US Stock Market Today: S&P 500 Futures Edge Higher on Surging Global Chip Demand

The Morning Bull - US Market Morning Update Tuesday, Dec, 9 2025

US stock futures are edging higher this morning, with S&P 500 contracts up about 0.1 percent, as investors weigh booming global tech demand against rising borrowing costs. Taiwan just reported record November exports of 64 billion US dollars, up 56 percent from a year ago, a sign of powerful demand for chips and electronics that supports US technology and semiconductor names. At the same time, the US 10 year Treasury yield has climbed back near 4.17 percent, which means higher mortgage, credit card, and business loan costs. The dilemma now is whether growth sensitive tech can outrun the drag on banks and utilities.

We have pinpointed 27 AI penny stocks that appear positioned to benefit from strong chip demand before borrowing costs rise further.

Top Movers

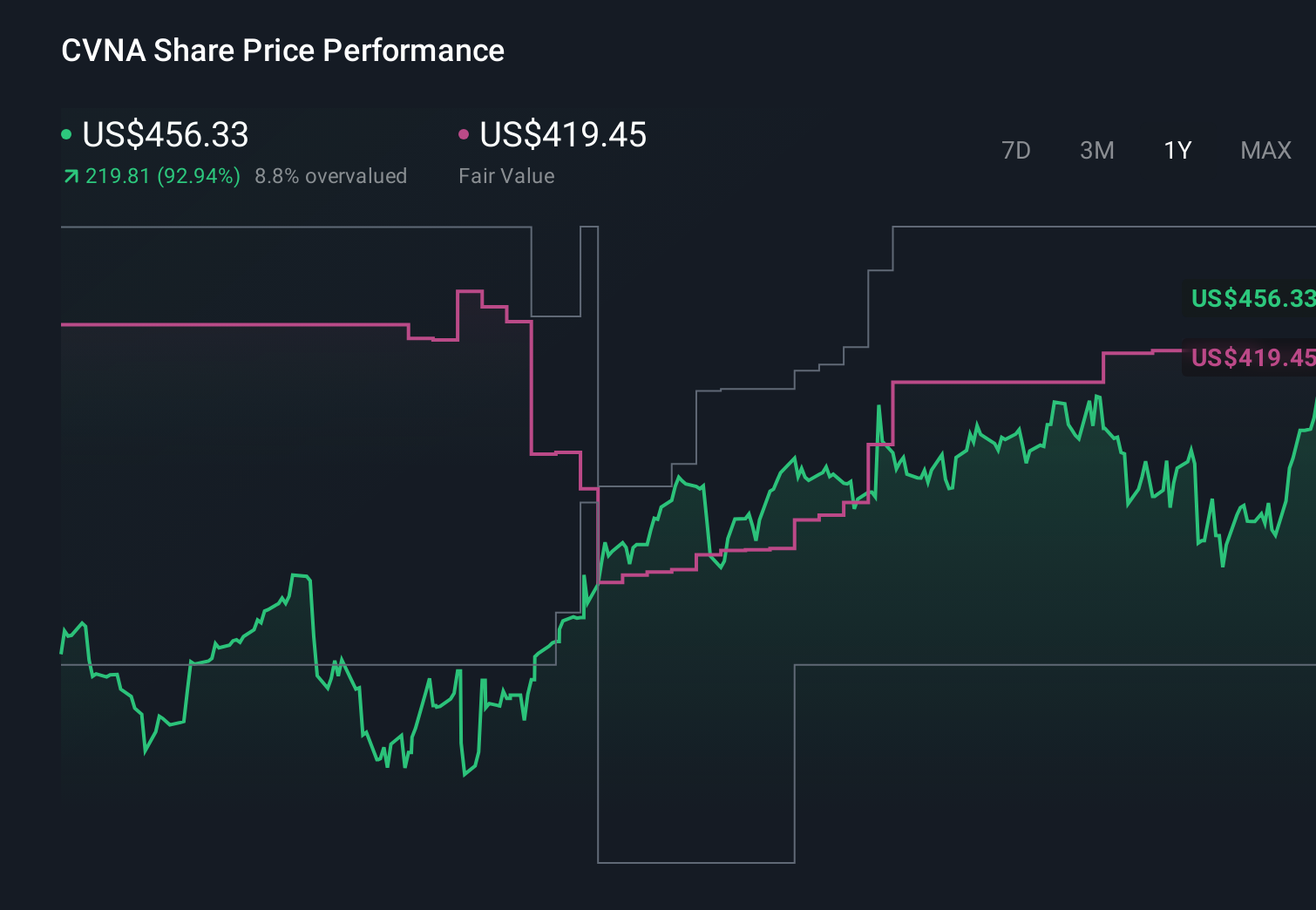

- Carvana (CVNA) jumped 12.06 percent after news it will join the S&P 500 index.

- Astera Labs (ALAB) climbed 9.00 percent as investors cheered adoption of its Leo CXL Smart Memory Controller.

- Flex (FLEX) rose 8.22 percent on renewed optimism around hardware demand and operational execution.

