3 European Dividend Stocks To Consider For Your Portfolio

As the European market navigates mixed returns amid hopes for interest rate cuts in the U.S. and UK, investors are closely watching inflation trends and economic growth revisions across the eurozone. In such a dynamic environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to bolster their portfolios with reliable returns amidst economic fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.35% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.65% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.06% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.80% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.60% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.86% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.20% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.42% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

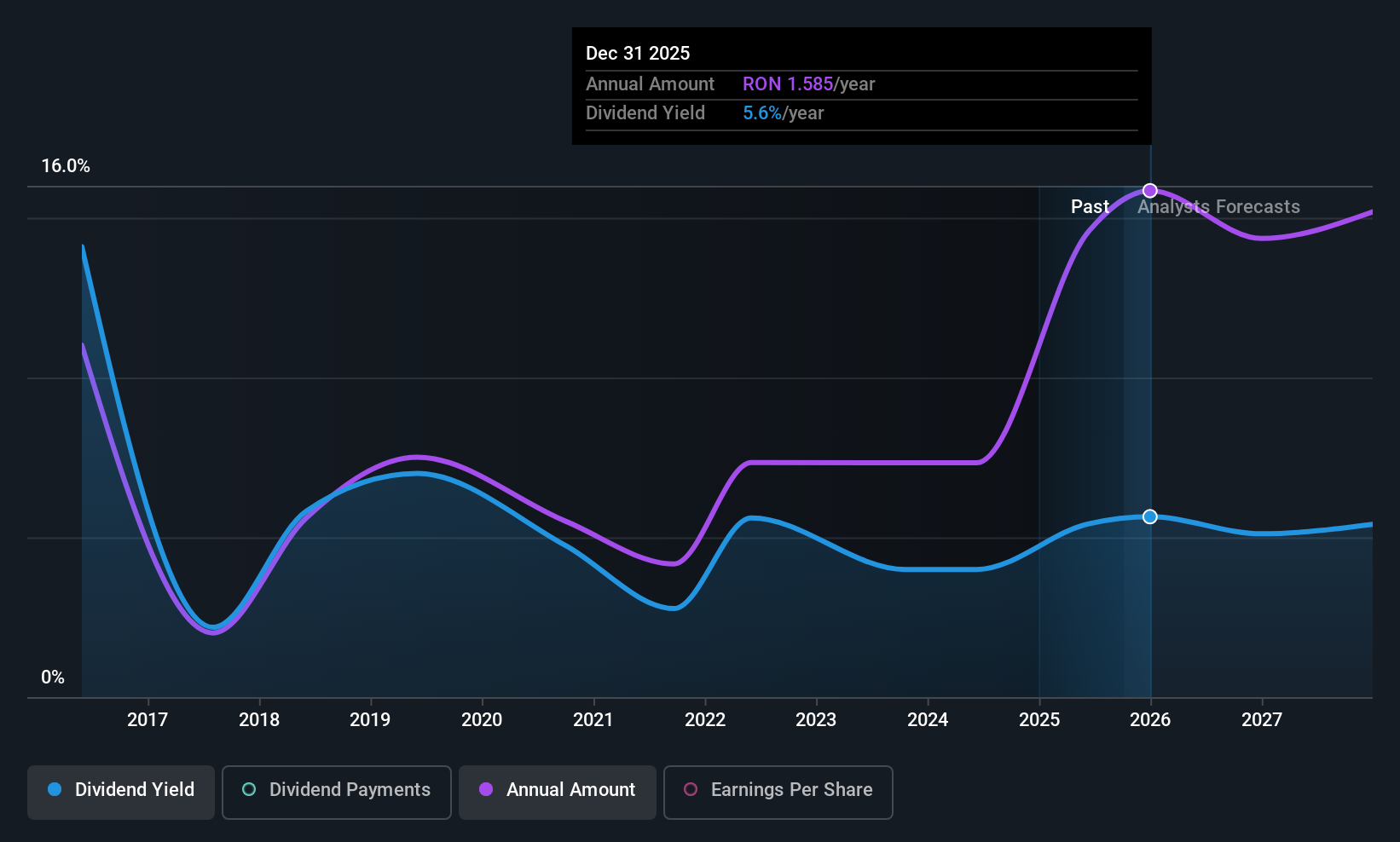

Banca Transilvania (BVB:TLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banca Transilvania S.A. offers a range of banking products and services in Romania, Italy, and the Republic of Moldova with a market cap of RON32.82 billion.

Operations: Banca Transilvania S.A.'s revenue segments include Retail (RON3.95 billion), Micro (RON1.67 billion), Treasury (RON1.37 billion), Leasing and Consumer Loans Granted by Non-Bank Financial Institutions (RON819.62 million), Large Corporate (RON993.11 million), Mid Corporate (RON909.41 million), and SME (RON606.65 million).

Dividend Yield: 4.8%

Banca Transilvania's dividend payments have been volatile over the past decade, although they have shown growth. The company recently approved a cash dividend distribution of RON 700 million from reserves, with a gross dividend per share of RON 0.6420 payable on December 11, 2025. Despite having a high level of bad loans at 3.7%, its dividends are currently well covered by earnings with a payout ratio of 39.8%.

