ACV Auctions (ACVA): Valuation Check After AI Inspection Rollout and Commercial Expansion News

ACV Auctions (ACVA) has been in focus after rolling out AI powered inspection tools and accelerating its commercial expansion, a combination that could reshape how dealers source, evaluate, and move used vehicles on its marketplace.

See our latest analysis for ACV Auctions.

Despite the buzz around its AI inspections and yard expansion, ACV Auctions’ 1 month share price return of 50.37% comes after a tough stretch, with its 1 year total shareholder return still down 63.34%. This suggests that momentum is rebuilding from a depressed base.

If the ACV story has you interested in where digital and data are changing auto and mobility, it is worth exploring auto manufacturers as potential next candidates for your watchlist.

With shares still well below prior highs yet rallying hard on AI and commercial traction, has ACV Auctions’ risk reward finally tilted in favor of value seekers, or is the market already discounting years of future growth?

Most Popular Narrative: 21.8% Undervalued

With the most popular narrative putting ACV Auctions’ fair value meaningfully above the last close, the gap between sentiment and price becomes hard to ignore.

The company's successful commercialization of value added adjacent services such as ACV Transport and ACV Capital is increasing share of wallet among dealer partners and leveraging network effects, directly supporting both revenue acceleration and net margin improvement as operating scale increases. Strategic investment in new remarketing centers (greenfield strategy) and a commercial wholesale platform broadens ACV's total addressable market by enabling new commercial and upstream business lines, providing multi year top line growth levers that are likely not fully reflected in current valuation.

Curious how a still loss making marketplace earns a premium growth tag, with future margins and valuation multiples usually reserved for standout compounders? The narrative leans on ambitious revenue scaling, a sharp swing into profitability, and a punchy earnings multiple years from now. Want to see exactly which financial leaps have to land for that upside to materialize?

Result: Fair Value of $10.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, flat dealer wholesale volumes and unproven initiatives such as new remarketing centers could delay operating leverage and challenge the upbeat growth narrative.

Find out about the key risks to this ACV Auctions narrative.

Another View: Multiples Paint a Richer Picture

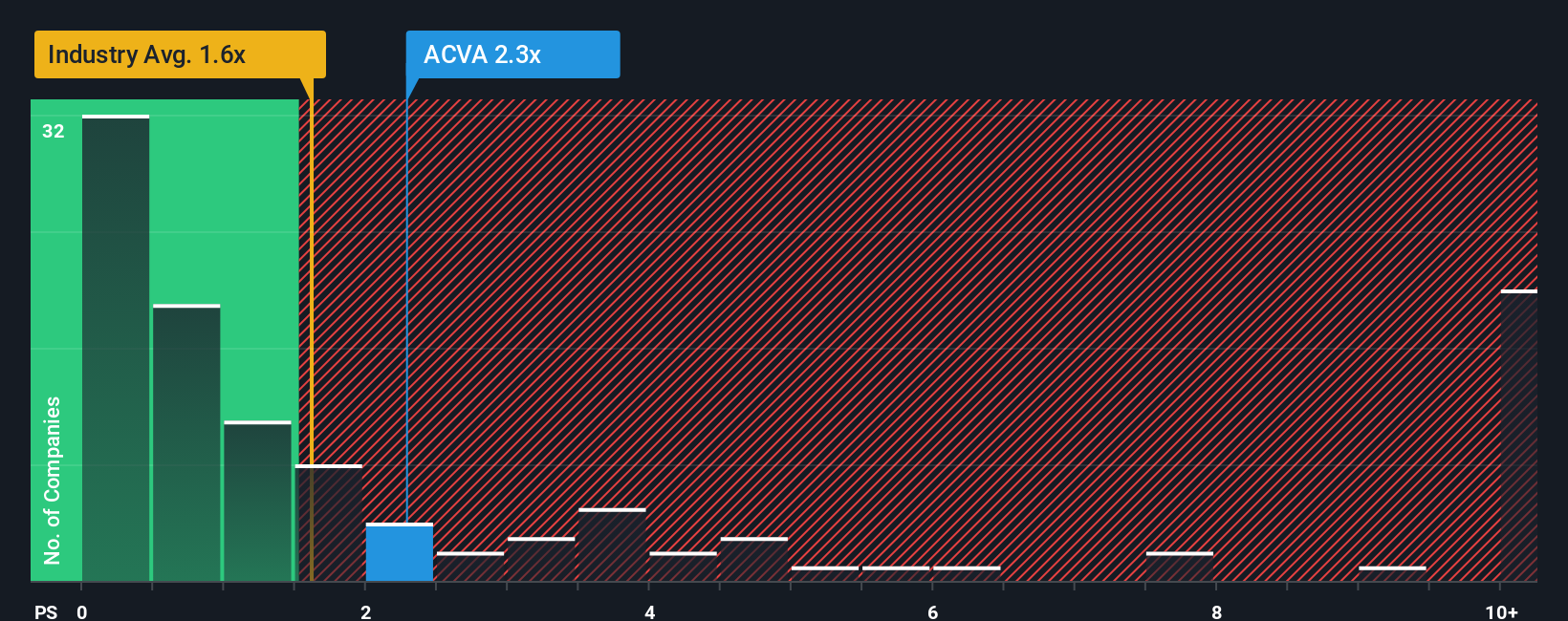

While the narrative and fair value model argue ACV Auctions is 21.8% undervalued, the market based view looks less forgiving. At a 1.9x price to sales ratio versus 1.1x for peers and a 1.2x fair ratio, investors are paying up today, raising the question of how much upside is really left if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a complete, data driven view in minutes using Do it your way.

A great starting point for your ACV Auctions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your advantage and use the Simply Wall Street Screener to uncover targeted, high conviction opportunities that most investors overlook.

- Capture overlooked value by focusing on companies trading below their intrinsic worth, starting with these 909 undervalued stocks based on cash flows that already align with strong cash flow potential.

- Explore trends in automation and machine learning by zeroing in on these 27 AI penny stocks that are exposed to enterprise and consumer demand for these technologies.

- Strengthen your income strategy by reviewing these 15 dividend stocks with yields > 3% that combine attractive yields with the potential for long term capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報