3 Global Dividend Stocks Yielding Over 3.3% To Enhance Your Portfolio

As global markets navigate the complexities of interest rate expectations and economic uncertainties, investors are keenly observing performance trends across major indices. With U.S. stock indexes recently posting gains amid hopes for Federal Reserve rate cuts and mixed economic signals from regions like Europe and China, the search for stable investment opportunities remains a priority. In such an environment, dividend stocks yielding over 3.3% can offer a blend of income and potential growth, providing resilience against market volatility while enhancing portfolio stability.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.47% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.95% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.65% | ★★★★★★ |

| NCD (TSE:4783) | 4.35% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.71% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.86% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.42% | ★★★★★★ |

Click here to see the full list of 1317 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

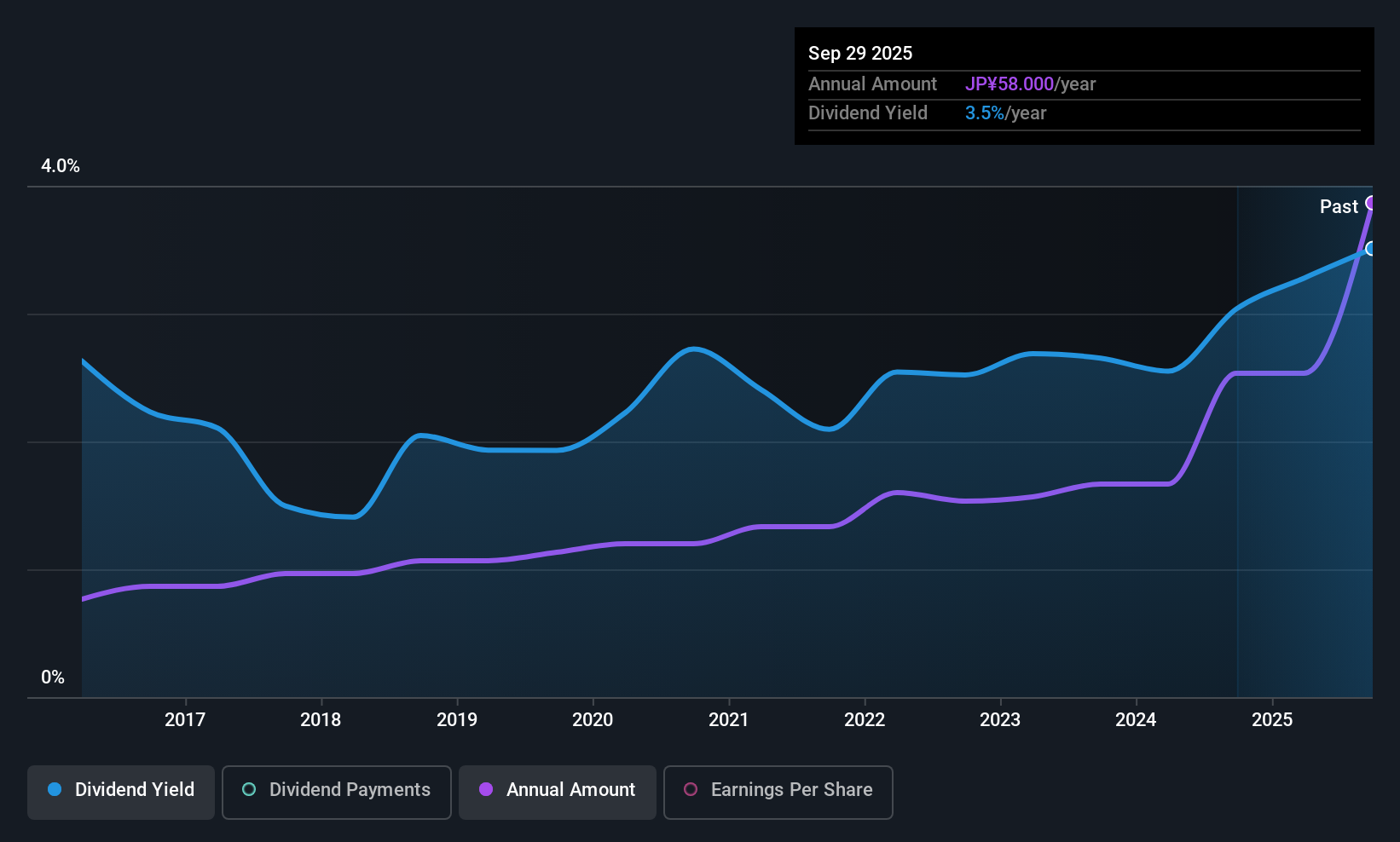

Cresco (TSE:4674)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cresco Ltd., along with its subsidiaries, provides IT services and digital solutions in Japan, with a market cap of ¥65.51 billion.

Operations: Cresco Ltd.'s revenue is primarily derived from its IT Service Business across Finance (¥17.20 billion), Enterprise (¥22.70 billion), and Manufacturing (¥14.22 billion) sectors, along with contributions from its Digital Solution Business (¥7.08 billion).

Dividend Yield: 3.6%

Cresco's dividend payments have historically been volatile and unreliable, with fluctuations exceeding 20% annually. However, dividends are currently well-covered by earnings (46.2%) and cash flows (53%), suggesting sustainability in the short term. Despite a modest yield of 3.6%, below Japan's top quartile, Cresco has shown dividend growth over the past decade. Recent share buybacks totaling ¥1.5 billion could positively impact future dividends by reducing outstanding shares.

- Click here to discover the nuances of Cresco with our detailed analytical dividend report.

- The analysis detailed in our Cresco valuation report hints at an deflated share price compared to its estimated value.

