Commercial Metals (CMC): Revisiting Valuation After J.P. Morgan Upgrade and Rebar Pricing Tailwinds

Commercial Metals, recently upgraded by J.P. Morgan, has investors taking a fresh look at the stock as stronger rebar pricing and expected sector synergies begin to filter into expectations and trading behavior.

See our latest analysis for Commercial Metals.

The upgrade appears to have reinforced an upswing that was already underway, with Commercial Metals’ 30 day share price return of 13.6 percent feeding into a robust year to date gain of 35.8 percent. Its five year total shareholder return of 263.2 percent underlines how long term holders have been rewarded as the market increasingly prices in growth and acquisition upside alongside higher rebar economics.

If this kind of momentum has you thinking more broadly about the sector, it might be a good time to explore fast growing stocks with high insider ownership as a way to spot the next wave of leadership names.

Yet with the shares hovering just below analyst targets and years of outperformance already in the rearview mirror, the real question now is whether Commercial Metals still offers upside or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 2% Undervalued

With Commercial Metals last closing at $66.76 versus a narrative fair value of $67.85, expectations are tilted toward steady upside built on execution.

CMC's strategic initiatives, particularly the Transform, Advance, and Grow (TAG) program, are projected to generate an additional $25 million in benefits over the rest of fiscal 2025 and promise further enhancements in the coming years. These improvements are likely to permanently improve margins and increase earnings.

Want to see how a margin uplift story justifies a higher future earnings base and a richer multiple, despite modest top line growth assumptions? Read the complete narrative.

Result: Fair Value of $67.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering legal overhang from the Pacific Steel litigation and potential construction slowdowns from higher rates could easily derail that margin-driven upside story.

Find out about the key risks to this Commercial Metals narrative.

Another View: Rich on Earnings

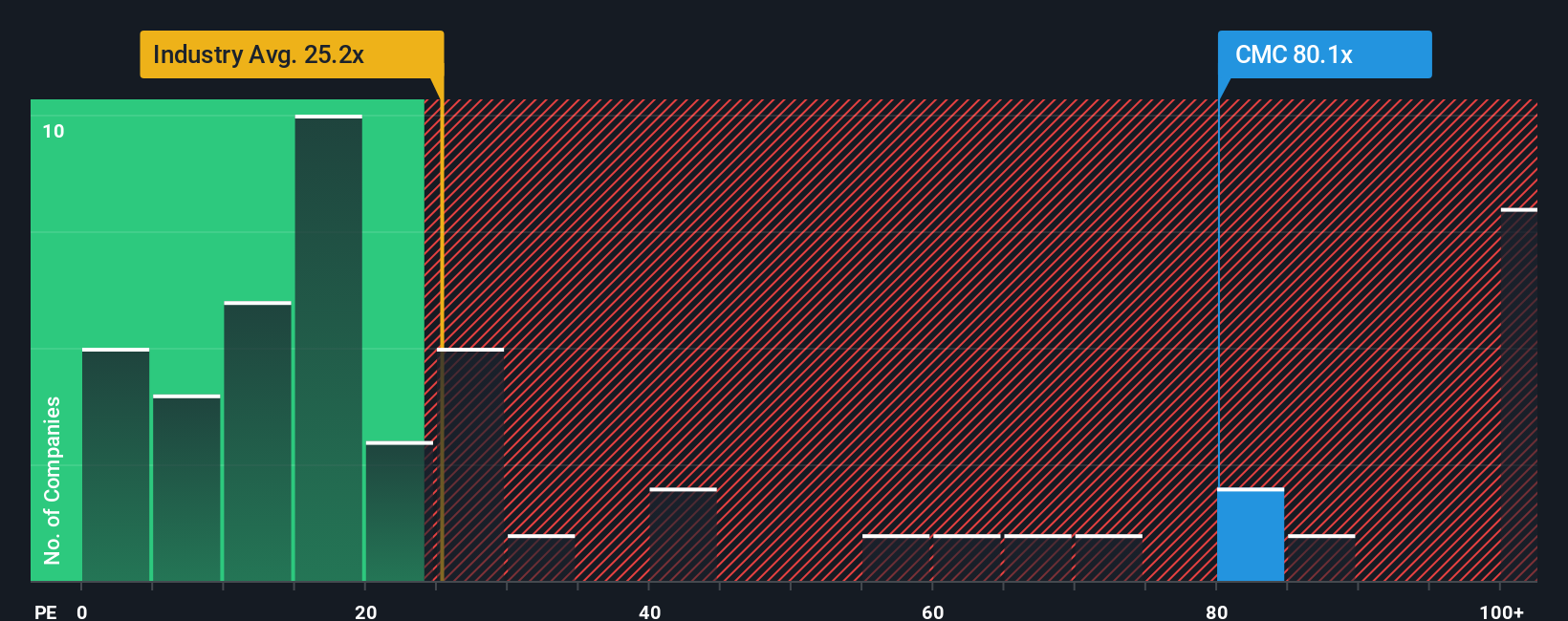

While the narrative fair value paints Commercial Metals as slightly undervalued, its current price to earnings ratio of 87.6 times looks stretched versus a fair ratio of 30.5 times, a peer average of 45.4 times and an industry average of 22.2 times. This raises the risk that expectations are already too high.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commercial Metals Narrative

If the story here does not fully align with your view, or you would rather test the assumptions yourself, you can easily build a personalized thesis in just a few minutes: Do it your way.

A great starting point for your Commercial Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, line up your next opportunities with the Simply Wall St Screener so you are not relying on just one compelling idea.

- Capitalize on market mispricing by targeting these 905 undervalued stocks based on cash flows that analysts may be underestimating today but cash flow math suggests could rerate tomorrow.

- Ride powerful technology shifts by focusing on these 27 AI penny stocks that are building real products on top of artificial intelligence, not just chasing buzzwords.

- Strengthen your income stream by filtering for these 15 dividend stocks with yields > 3% that can help support long term returns through regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報