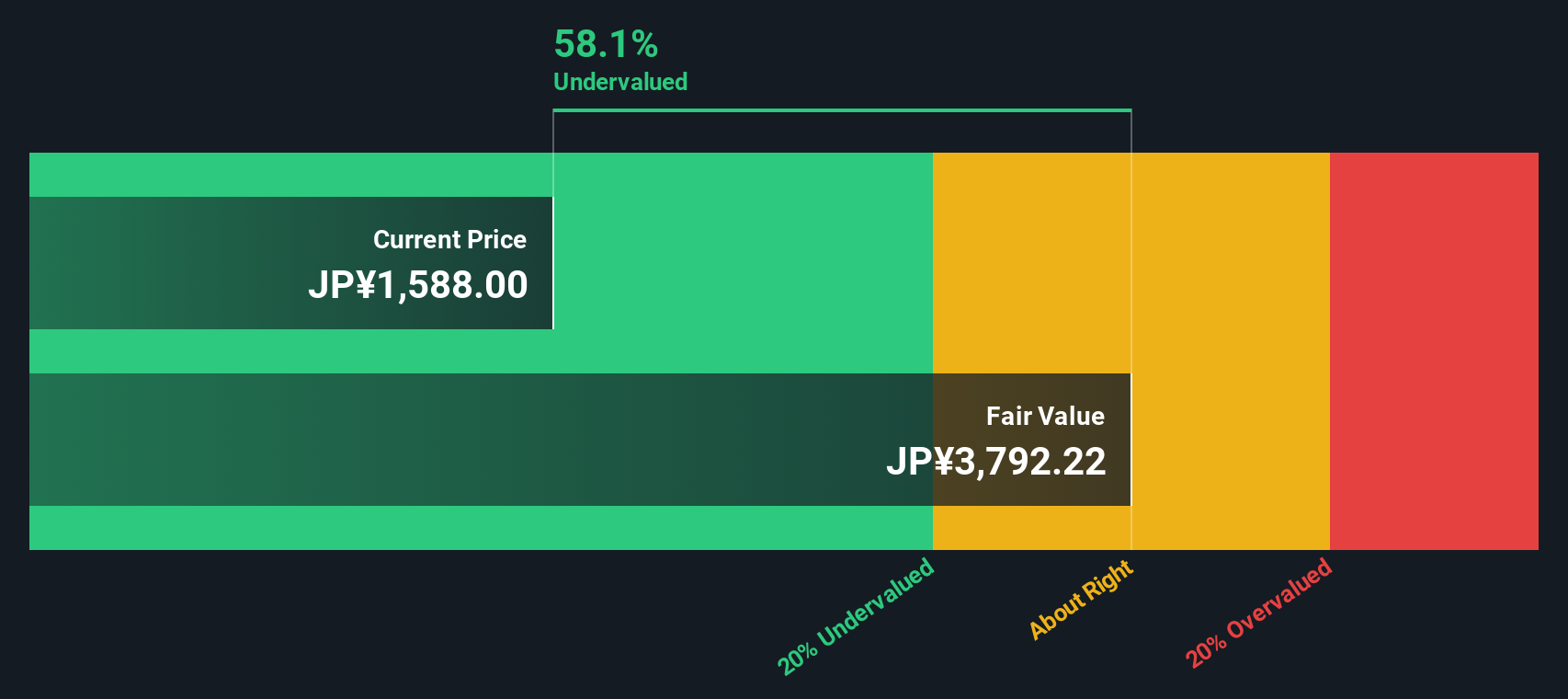

Another View: DCF Points to Deep Value

While the 61x earnings multiple may appear expensive, our DCF model presents a different perspective. It suggests fair value around ¥3804.78, which is roughly 59 percent above the current ¥1558.5 share price. This raises an important question: is the market overpaying based on today’s earnings, or underestimating the company’s future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kuraray for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kuraray Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Kuraray research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Kuraray when you can quickly uncover focused opportunities tailored to your strategy using the Simply Wall Street Screener.

- Capitalize on mispriced businesses by using these 904 undervalued stocks based on cash flows that may offer stronger upside potential relative to their cash flow strength.

- Strengthen your income portfolio by targeting companies in these 15 dividend stocks with yields > 3% that aim to deliver reliable cash returns above 3 percent yields.

- Position yourself ahead of financial innovation by scanning these 80 cryptocurrency and blockchain stocks that are building real world applications around blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報