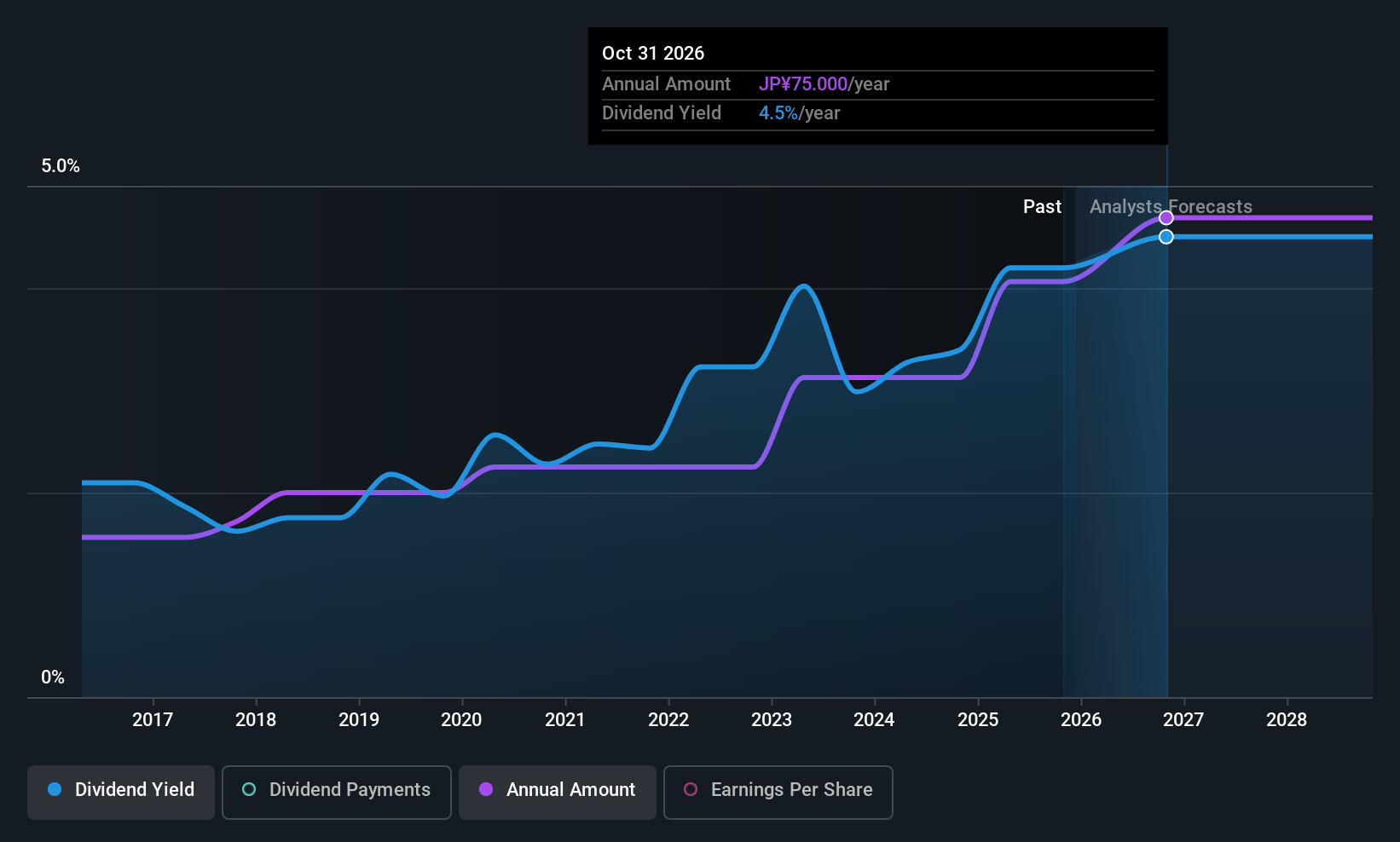

Hagihara Industries (TSE:7856)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hagihara Industries Inc., along with its subsidiaries, manufactures and sells plastic and industrial machinery products in Japan, Indonesia, Asia, and internationally, with a market cap of ¥22.37 billion.

Operations: Hagihara Industries Inc. generates revenue primarily from its Plastic Products segment, which accounts for ¥26.46 billion, and its Engineering Products segment, contributing ¥6.72 billion.

Dividend Yield: 3.8%

Hagihara Industries has maintained stable and reliable dividend payments over the past decade, with a payout ratio of 50.6% indicating coverage by earnings. However, its high cash payout ratio of 400.8% suggests dividends are not well-supported by cash flows, raising sustainability concerns despite a yield of 3.82%, ranking in Japan's top quartile. Recent downward revisions in earnings guidance due to weakened demand and external economic pressures may further impact future dividend stability.

- Navigate through the intricacies of Hagihara Industries with our comprehensive dividend report here.

- The analysis detailed in our Hagihara Industries valuation report hints at an inflated share price compared to its estimated value.

