Reassessing South32 (ASX:S32) Valuation After Geoff Healy’s Appointment to the Board

South32 (ASX:S32) has caught fresh attention after appointing seasoned executive Geoff Healy as an independent Non Executive Director. This governance move nudges investors to revisit the miner's long term strategy and valuation.

See our latest analysis for South32.

The board refresh lands as the share price trades at A$3.37, with a strong 3 month share price return of 32.2 percent but a weaker 1 year total shareholder return of minus 5.6 percent, hinting at improving momentum after a tougher stretch.

If this kind of governance shift has you thinking more broadly about leadership and alignment, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling ideas.

With the share price rebounding, yet longer term returns still lagging, the key question is whether South32’s improved governance and earnings momentum signal undervaluation, or if the market is already pricing in the next leg of growth?

Most Popular Narrative: 20% Undervalued

With South32 closing at A$3.37 against a most popular narrative fair value near A$3.38, expectations hinge on sizeable earnings and margin expansion over time.

Analysts are assuming South32's revenue will grow by 4.5% annually over the next 3 years.

Analysts assume that profit margins will increase from 5.3% today to 15.6% in 3 years time.

Want to see what kind of profit engine those assumptions build, and what multiple they need to make the numbers work? Explore the full narrative now.

Result: Fair Value of A$3.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent alumina oversupply or costly delays at projects like Hermosa and Sierra Gorda could squeeze margins and undermine the growth story.

Find out about the key risks to this South32 narrative.

Another Angle on Value

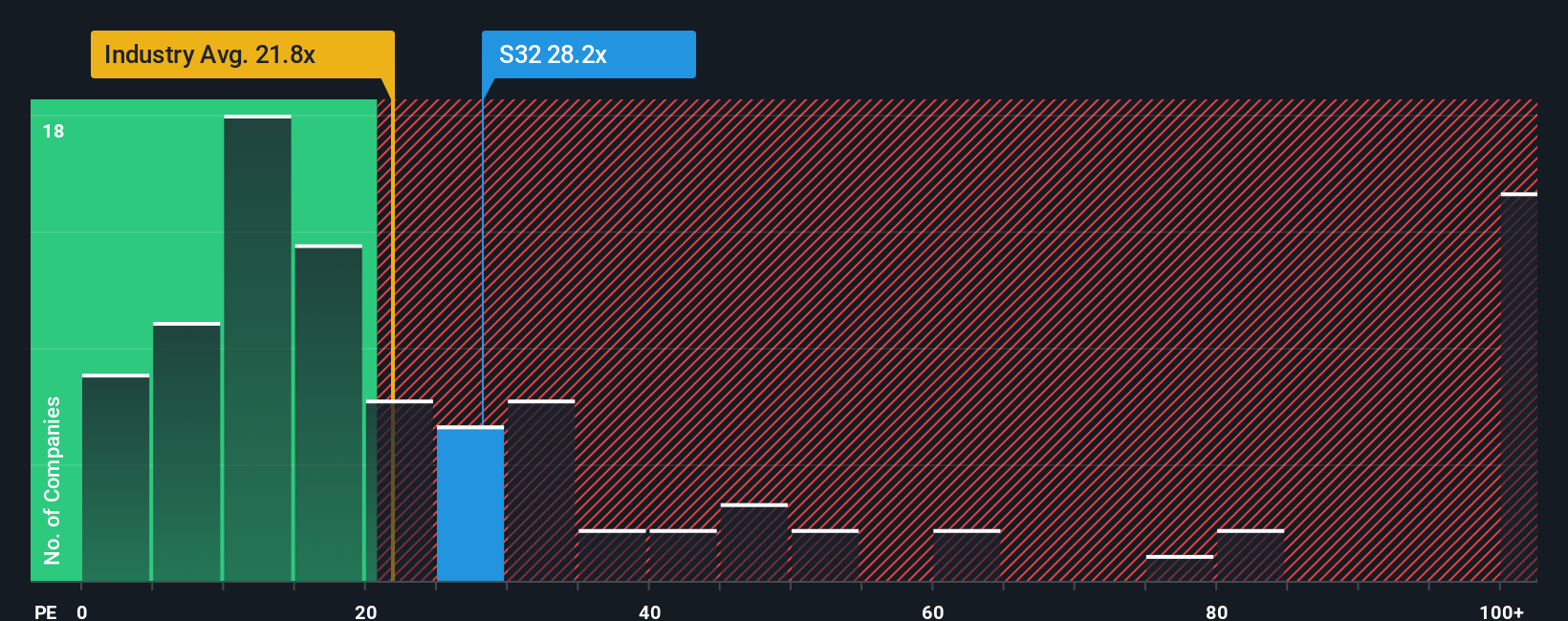

While the popular narrative leans on future growth to call South32 undervalued, the current price to earnings ratio of 31.5 times tells a different story. It sits above both the peer average of 20.8 times and a fair ratio of 30.3 times. This points to a thinner margin for error if forecasts slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own South32 Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your South32 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to broaden your watchlist beyond South32? Use the Simply Wall St Screener to uncover focused opportunities before the crowd catches on and prices move away.

- Capture potential multi baggers by scanning these 3593 penny stocks with strong financials that already show strong balance sheets and improving fundamentals.

- Position yourself for the next wave of innovation with these 27 AI penny stocks at the intersection of data, automation, and scalable software economics.

- Lock in quality at sensible prices by targeting these 909 undervalued stocks based on cash flows where cash flow strength and valuation still leave room for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報