Is Carvana still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

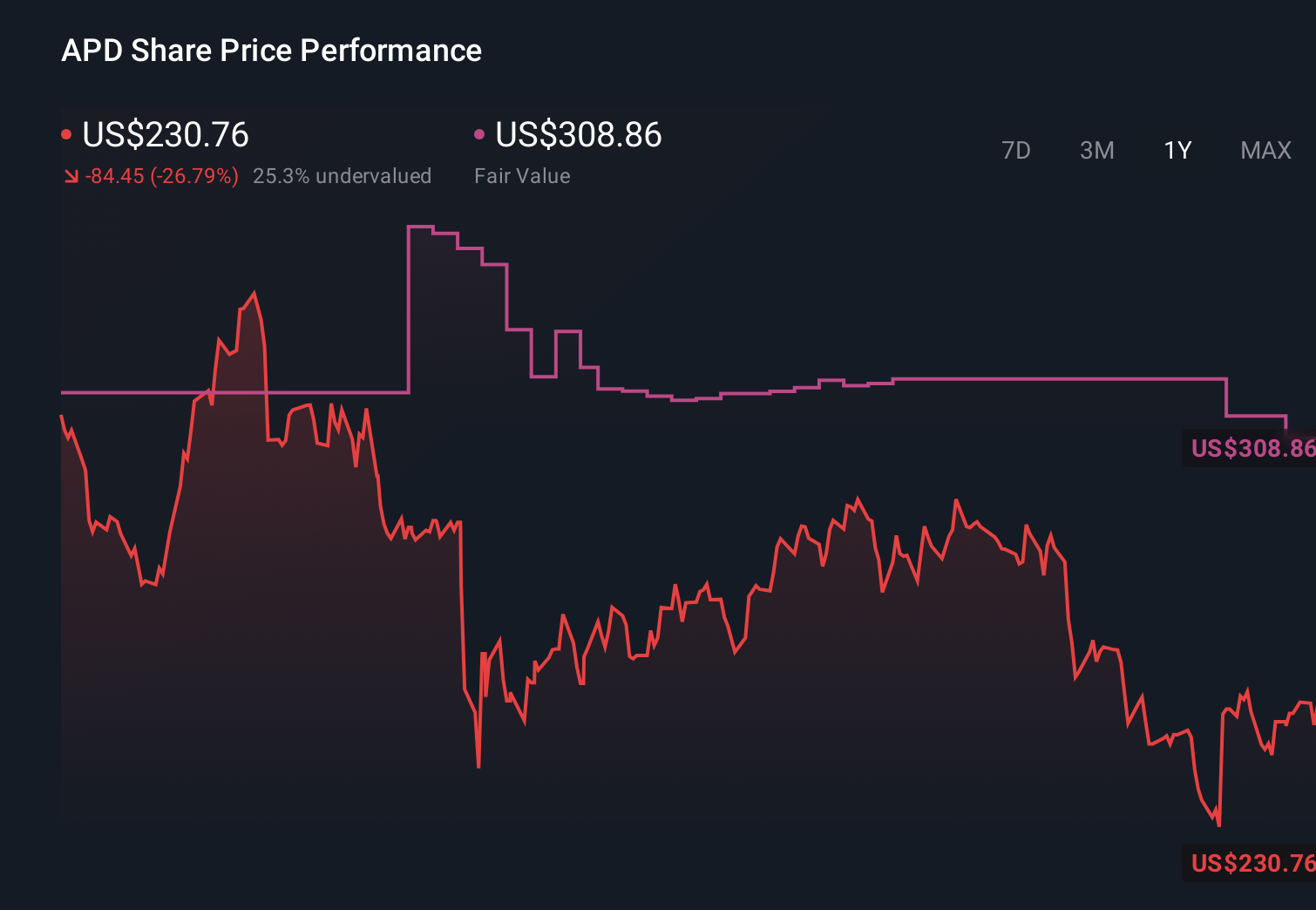

- Air Products and Chemicals (APD) slid 9.45 percent after investors questioned returns on new clean ammonia partnership plans.

- Polestar Automotive Holding UK (PSNY) fell 7.15 percent ahead of its steep 1 for 30 reverse stock split.

- Marvell Technology (MRVL) dropped 6.99 percent after Benchmark downgraded the stock to Hold amid growth concerns.

Look past the noise - uncover the top narrative that explains what truly matters for Polestar Automotive Holding UK's long-term success.

On The Radar

High profile tech and retail earnings over the next two sessions will anchor trading sentiment more than macro data.

- Consumer Staples: Costco Wholesale (COST) reports Q1 results on Thursday, highlighting traffic, membership trends, and price sensitivity.

- Premium Athleisure: lululemon athletica (LULU) Q3 earnings on Thursday will test discretionary demand for higher end apparel.

- Chip and AI Infrastructure: Broadcom (AVGO) posts Q4 numbers Thursday, giving a read on AI server and networking budgets.

- Design Software: Adobe (ADBE) Q4 earnings Wednesday will spotlight AI driven upsells and subscription growth durability.

- Enterprise Software: Oracle (ORCL) reports Wednesday, with cloud growth and AI database demand in sharp focus.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

How To Act On Today's Market

Most investors are chasing yesterday's winners, but the real edge is spotting durable value before the crowd moves in, and time is not on your side. Our models just surfaced undervalued stocks based on cash flows, quietly mispriced by the market, with cash flow strength and upside potential that make them stand out in a higher rate, stock picker’s market.

Ready to take control of your next move? Use our stock screener to run custom searches that fit your unique style and set timely alerts so you never miss a promising new opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報