Undiscovered Gems in Europe for December 2025

As the European markets navigate a period of mixed economic signals, with the pan-European STOXX Europe 600 Index edging slightly higher amid hopes for interest rate cuts, investors are keenly observing opportunities within small-cap stocks. In this environment, identifying promising companies that demonstrate resilience and potential for growth can be particularly rewarding, especially those that manage to thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Evergent Investments (BVB:EVER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Evergent Investments SA is a publicly owned investment manager with a market capitalization of RON 2.44 billion.

Operations: The primary revenue streams for Evergent Investments are financial investment services and the manufacture of agricultural machinery and equipment, generating RON 220.41 million and RON 21.61 million respectively. The cultivation of fruit-bearing trees, specifically blueberries, contributes an additional RON 7.90 million in revenue.

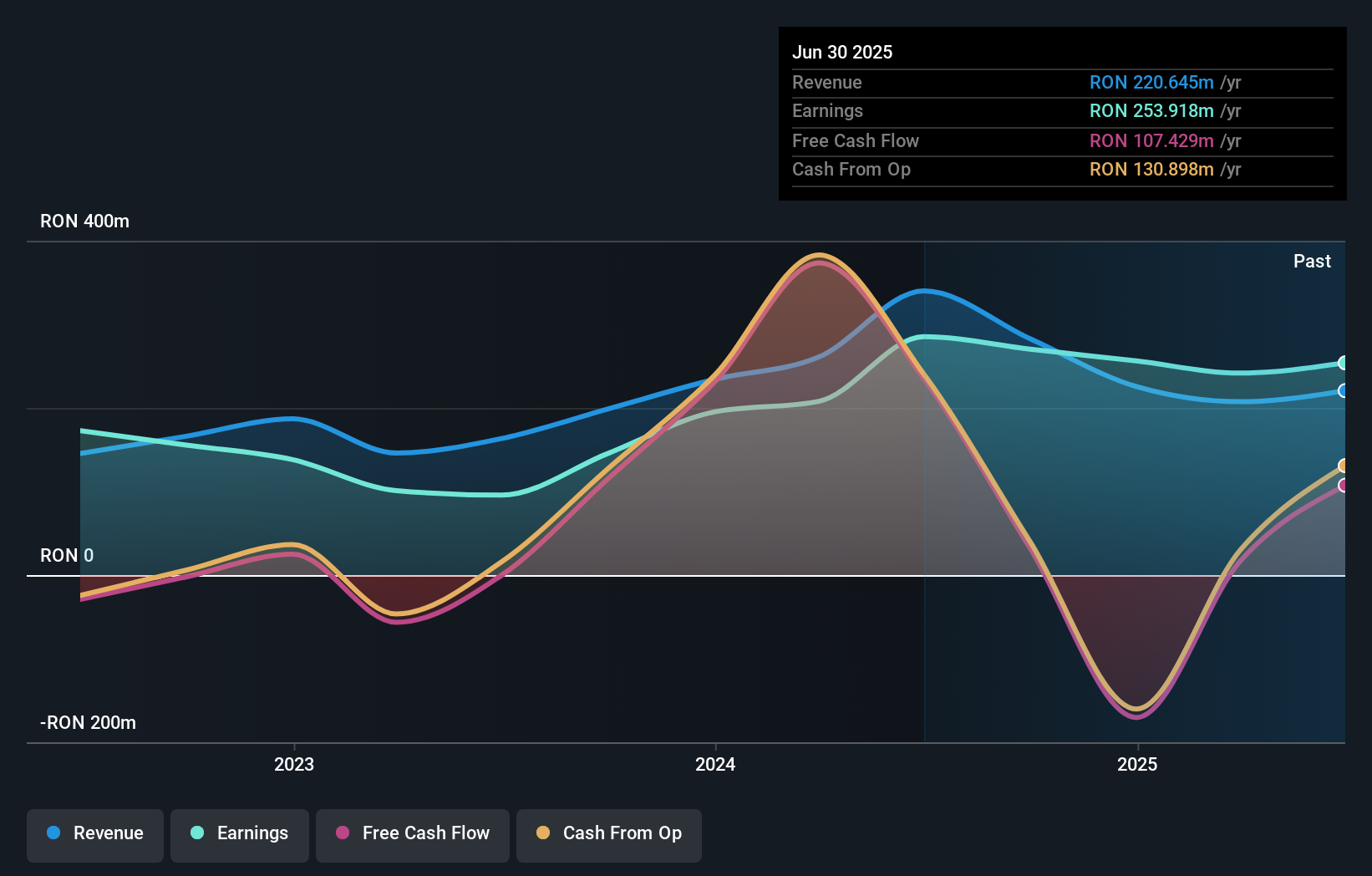

Evergent Investments, a financial entity with a robust track record, showcases promising attributes. With earnings growth of 25.4% over the past year, it outpaced the Capital Markets industry average of -31.6%. The company's price-to-earnings ratio stands at 8.9x, offering better value compared to the Romanian market's 14.9x. Furthermore, Evergent maintains high-quality earnings and its interest payments are well-covered by EBIT at 16.8x coverage. Recent announcements revealed net income for nine months ending September 2025 was RON 151.73 million, up from RON 132.92 million last year, reflecting solid financial health and potential for future growth.

- Click here to discover the nuances of Evergent Investments with our detailed analytical health report.

Explore historical data to track Evergent Investments' performance over time in our Past section.

Freetrailer Group (DB:R0C)

Simply Wall St Value Rating: ★★★★★☆

Overview: Freetrailer Group A/S is a technology company that operates a sharing-economy platform for the free rental of trailers and cargo bikes across Denmark, Sweden, Germany, and the Netherlands with a market cap of €747.25 million.