- Navigate through the intricacies of Banca Transilvania with our comprehensive dividend report here.

- Our valuation report here indicates Banca Transilvania may be undervalued.

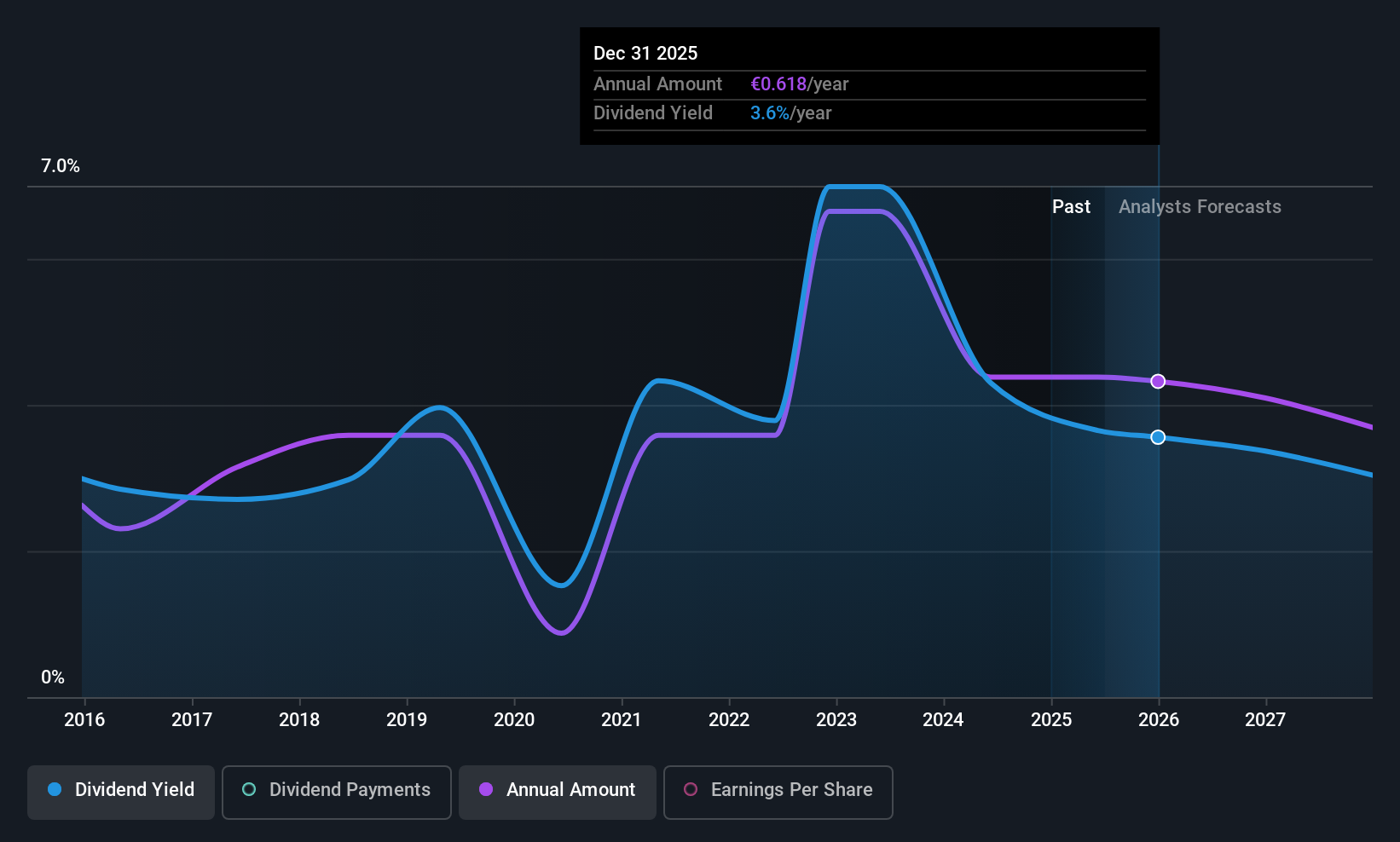

Semapa - Sociedade de Investimento e Gestão SGPS (ENXTLS:SEM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Semapa - Sociedade de Investimento e Gestão SGPS operates through its subsidiaries to produce and sell pulp, printing and writing papers, and tissues across various regions including Portugal, Europe, the United States, Africa, Asia, and Oceania with a market cap of approximately €1.36 billion.

Operations: Semapa - Sociedade de Investimento e Gestão SGPS generates revenue through its subsidiaries by producing and selling pulp, printing and writing papers, and tissues across multiple continents.

Dividend Yield: 3.7%

Semapa's dividend history is marked by volatility, with significant annual drops exceeding 20% in the past decade. Despite this, dividends have grown over the same period and remain well covered by earnings and cash flows, with low payout ratios of 26.3% and 32.4%, respectively. Trading at a good value relative to peers and industry standards, Semapa's stock is also significantly below its estimated fair value of €1 billion, though it carries a high debt level.

