Africa Israel Residences (TASE:AFRE): Assessing Valuation After Q3 Profit Growth Despite Lower Sales

Africa Israel Residences (TASE:AFRE) just posted third quarter results, with profit moving higher even as sales slipped. This mix quickly puts margins, cash generation and the new dividend into sharper focus for investors.

See our latest analysis for Africa Israel Residences.

Despite the stronger earnings and a newly confirmed cash dividend, the latest share price of ₪271.2 leaves Africa Israel Residences with a modest 90 day share price return of 6.06%, while the five year total shareholder return of 166.68% still points to substantial long term wealth creation and suggests momentum has cooled rather than reversed.

If these results have you thinking about what else might be interesting in the market, it could be a good moment to explore fast growing stocks with high insider ownership.

With earnings jumping even as revenue slipped and a fresh cash dividend on the way, investors now have to ask whether Africa Israel Residences is trading below its true worth or whether the market already anticipates further growth.

Price-to-Earnings of 14.1x: Is it justified?

On a headline basis, Africa Israel Residences trades at a price-to-earnings multiple of 14.1x against the last close of ₪271.2, suggesting a cheaper earnings tag than many peers even as our DCF view flags the shares as expensive.

The price-to-earnings ratio compares the company’s current share price with its earnings per share and is a common way to gauge how much investors are willing to pay for each unit of profit. For a residential developer with relatively mature operations and meaningful earnings, it is a relevant yardstick for how the market is pricing its current profitability and expected future growth.

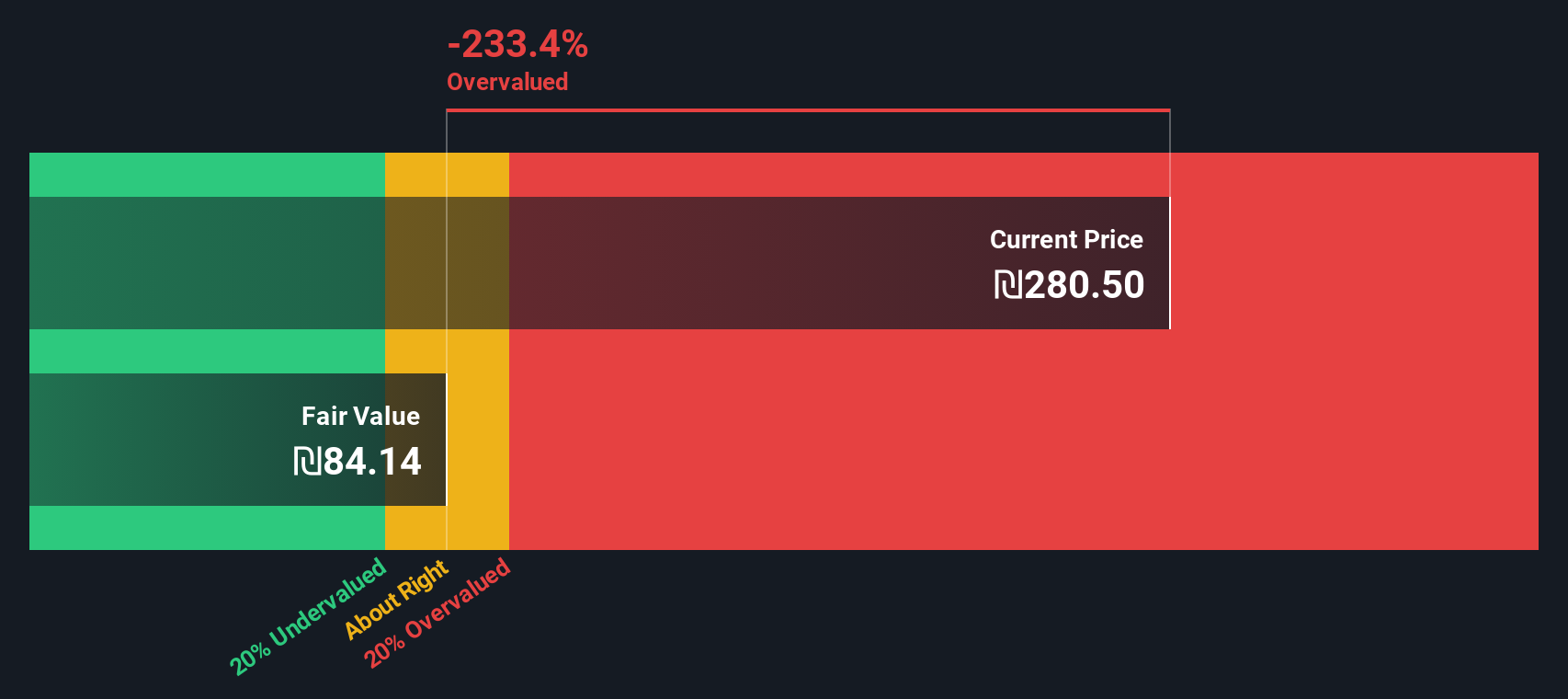

Here, the 14.1x multiple sits below the broader Israeli market average of 15.3x and well under the 24.2x peer average, which implies investors are not paying a premium for Africa Israel Residences earnings despite its 44.5% year on year profit growth and wider net margins. Even so, our SWS DCF model points in a very different direction, with an estimated fair value of ₪83.58 per share that sits far below the current ₪271.2 price. This indicates that when cash flow expectations and risk are fully modelled, the stock screens significantly overvalued on a fundamental basis despite the modest looking earnings multiple.

Compared with the Israeli real estate industry price-to-earnings average of 14.8x, Africa Israel Residences still trades at a slight discount. This reinforces the idea that, on simple profit multiples, it does not carry an obvious sector premium, even though more detailed cash flow based analysis paints a far richer valuation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14.1x (ABOUT RIGHT)

However, fresh macro shocks in Israel or a sharper property downturn could quickly challenge recent margin gains and pressure both earnings visibility and sentiment.

Find out about the key risks to this Africa Israel Residences narrative.

Another View on Value

While Africa Israel Residences looks inexpensive on a simple 14.1x earnings basis, our SWS DCF model paints a tougher picture, with fair value at roughly ₪83.58 per share, well below the current ₪271.2 level. If cash flows disappoint, today’s discount to peers could quickly vanish.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Africa Israel Residences for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Africa Israel Residences Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Africa Israel Residences research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, apply the same focused approach to other opportunities and let data driven screeners help you spot your next potential winners early.

- Capture potential mispricings by starting with these 909 undervalued stocks based on cash flows that already show cash flow support for their market prices.

- Explore structural trends by checking out these 27 AI penny stocks positioned in intelligent automation and data driven innovation.

- Review these 15 dividend stocks with yields > 3% that combine income potential with underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報