Operations: Freetrailer Group generates revenue primarily from its Software & Programming segment, amounting to DKK 137.99 million. The company's financial performance is characterized by a focus on this segment as a key revenue driver.

Freetrailer Group, a nimble player in the rental trailer industry, has shown robust financial performance with earnings growing 42.2% over the past year, outpacing the transportation sector's growth of 7.6%. The company reported first-quarter sales of DKK 41.75 million and net income of DKK 9.67 million compared to last year's figures of DKK 33.25 million and DKK 7.7 million respectively, indicating solid revenue expansion and profitability improvement. With strategic agreements like those with Het Goed in the Netherlands and Mio in Sweden, Freetrailer is poised for further market penetration across Europe as it expands its service offerings significantly by early next year.

- Get an in-depth perspective on Freetrailer Group's performance by reading our health report here.

Examine Freetrailer Group's past performance report to understand how it has performed in the past.

FM Mattsson (OM:FMM B)

Simply Wall St Value Rating: ★★★★★★

Overview: FM Mattsson AB (publ) is engaged in the development, manufacturing, and sale of water taps and related products for bathrooms and kitchens across several European countries and internationally, with a market cap of approximately SEK2.50 billion.

Operations: FM Mattsson generates revenue primarily from the Nordic Countries, contributing SEK1.11 billion, and international markets, accounting for SEK827.81 million.

FM Mattsson, a notable player in the European market, has demonstrated robust earnings growth of 15.6% over the past year, surpassing the building industry's -1.7%. The company is debt-free, eliminating concerns about interest coverage and highlighting financial stability. Its price-to-earnings ratio stands at 21x, offering a favorable comparison to Sweden's broader market at 22.3x. Recent reports show third-quarter sales of SEK 447 million with net income climbing to SEK 31 million from SEK 22 million last year, reflecting solid performance and potential for continued growth in its sector.

- Click to explore a detailed breakdown of our findings in FM Mattsson's health report.

Gain insights into FM Mattsson's past trends and performance with our Past report.

Summing It All Up

- Unlock our comprehensive list of 312 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報