Invitation Homes (INVH): Revisiting Valuation After Recent Share Price Weakness

Invitation Homes (INVH) has quietly slipped over the past month, with shares down about 5% and roughly 18% over the past year, drawing valuation focused investors back to the single family rental giant.

See our latest analysis for Invitation Homes.

That slide sits on top of a softer trend, with the 1 year total shareholder return down almost 18% and the 5 year total shareholder return barely positive. This hints that momentum is still fading as investors reassess growth and interest rate risks.

If this kind of re rating in real estate has you rethinking your portfolio, it might be worth exploring fast growing stocks with high insider ownership as potential fresh ideas beyond the sector.

With the share price lagging while revenue still edges higher, and analysts seeing around 30% upside, investors now face a key question: is Invitation Homes a discounted way into single family rentals, or already priced for future growth?

Most Popular Narrative: 23.2% Undervalued

With Invitation Homes last closing at $26.66 versus a narrative fair value in the mid $30s, the story leans toward underappreciated long term earnings power.

Strong demographic momentum including the sustained rise in new household formation among adults in their late 30s and the persistent shortage of new housing construction signals long term, robust demand for single family rentals, positioning Invitation Homes for steady occupancy and rent growth, which should bolster revenue and long term earnings. Ongoing high barriers to homeownership, such as elevated mortgage rates and home prices, are expected to keep a large segment of Millennials and Gen Z in the rental market, allowing Invitation Homes to retain residents for longer tenures, support high renewal rates, and maintain stable cash flows and net margins.

Want to see how that demand story turns into a richer valuation? The narrative leans on steady top line growth, firm margins, and a bold future earnings multiple. Curious which assumptions really stretch the price higher, and which keep it grounded in today’s cash flows? The full breakdown spells it out.

Result: Fair Value of $34.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated Sun Belt supply and rising property tax and insurance costs could cap rent growth and compress margins, which may challenge that optimistic long term valuation.

Find out about the key risks to this Invitation Homes narrative.

Another Angle, Using Market Ratios

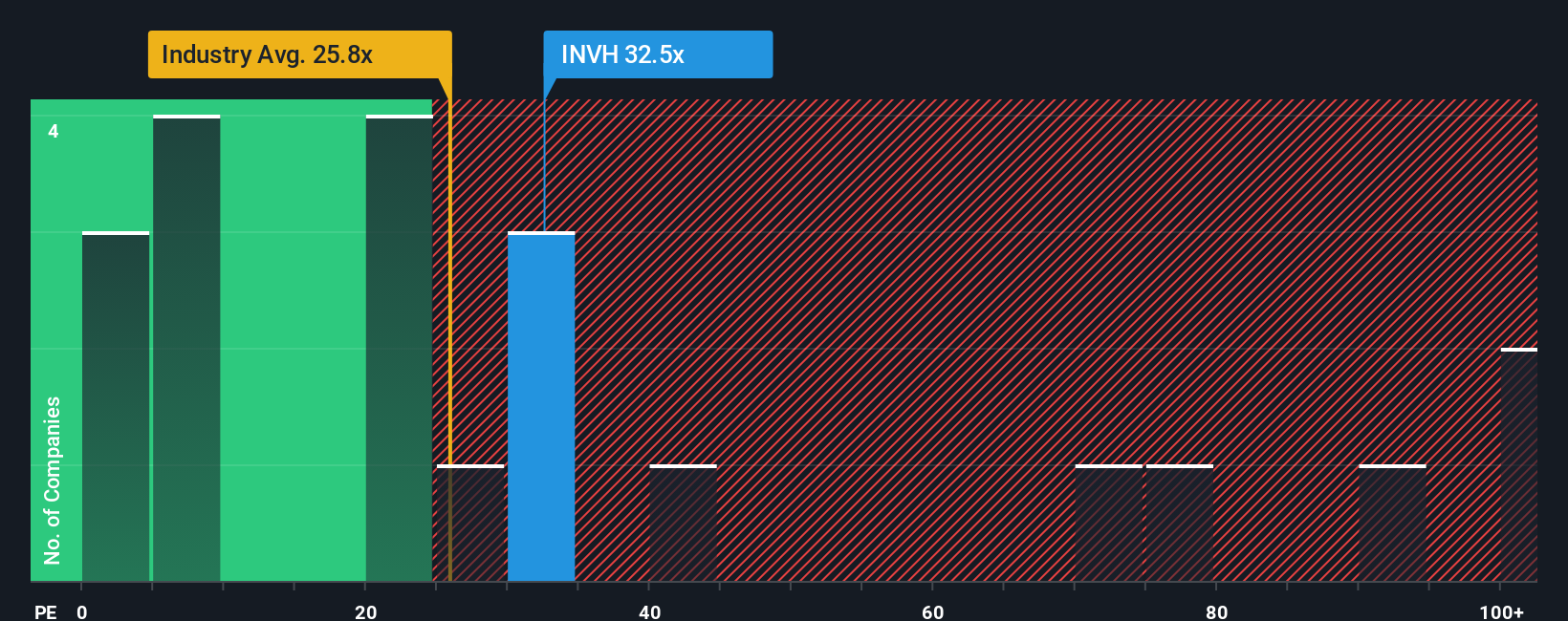

While the narrative fair value suggests upside, the current price already bakes in a rich earnings multiple. Invitation Homes trades on a 27.9x P/E versus 25.9x for peers and 24.5x for the broader Residential REITs group, only slightly below a 29.6x fair ratio. This raises the question of how much safety margin is really left if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Invitation Homes Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Invitation Homes research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with one real estate thesis when you can quickly uncover fresh, data backed ideas that keep your portfolio evolving ahead of the crowd.

- Capitalize on mispriced opportunities by targeting companies trading below their cash flow potential using these 903 undervalued stocks based on cash flows to refresh your value shortlist.

- Ride powerful innovation trends by scanning these 27 AI penny stocks that could transform entire industries and reshape long term growth expectations.

- Lock in reliable income streams by reviewing these 15 dividend stocks with yields > 3% to uncover yields that may strengthen total returns through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報