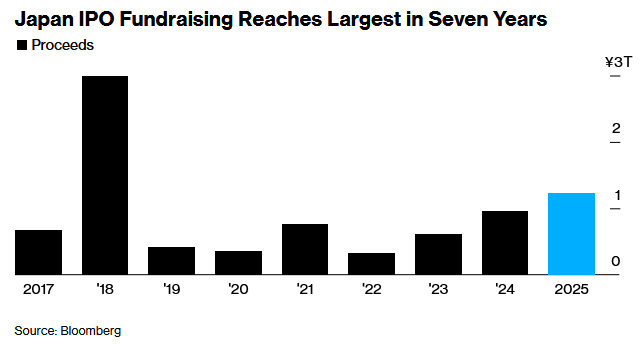

The Japanese IPO market ushered in the hottest year since 2018! The future is feared to be “headwinds” by the Bank of Japan's interest rate hike

The Zhitong Finance App learned that in 2025, the Japanese stock market's initial public offering (IPO) raised 1.2 trillion yen (about 7.7 billion US dollars) of capital, the highest level since 2018. Among them, the IPOs of companies such as JX Advanced Metals and SBI Shinsei Bank reached several billion dollars, and some IPOs, including the brand Human Made invested by Japanese star designer Nigo and Okinawan beer maker Orion Breweries, were oversubscribed by more than 60 times.

The impressive performance of the Japanese stock market IPOs in 2025 was due to the IPO boom that swept through Asia. In India, the scale of IPO financing in India reached a record high as companies rushed to monetize investors' demand for new shares. In Hong Kong, China, the scale of IPO financing is also expected to reach a new high since 2021.

Investor demand for Japanese stocks also appears to be strong. Japan's benchmark stock index, the Tokyo Stock Exchange Index, reached a new high this year, thanks to the end of decades of deflation in Japan and improvements in corporate governance promoted by the Japanese government and the Tokyo Stock Exchange.

The Bank of Japan's interest rate hike may put pressure on the IPO market

However, it is worth noting that in a context where the Bank of Japan is likely to raise interest rates this month and may raise interest rates further in the future, rising interest rates may present challenges to the IPO market.

A report last week indicated that people familiar with the matter revealed that the Bank of Japan is preparing to raise interest rates at a policy meeting later this month, provided that there are no major shocks to the economy or financial markets during this period. People familiar with the matter said that the Bank of Japan will also say that if its economic outlook is realized, it will continue to raise interest rates, while remaining cautious about the extent to which it will eventually push interest rates.

The market's focus is on how the Bank of Japan will actively hint at further interest rate hikes. People familiar with the matter said that as the impact of US tariffs becomes more clear, and corporate profits continue to be high, providing room for companies to raise wages, Bank of Japan officials assessed that the possibility that their economic outlook will be realized has increased.

Bank of Japan Governor Kazuo Ueda recently sent a more clear guidance signal on neutral interest rate estimates than before. Currently, the Bank of Japan assesses the nominal neutral interest rate to be in a broad range of 1% to 2.5%. Since the market is almost completely priced, the Bank of Japan will raise the policy interest rate from 0.5% to 0.75% in December, some market participants speculate based on this that the Bank of Japan may raise the neutral interest rate estimate to release a signal that there is still room to continue to raise interest rates in the future.

Despite such expectations in the market, many former Bank of Japan officials believe that it is unlikely that the central bank will announce clear figures on neutral interest rates. Former Bank of Japan chief economist Kameda Seisaku said that under the high level of uncertainty, the Bank of Japan is more inclined to preserve policy flexibility through “constructive vague” methods rather than give specific figures that may restrict itself. He expects that at most, Kazuo Ueda will indicate the general position of the neutral interest rate within a broad range.

Meanwhile, some market participants believe that the Bank of Japan needs to maintain hawkish guidance and promise to raise interest rates further after raising interest rates to 0.75% to avoid triggering a new round of depreciation of the yen. As inflation continues to be above target, wages are expected to grow steadily again, and the yen continues to weaken, the Bank of Japan is indeed likely to raise interest rates further in the future. This will mean an increase in the overall interest rate environment, which will directly affect the borrowing costs of companies planning an IPO. For small and medium-sized enterprises that rely on loans to expand and have tight cash flow (these are one of the main forces in IPOs), rising financing costs may cause them to reevaluate the timing of IPOs or even delay IPOs.

Furthermore, higher interest rates will attract some capital from high-risk assets (such as stocks) to risk-free or low-risk assets (such as treasury bonds), which may tighten the overall liquidity margin of the Japanese stock market. More importantly, since stock valuations (especially growth stocks) depend on future cash flow discounting, rising discount rates due to interest rate hikes will suppress stock valuations and will undoubtedly have an impact on companies planning IPOs — especially those that are not yet profitable and rely on high growth narratives. The tightening of stock market liquidity and pressure on valuations may dampen companies' desire to IPO.

However, in the early stages of a major shift in monetary policy, the market usually takes time to digest, and uncertainty increases, which may increase stock market volatility. In a volatile market, it is difficult for issuers and underwriters to determine an optimal issue price that can both attract investors and meet financing goals. When market sentiment weakens, IPOs may face insufficient subscriptions and increased risk of breakouts after listing, which will damage the confidence of subsequent issuers.

However, some analysts believe that in the medium to long term, the impact of interest rate hikes on the IPO market may be positive. If the Bank of Japan's further interest rate hikes are based on a virtuous cycle of “continuous and steady rise in prices” and “wage growth,” that is, the Japanese economy has finally escaped the shadow of deflation that has continued for decades, it will be a fundamental benefit. This establishes a more normal and healthy foundation for the Japanese stock market, and also provides long-term support for the stock market and the IPO market. Furthermore, if interest rate hikes help stabilize the yen and even strengthen the yen, it will enhance international investors' confidence in holding Japanese assets and increase international investors' interest in participating in the Japanese IPO market.

Nasdaq

Nasdaq 華爾街日報

華爾街日報