Investors Still Waiting For A Pull Back In Aritzia Inc. (TSE:ATZ)

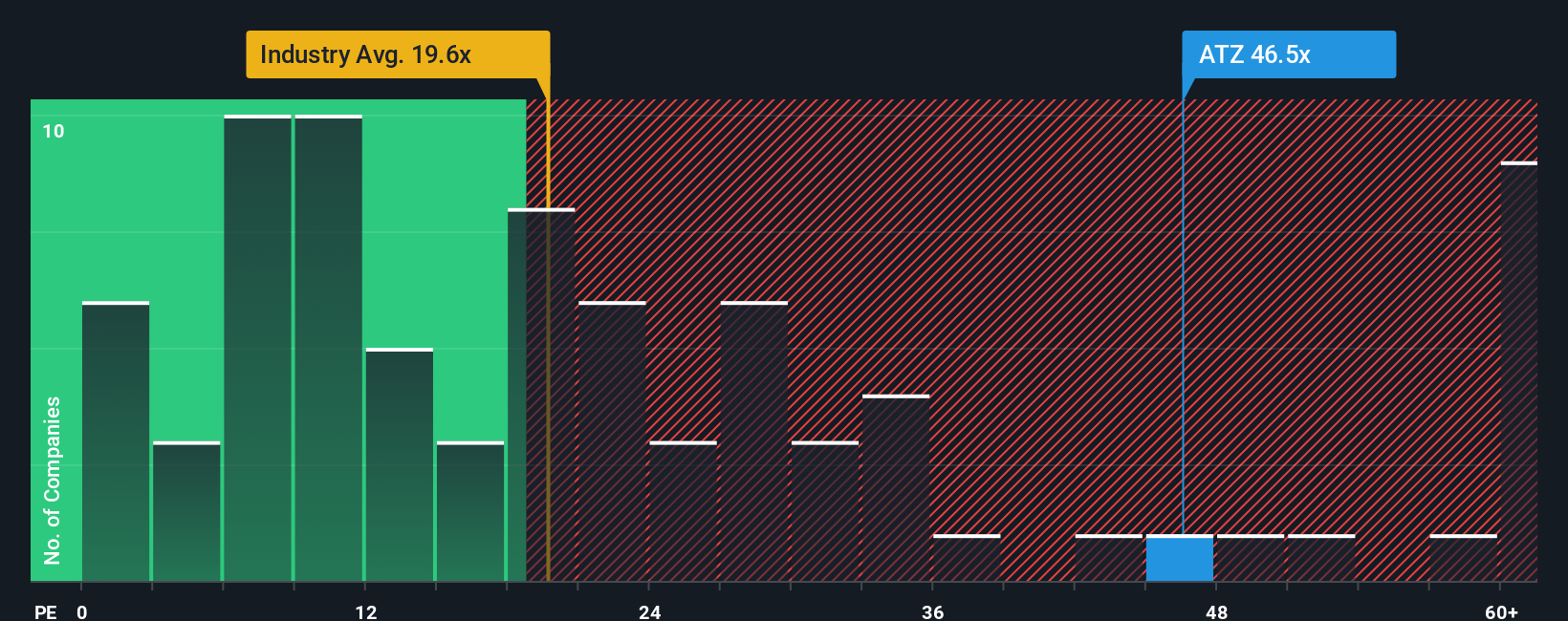

Aritzia Inc.'s (TSE:ATZ) price-to-earnings (or "P/E") ratio of 46.5x might make it look like a strong sell right now compared to the market in Canada, where around half of the companies have P/E ratios below 16x and even P/E's below 8x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Aritzia has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Aritzia

What Are Growth Metrics Telling Us About The High P/E?

Aritzia's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 173% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 51% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 17% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

With this information, we can see why Aritzia is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Aritzia's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Aritzia maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Aritzia with six simple checks on some of these key factors.

You might be able to find a better investment than Aritzia. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報