The Bull Case For Iberdrola (BME:IBE) Could Change Following New EU-Backed Grid-Scale Storage Grants

- Iberdrola has secured €170 million in grants, co-financed by European Regional Development Fund money and awarded by Spain’s IDAE, to support 11 battery storage projects, three industrial thermal storage initiatives, and an expansion of pumped storage capacity.

- This funding deepens Iberdrola’s role in grid-scale storage, potentially enhancing the flexibility and reliability of its renewable-heavy power portfolio across key markets.

- We’ll now explore how this new grant-backed energy storage push could influence Iberdrola’s investment narrative built around regulated growth.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Iberdrola Investment Narrative Recap

To own Iberdrola, you need to believe in a long-run story of regulated network growth, underpinned by predictable returns from grids in the US, UK, and Spain, with renewables as a complementary engine. The new €170 million in grants supports this theme but does not materially change the immediate focus on executing the €5 billion equity raise and managing the key risk of regulatory shifts in core regulated markets.

Among recent announcements, the €5.016 billion follow-on equity offering stands out as most relevant to these new storage grants, because both speak to Iberdrola’s capital intensive plan to grow its regulated and renewables base. Together, they highlight a near term catalyst around scaling grid and clean generation assets, while reminding investors that dependence on capital markets and policy support remains central to the story.

Yet against this growth push, investors should also be aware of the risk that changing UK and US regulatory frameworks could...

Read the full narrative on Iberdrola (it's free!)

Iberdrola's narrative projects €50.1 billion revenue and €7.0 billion earnings by 2028. This requires 3.7% yearly revenue growth and about a €2.2 billion earnings increase from €4.8 billion today.

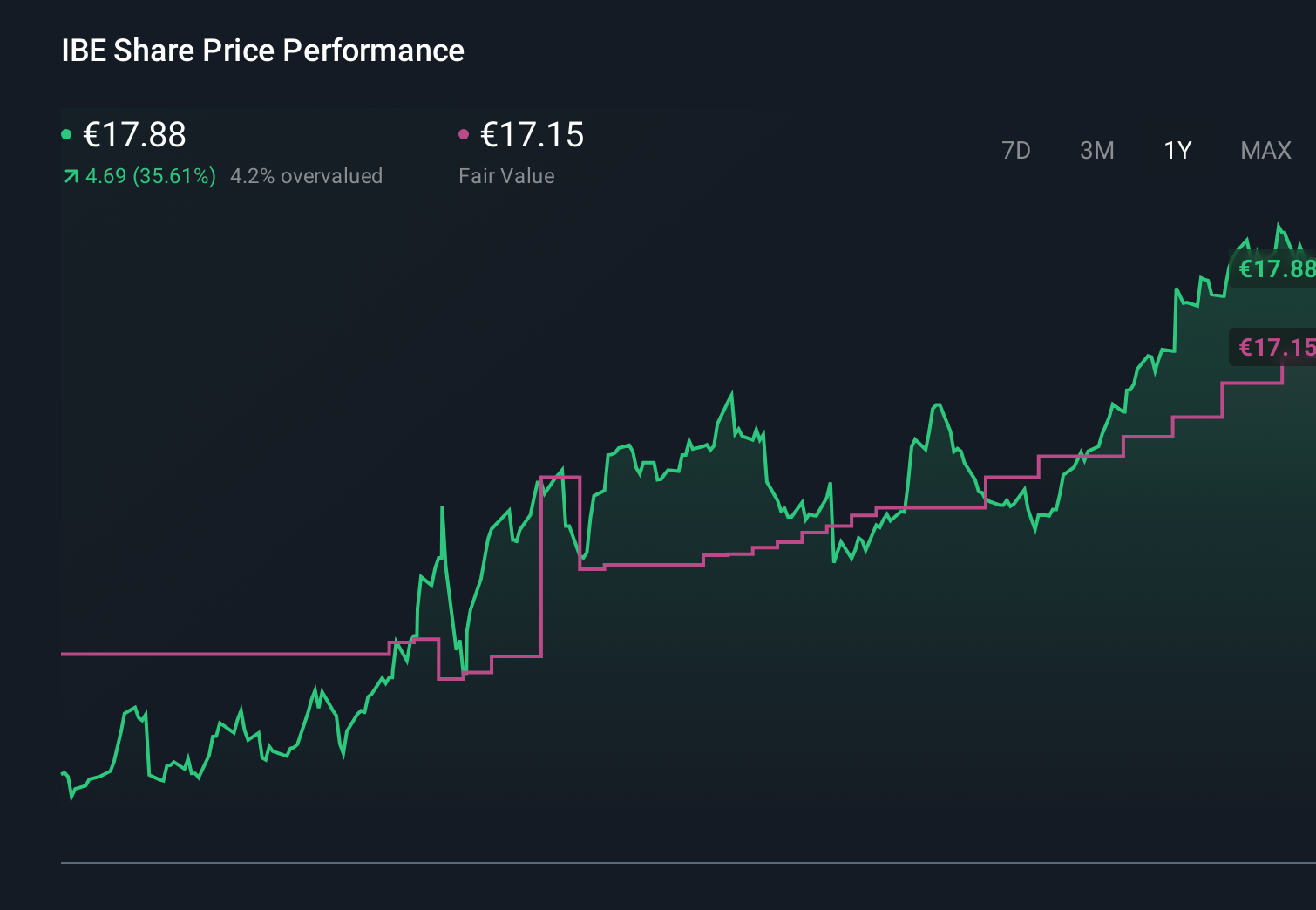

Uncover how Iberdrola's forecasts yield a €17.06 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community currently place Iberdrola’s fair value anywhere between €0.37 and €17.06, with estimates spread across the full range. When you set those views against the company’s heavy reliance on supportive regulation for a planned near tripling of its regulated asset base, it underlines why many investors compare several perspectives before forming a view.

Explore 10 other fair value estimates on Iberdrola - why the stock might be worth less than half the current price!

Build Your Own Iberdrola Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iberdrola research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Iberdrola research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iberdrola's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報