First Commonwealth Financial (FCF): Revisiting Valuation After New $25 Million Share Repurchase Program

First Commonwealth Financial (FCF) just wrapped up a $25 million share repurchase and secured board approval for a fresh buyback plan, a clear signal of management confidence in the bank’s long term outlook.

See our latest analysis for First Commonwealth Financial.

That confidence has started to show up in the trading pattern too, with a roughly 5% 1 month share price return helping offset a softer 90 day patch, even as the 1 year total shareholder return remains negative but the 5 year total shareholder return sits comfortably higher. This suggests momentum is rebuilding rather than breaking.

If this kind of capital return story has you thinking more broadly about your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership.

With earnings still growing, a near 50% intrinsic value discount, and a modest premium to analyst targets, the real question is whether First Commonwealth is quietly undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 13.5% Undervalued

With First Commonwealth Financial last closing at $16.61 against a narrative fair value of $19.20, the spread hints at upside the market has yet to fully acknowledge.

Expansion of fee-based revenue streams, including SBA lending, wealth management, mortgage, and insurance, is reducing reliance on traditional interest income, diversifying earnings sources, and supporting improved risk adjusted returns and long-term earnings growth even amidst rate volatility.

Curious how steady loan growth, rising margins, and a richer mix of fee income could all point to a higher valuation than today? See what assumptions power that story.

Result: Fair Value of $19.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower digital progress and heavy regional exposure mean tougher competition or a local downturn could quickly erode growth and the perceived valuation gap.

Find out about the key risks to this First Commonwealth Financial narrative.

Another Angle on Valuation

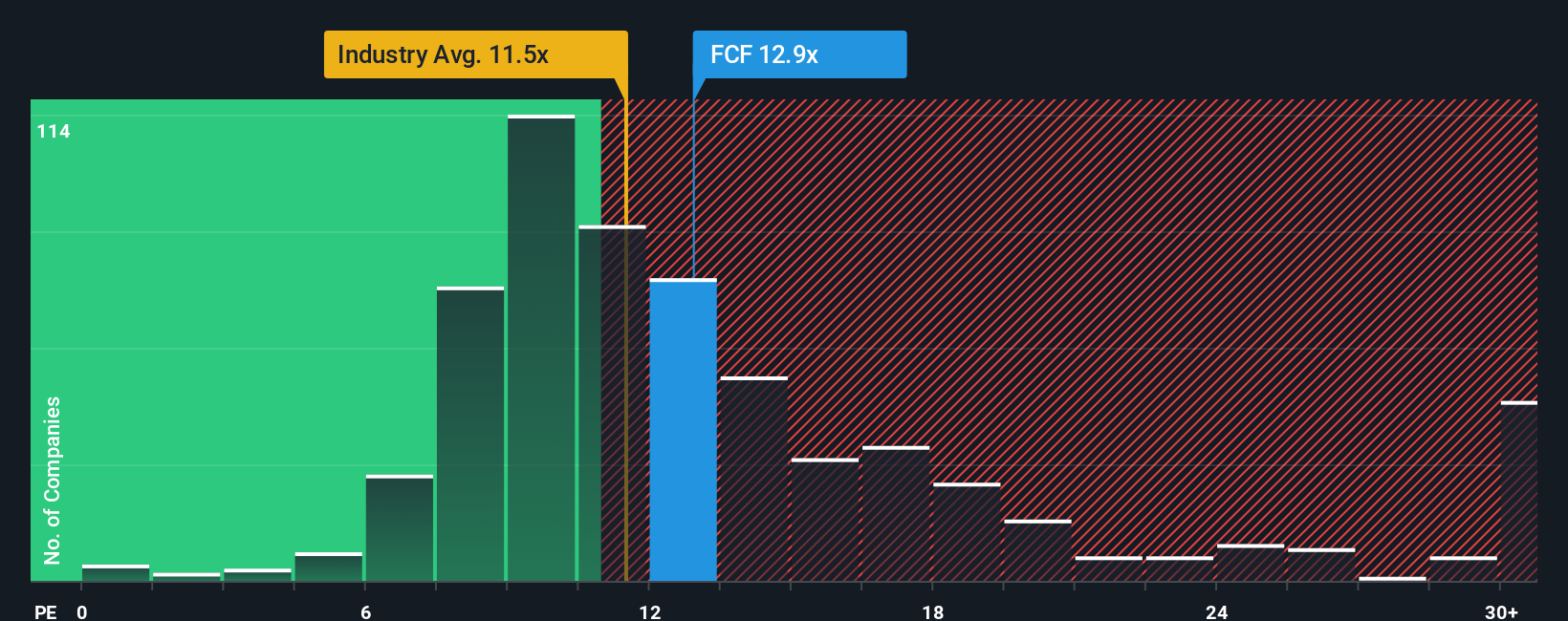

On earnings, First Commonwealth looks less obviously cheap, trading around 12 times profits versus 11.6 times for US banks on average and a 12.4 times peer mark, while our fair ratio sits slightly higher at 12.8 times. Is that a small safety margin or a thin one?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Commonwealth Financial Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Commonwealth Financial.

Ready for your next investing move?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street's powerful screener so your next idea is intentional, not accidental.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value through these 903 undervalued stocks based on cash flows.

- Position yourself early in the AI revolution by screening for innovators reshaping industries with these 27 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報