Assessing Mitsui Kinzoku (TSE:5706) After Its Strong Share Price Run: Is the Valuation Still Justified?

Mitsui Kinzoku Company (TSE:5706) has quietly turned into a serious momentum story, with the share price climbing about 75% over the past 3 months and nearly tripling investors money year to date.

See our latest analysis for Mitsui Kinzoku Company.

That surge has come on top of an already impressive run, with the 1 year total shareholder return near 290% and the 3 year total shareholder return above 540%. This suggests that momentum is still very much building rather than fading.

If Mitsui Kinzoku’s run has you wondering what else might be setting up for strong gains, it is a good time to explore fast growing stocks with high insider ownership.

Yet with the share price now hovering around its analyst target and recent revenue barely growing, investors have to ask whether Mitsui Kinzoku is still mispriced or if the market is already factoring in the next leg of growth.

Price-to-Earnings of 22x: Is it justified?

Mitsui Kinzoku is trading on a price-to-earnings ratio of 22x at the last close of ¥18,000, which implies a rich valuation versus both its own fair ratio and parts of the market.

The price-to-earnings ratio compares the current share price to the company’s earnings per share. For a cyclical, capital-intensive metals and mining business it is a key gauge of how enthusiastically investors are pricing in current and future profits.

In Mitsui Kinzoku’s case, the stock looks inexpensive compared to its direct peer group, where the average P/E sits at 32x. However, it appears stretched against the broader Japanese metals and mining industry average of 12.1x, as well as against the estimated fair P/E of 16.7x that our fair ratio work suggests the market could gravitate toward over time.

Explore the SWS fair ratio for Mitsui Kinzoku Company

Result: Price-to-Earnings of 22x (OVERVALUED)

However, slowing revenue and a share price already above analyst targets mean that any earnings miss or cyclical metals downturn could quickly puncture this momentum.

Find out about the key risks to this Mitsui Kinzoku Company narrative.

Another View on Valuation

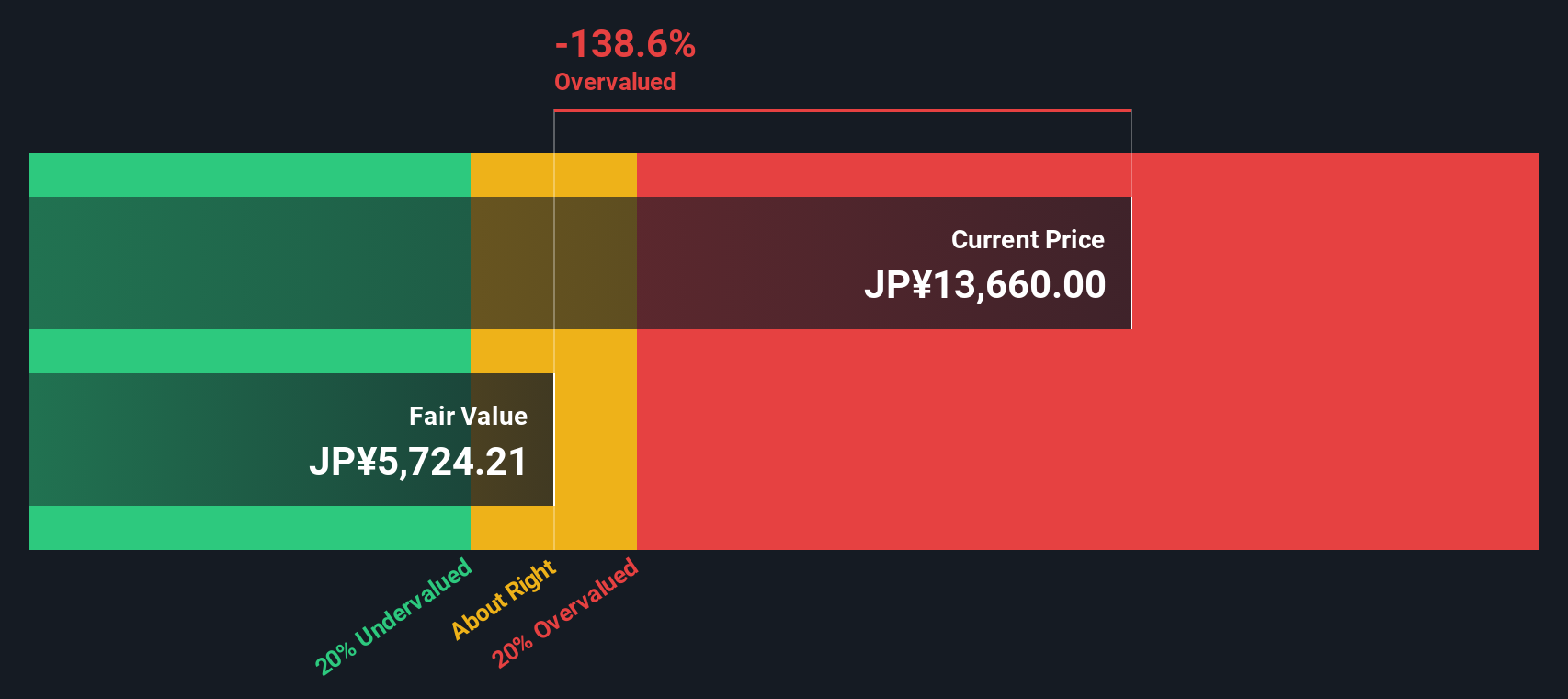

Our DCF model paints a far less forgiving picture, with Mitsui Kinzoku trading well above its estimated fair value of ¥6,825. While momentum investors may shrug this off, it raises a tougher question: how long can sentiment trump fundamentals if cash flows do not catch up?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui Kinzoku Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui Kinzoku Company Narrative

If you would rather rely on your own analysis and challenge these assumptions directly, you can build a complete view in just minutes: Do it your way.

A great starting point for your Mitsui Kinzoku Company research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for your next investing move?

Do not stop at one opportunity when you can quickly scan fresh ideas on Simply Wall Street’s Screener that match your strategy, risk appetite, and return targets.

- Target high-potential value opportunities by reviewing these 905 undervalued stocks based on cash flows that may be trading below the worth implied by their future cash flows.

- Capture cutting edge growth themes with these 27 AI penny stocks shaping everything from automation to intelligent analytics across global markets.

- Lock in potential income streams by examining these 15 dividend stocks with yields > 3% that combine attractive yields with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報