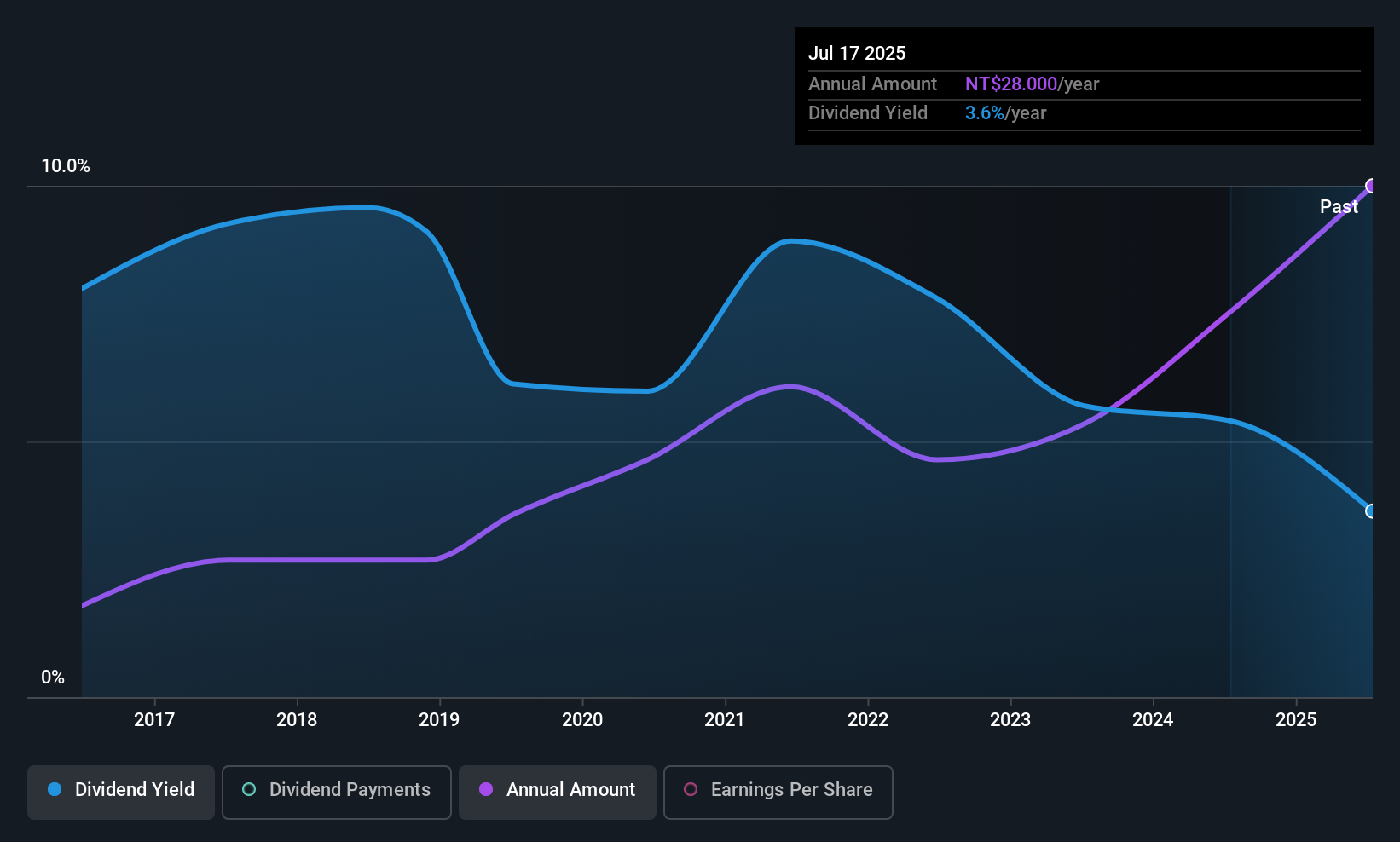

United Integrated Services (TWSE:2404)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Integrated Services Co., Ltd. offers engineering construction services across Taiwan, Mainland China, Singapore, the United States, and Japan, with a market cap of NT$152.76 billion.

Operations: United Integrated Services Co., Ltd. generates its revenue primarily from Engineering and Integration services amounting to NT$57.86 billion, supplemented by Maintenance and Design services at NT$202.96 million.

Dividend Yield: 3.3%

United Integrated Services has shown strong earnings growth, with a 61.5% increase over the past year, supporting its dividend payments. Despite a payout ratio of 62.9%, dividends are well-covered by cash flows (19.4%). However, the dividend yield of 3.35% is lower than Taiwan's top quartile payers and has been volatile over the past decade, raising concerns about reliability despite being covered by both earnings and cash flow.

- Take a closer look at United Integrated Services' potential here in our dividend report.

- Our valuation report unveils the possibility United Integrated Services' shares may be trading at a discount.

Turning Ideas Into Actions

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1314 more companies for you to explore.Click here to unveil our expertly curated list of 1317 Top Global Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報