Xeris Biopharma (XERS): Valuation Check After USPTO Notice of Allowance for Weekly Levothyroxine XP-8121 Patent

The latest move in Xeris Biopharma Holdings (XERS) shares comes after the company secured a USPTO Notice of Allowance for XP-8121, its once weekly levothyroxine injection, potentially reshaping a tricky hypothyroidism niche.

See our latest analysis for Xeris Biopharma Holdings.

That patent progress has helped snap the stock back into focus, with a 1 day share price return of 7.37 percent at 6.99 and year to date share price returns above 100 percent. Even after a softer three month patch, this suggests momentum is still broadly building on top of a very strong three year total shareholder return of 395.74 percent.

If XP-8121 has caught your eye, this could also be a good moment to explore other potential winners across healthcare stocks for ideas beyond a single name.

Yet with analysts’ targets sitting well above the current price and valuation metrics hinting at a sizable intrinsic discount, investors must now ask whether Xeris remains a mispriced growth story or if the market is already baking in future gains.

Most Popular Narrative Narrative: 39.2% Undervalued

With the most widely followed fair value at 11.50 versus the 6.99 last close, the narrative leans heavily toward upside and backs that view with aggressive growth maths.

The impending launch of XP-8121, which utilizes proprietary delivery technology to address a significant unmet need in hypothyroidism, opens the door to a high-value market segment underserved by innovation, potentially driving new revenue streams and long-term margin expansion.

Want to see what kind of revenue trajectory, margin lift, and future earnings multiple are built into that upside, and how far those assumptions really stretch? Read on to unpack the full narrative driving this valuation call.

Result: Fair Value of $11.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on navigating heavy reliance on a narrow product lineup while containing rising SG&A and R&D costs that could squeeze margins.

Find out about the key risks to this Xeris Biopharma Holdings narrative.

Another Lens on Value

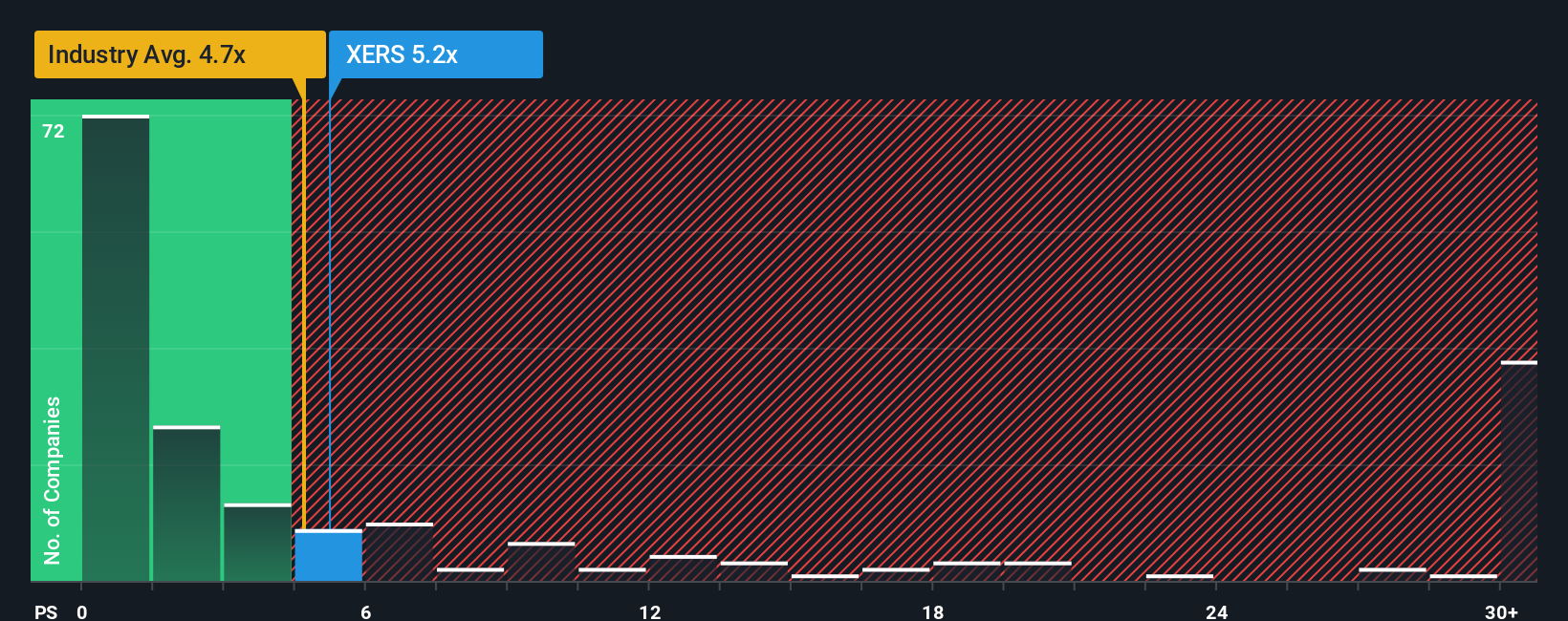

While the narrative suggests Xeris is deeply undervalued, the price to sales ratio paints a cooler picture. At around 4.4 times sales, the stock trades slightly richer than the US pharma average of 4 times but notably below peers at 10.9 times and under its 6.1 times fair ratio, hinting at upside without screaming bargain. Which signal should investors trust more at this stage of the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xeris Biopharma Holdings Narrative

If you see the story differently or prefer to challenge the assumptions with your own research, you can build a fresh narrative in minutes: Do it your way

A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to keep your edge and spot the next opportunities before the crowd catches on, use the Simply Wall St Screener to uncover fresh prospects.

- Capture income potential by reviewing these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while many investors are still chasing pure growth stories.

- Position yourself early in structural tech shifts by scanning these 27 AI penny stocks that could benefit as artificial intelligence reshapes entire industries.

- Lock in potential bargains by filtering for these 909 undervalued stocks based on cash flows where market prices may not yet reflect the underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報