Tokyu Fudosan Holdings (TSE:3289) Valuation After Launching Japan’s First ICMA-Aligned Climate and Nature Linked Bonds

Tokyu Fudosan Holdings (TSE:3289) just launched Climate and Nature Linked Bonds, Japan’s first sustainability linked issue aligned with ICMA guidelines, a financing move that ties its cost of capital directly to environmental performance.

See our latest analysis for Tokyu Fudosan Holdings.

The market seems to be rewarding this sustainability push, with a roughly 50 percent year to date share price return and a 5 year total shareholder return above 200 percent, suggesting momentum is still building rather than fading.

If you like the structural themes behind Tokyu Fudosan but want more ideas, it could be worth scanning fast growing stocks with high insider ownership for other under the radar compounders.

Yet with the share price already ahead of analyst targets and long term returns firmly in triple digits, investors now face a tougher call: is there still upside left, or is future growth already priced in?

Price-To-Earnings of 9.9x: Is it justified?

On a last close of ¥1451, Tokyu Fudosan looks inexpensive, with a 9.9x price to earnings ratio that screens as good value against the broader Japanese market and real estate peers.

The price to earnings multiple compares what investors are paying today to each unit of current earnings. This is a key lens for a mature, cash generative real estate group like Tokyu Fudosan.

At 9.9x earnings, the market is assigning a discount despite significantly improved profitability, including high quality earnings, faster recent profit growth, and margins that have stepped up versus last year. This suggests investors may still be underpricing the durability of these earnings.

The gap is even starker when stacked against the estimated fair price to earnings ratio of 15.2x, as well as the Japan real estate industry average of 11.5x and the wider market’s 14x. This implies meaningful room for the multiple to converge higher if current performance trends hold.

Explore the SWS fair ratio for Tokyu Fudosan Holdings

Result: Price-to-Earnings of 9.9x (UNDERVALUED)

However, risks remain, including modest single digit revenue and profit growth, plus shares already trading above consensus targets, limiting room for disappointment.

Find out about the key risks to this Tokyu Fudosan Holdings narrative.

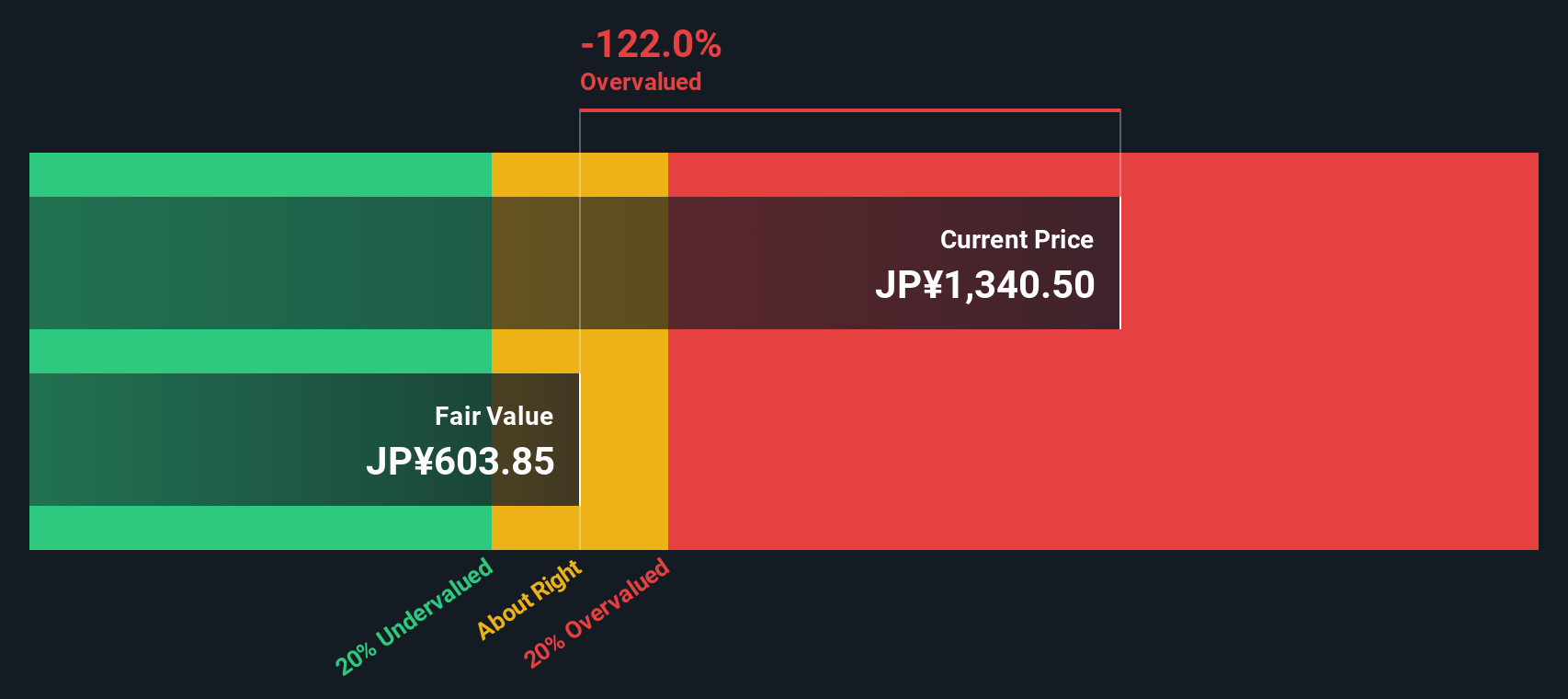

Another View: DCF Sends a Very Different Signal

While earnings multiples suggest Tokyu Fudosan looks cheap, our DCF model is far more cautious. It puts fair value around ¥610 per share, well below the current ¥1451 price and implying the stock may be meaningfully overvalued on long term cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyu Fudosan Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyu Fudosan Holdings Narrative

If you come to a different conclusion, or simply prefer to dig into the numbers yourself, you can build a full story in just a few minutes: Do it your way.

A great starting point for your Tokyu Fudosan Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with one opportunity, use the Simply Wall Street Screener to pinpoint stocks that match your strategy before the market fully catches on.

- Target generous income streams with these 15 dividend stocks with yields > 3% that combine attractive yields with the potential for capital growth.

- Capitalize on structural tech tailwinds by reviewing these 27 AI penny stocks shaping automation, data intelligence, and next generation platforms.

- Position yourself early in the next wave of digital finance by analysing these 81 cryptocurrency and blockchain stocks at the forefront of blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報