Implicit fluctuations in US stocks hit a new high since March, and traders are betting that the Fed's decision will trigger intense market conditions

The Zhitong Finance App learned that Strategas Group's data shows that after the Federal Reserve made a decision this Wednesday, the implied fluctuation of the US stock market in either direction was slightly less than 1%. A fluctuation of this magnitude would be the biggest one-day fluctuation in the benchmark stock index since March after the Federal Reserve's decision.

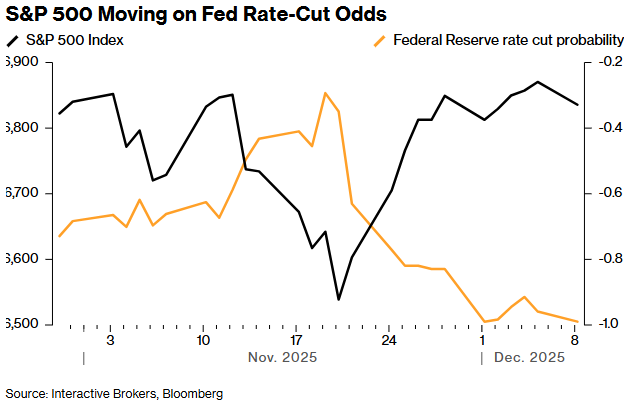

Over the past six weeks, the volatility surrounding interest rate decisions has been one of the main characteristics of stock trading, and its importance has even surpassed concerns about the impact of the AI bubble and US President Trump's trade policy. In mid-November, the market's implied probability of cutting interest rates fell to 30%. Just before that, the S&P 500 index and Nasdaq 100 index fell more than 5% from record highs at the end of October.

New York Federal Reserve Chairman John Williams said on November 21 that he believes there is room for policy relaxation in the near future, and the market interpreted this as full support for the December interest rate cut. Since then, the market's pricing of interest rate cuts has reached 97%, and the S&P 500 index has jumped 3.7%.

Jason Hunt, a technical strategist at J.P. Morgan Chase Securities, said, “Since the end of October, the trajectory of the market has mainly depended on the market's implied probability of easing policy interest rates in December.”

The trend of the S&P 500 index is affected by the probability that the Fed will cut interest rates

The potential for Wednesday's volatility is mainly due to possible differences among Federal Reserve officials. Three policy makers are expected to oppose interest rate cuts. Investors will also receive individual members' updated economic forecasts, as well as their views on future interest rate trends. Given that Federal Reserve Chairman Powell's term ends next year, these views are expected to be hugely divided.

But this also happened at a time when the Federal Reserve's interest rate decision had less and less immediate impact on stock trading. Part of this is due to the Federal Reserve's communication efforts. In previous meetings, investors could almost determine what the outcome would be, enabling investors to price any changes well in advance before the resolution was announced. Furthermore, for most of this year, transactions have been dominated by AI fervor rather than Federal Reserve policy.

Stefano Pascale, head of US equity derivatives research at Barclays Bank, said: “During these meetings, actual fluctuations were abnormally low, close to zero, which highlights that the influence of monetary policy as a traditional macroeconomic driver is weakening.” He pointed out that since the first quarter of 2023 (the end of the previous cycle of rate hikes), even on the day of the FOMC meeting, the amount of implied fluctuation “dropped significantly.”

This trend continued between the two meetings, and the rebound at the end of November was almost entirely based on expectations that the Federal Reserve would cut interest rates. However, Zachary Hill, head of portfolio management at Horizon Investments LLC, said he believes the market is paying too much attention to the actions the Federal Reserve will take this week, especially considering that price fluctuations before and after several interest rate cuts earlier this year have been moderate.

He said, “The impact of fluctuations in the probability of the Fed cutting interest rates on the market has exceeded our expectations, and frankly, it has also exceeded what should be.”

The actual absolute fluctuation of the S&P 500 index after the FOMC meeting results were announced

As the FOMC meeting's influence on the market is waning, Pascale advised investors to sell FOMC cross-style options to “take advantage of the recent pattern,” that is, the gap between implied and actual fluctuations in the S&P 500 index this Wednesday.

Many Wall Street strategists expect Wednesday's rate cuts will bring additional gains to the S&P 500. Sam Stovall, chief investment strategist at the CFRA, wrote in a report to clients that he expects interest rate cuts of 25 basis points “before the job market weakens”, which will help stimulate optimism in the market.

At Horizon, Hill said his team hasn't been in a hurry to rotate to the defensive sector over the past month and is trying to ignore market fluctuations. He said that whether the Federal Reserve cuts interest rates at this meeting is far less important than the long-term prospects for 2026. The new Federal Reserve Chairman selected by President Trump at that time is expected to push for more interest rate cuts.

“We're still looking for an offensive layout, especially when it comes to stocks,” he said. He added that he continues to be bullish on large AI-based tech stocks, as well as cyclical stocks that include banks of all sizes. “The areas we're not optimistic about are those sectors that are more defensive.”

Nasdaq

Nasdaq 華爾街日報

華爾街日報