ASM International (ENXTAM:ASM) Valuation After Morgan Stanley Top Pick Call and CEO Reappointment

Morgan Stanley putting ASM International (ENXTAM:ASM) at the top of its European chips list, together with a planned second term for CEO Hichem M Saad, has sharpened investor focus on the stock.

See our latest analysis for ASM International.

The bullish call from Morgan Stanley, combined with CEO continuity, comes as ASM International’s share price has surged, including a 6.92% 1 day share price return and 30.98% 90 day share price return. Its 5 year total shareholder return of 245.10% underlines powerful long term momentum.

If ASM’s run has you rethinking your chip exposure, this is a good moment to see what else is out there via high growth tech and AI stocks.

With the shares near €553 and still trading at a discount to analyst targets despite robust double digit revenue and earnings growth, is ASM International quietly undervalued, or is the market already baking in years of AI led expansion?

Most Popular Narrative Narrative: 12% Undervalued

With ASM International closing at €553 against a narrative fair value around €626, the latest consensus frames the stock as modestly mispriced on the upside.

Record growth in the spares and services business powered by an expanding installed base and high value outcome based services creates recurring, higher margin revenue streams that improve earnings stability and offset hardware order volatility.

Want to see what powers that premium view on ASM International? The narrative leans hard on compounding revenues, rising margins, and a future earnings multiple that still assumes discipline. Curious how those ingredients combine into that fair value upside? Dive in to uncover the exact growth and profitability path this story is built on.

Result: Fair Value of €626.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several risks could still upset this upside case, including prolonged China headwinds and a sharper than expected slowdown in wafer fab equipment spending.

Find out about the key risks to this ASM International narrative.

Another View: Cash Flows Tell A Tougher Story

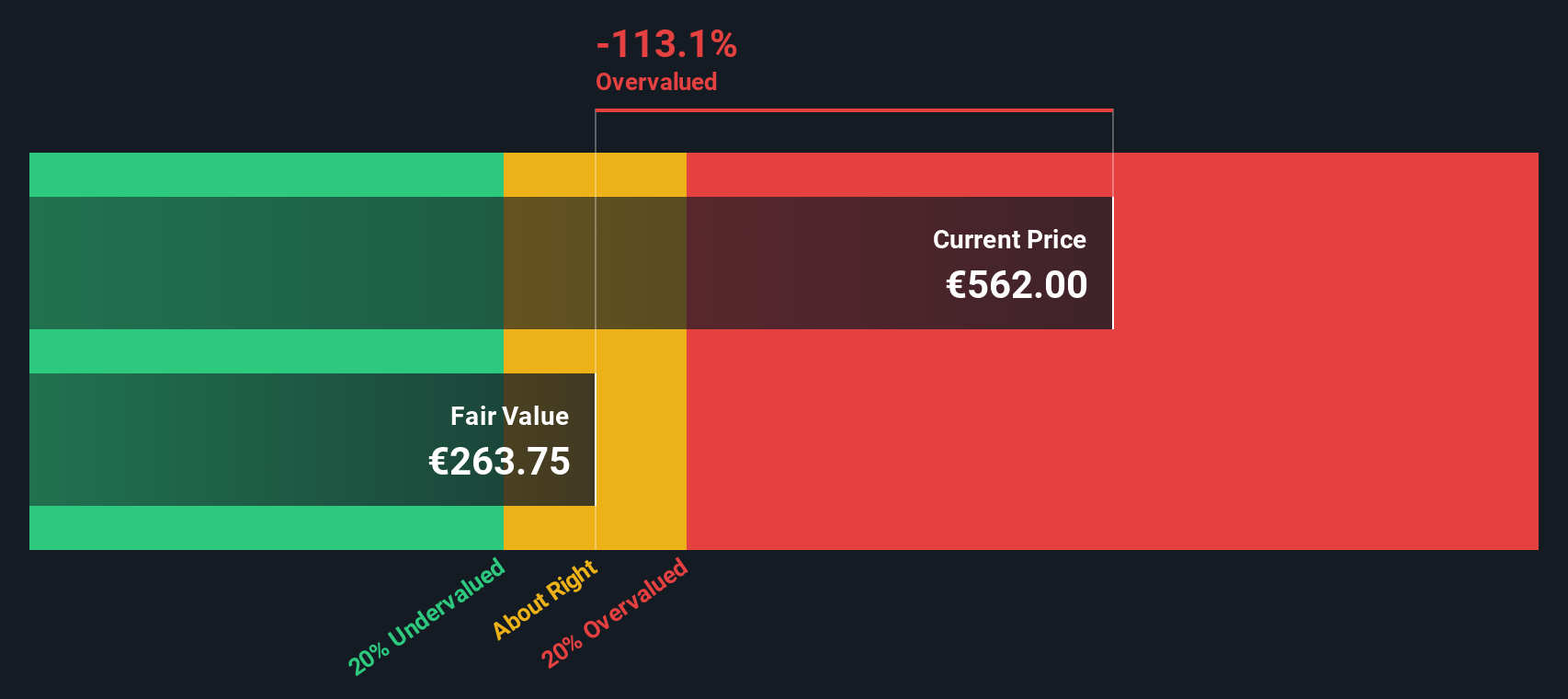

While the narrative based valuation paints ASM International as around 12% undervalued, our DCF model is far more cautious. It puts fair value closer to €255, well below the current €553 share price. If both are using reasonable assumptions, which version of the future do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASM International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASM International Narrative

If you are not fully convinced by these interpretations, or prefer hands on research, you can quickly build a tailored ASM International story yourself: Do it your way.

A great starting point for your ASM International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider giving yourself the chance to uncover fresh opportunities that could complement or outperform ASM International using powerful, data driven stock screens.

- Tap into potential multi baggers by scanning these 3595 penny stocks with strong financials that pair small market caps with surprisingly resilient balance sheets and improving fundamentals.

- Position your portfolio at the heart of the AI revolution by targeting these 27 AI penny stocks that are poised to benefit from accelerating demand for intelligent software and infrastructure.

- Explore more dependable portfolio income by reviewing these 15 dividend stocks with yields > 3% that combine above average yields with underlying businesses built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報