Is Asahi Kasei (TSE:3407) Quietly Trading HMD For A Higher-Return Materials Future?

- Asahi Kasei recently announced it will phase out production of hexamethylene diamine (HMD) by April 2027 as part of its portfolio optimization, while keeping PA66 and HDI operations in Miyazaki Prefecture unchanged and reassigning all affected employees.

- At the same time, its ROICA brand is partnering with NILIT’s SENSIL to develop biomass-balanced, lower-impact stretch fabrics, underscoring Asahi Kasei’s push toward higher-return, sustainability-oriented materials businesses.

- We’ll now examine how exiting HMD production to improve capital efficiency could reshape Asahi Kasei’s broader investment narrative for investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Asahi Kasei's Investment Narrative?

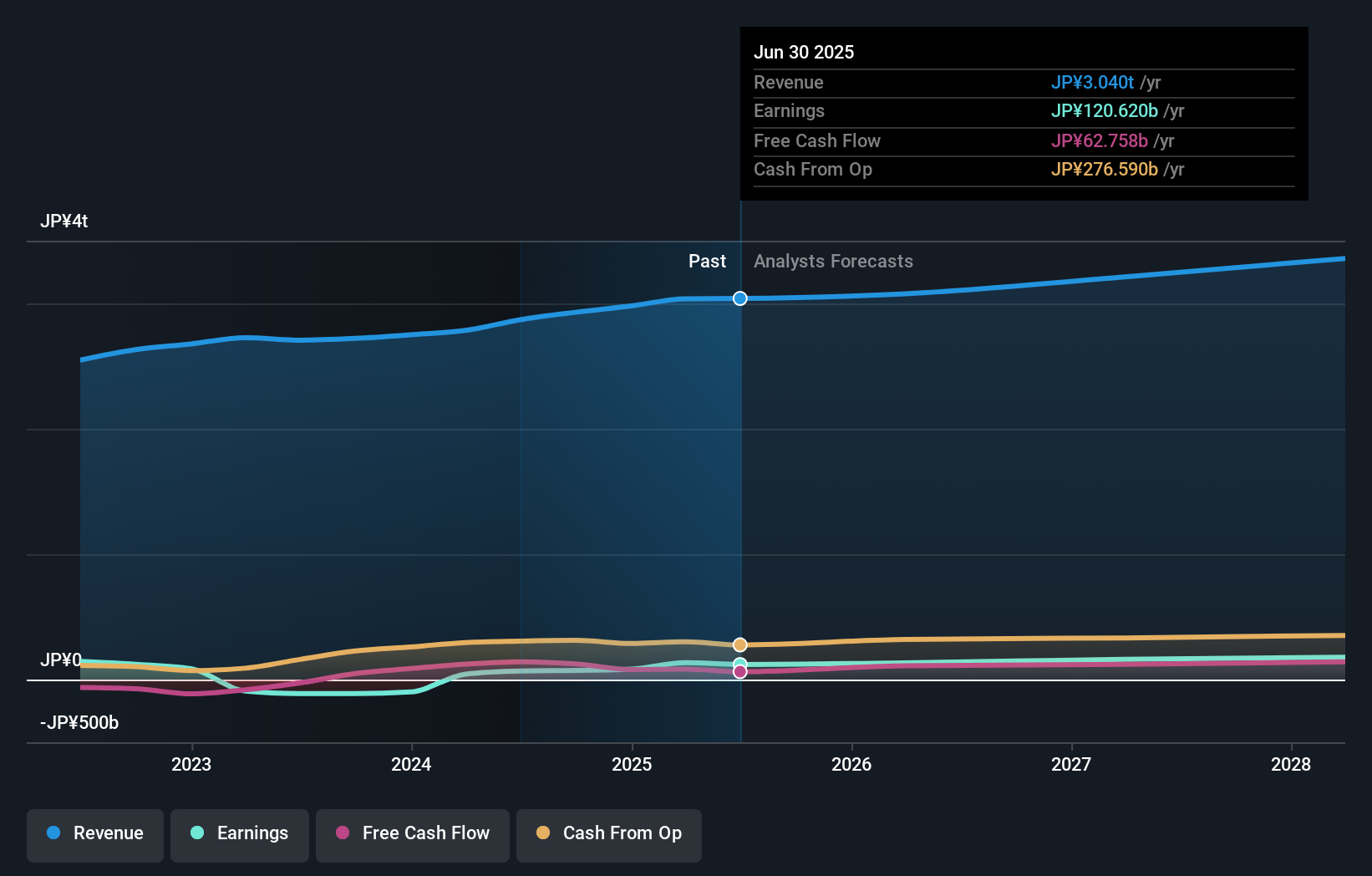

For Asahi Kasei, the investment case still leans on a diversified earnings base, improving profitability and a shareholder-friendly stance, with guided FY2026 earnings growth and a buyback of up to 3.31% of shares reinforcing that story. The decision to exit hexamethylene diamine by 2027 looks like a tidy fit with the “Trailblaze Together” focus on capital efficiency, particularly as management expects an immaterial hit to consolidated results and no disruption to PA66 or HDI. In the near term, catalysts remain centered on execution in healthcare, electronics and energy transition materials, plus progress on the buyback. The ROICA–SENSIL biomass-balanced partnership adds to the sustainability angle, but is unlikely to move the needle financially right away, while the key risk is still whether the portfolio shift truly lifts returns on equity from currently modest levels.

However, investors should be aware that improving returns may prove slower and bumpier than expected. Asahi Kasei's shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Asahi Kasei - why the stock might be worth as much as 96% more than the current price!

Build Your Own Asahi Kasei Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asahi Kasei research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Asahi Kasei research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asahi Kasei's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報