- Click here to discover the nuances of Semapa - Sociedade de Investimento e Gestão SGPS with our detailed analytical dividend report.

- According our valuation report, there's an indication that Semapa - Sociedade de Investimento e Gestão SGPS' share price might be on the cheaper side.

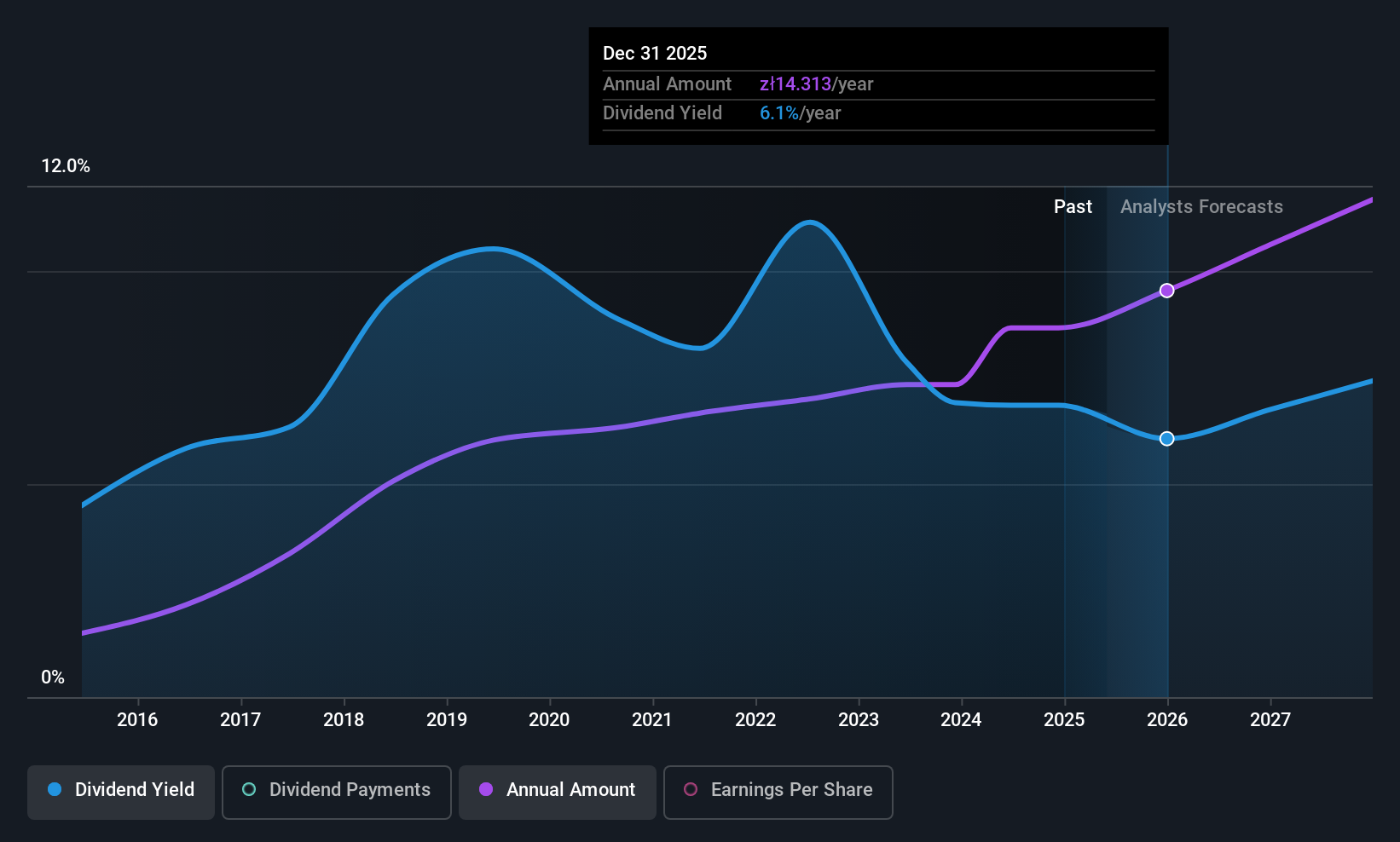

Dom Development (WSE:DOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dom Development S.A., with a market cap of PLN6.86 billion, operates in Poland through the development and sale of residential and commercial real estate properties, along with offering related support activities.

Operations: Dom Development S.A. generates revenue primarily from its Home Builders - Residential / Commercial segment, amounting to PLN3.32 billion.

Dividend Yield: 4.9%

Dom Development offers a stable dividend history with consistent growth over the past decade. Its dividends are well-covered by earnings, with a payout ratio of 55.8%, and cash flows, at 74.8%. The company trades slightly below its estimated fair value and delivers a reliable yield of 4.89%, though this is modest compared to top Polish dividend payers. Recent earnings reports show significant growth, supporting the sustainability of its dividend payments.

- Delve into the full analysis dividend report here for a deeper understanding of Dom Development.

- Upon reviewing our latest valuation report, Dom Development's share price might be too pessimistic.

Where To Now?

- Discover the full array of 205 Top European Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報