Cui Dongshu: In November, passenger car manufacturers' production, exports, and wholesale all hit record highs in the same month, exports hit record highs in previous months

The Zhitong Finance App learned that Cui Dongshu released an analysis of the operating characteristics of the national passenger car market in November 2025. Characteristics of the passenger car market in November 2025: In November, the production, export, and wholesale of passenger car manufacturers all hit record highs in the same month, and exports hit record highs in each month of the year; the independent brands of the six major state-owned groups, including Dongfeng, SAIC, FAW, BAIC, Chery, and Changan, increased by a total of 3% year-on-year in November. Among them, major groups such as Jihu, Rantu, and Deep Blue created strong growth in the second generation; this year, new cars were launched in batches, and “anti-internal roll” efforts promoted disorderly price reductions. The new energy promotion remained at 10% in November, and the overall trend was stable.

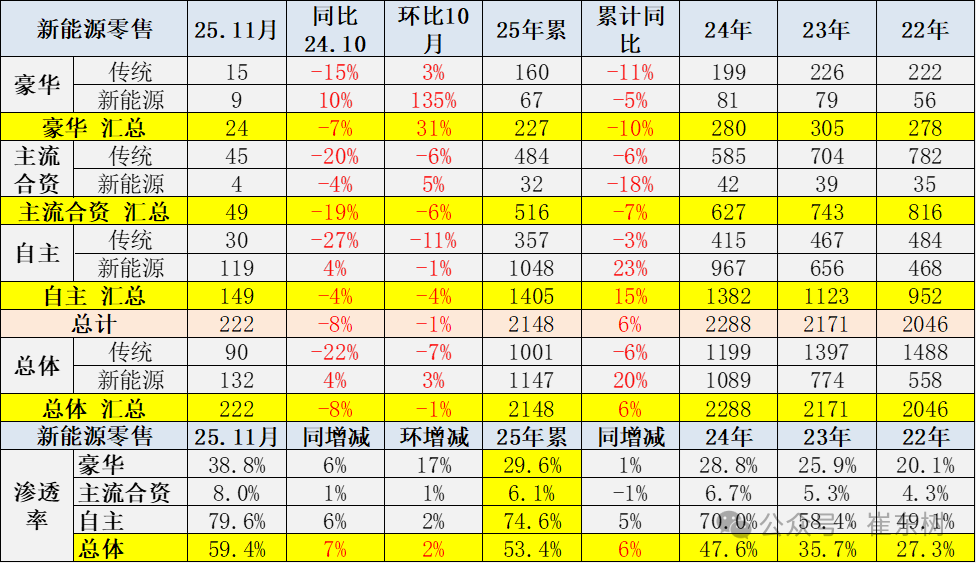

In addition, domestic retail sales of fuel vehicles fell 22% year on year in November; retail sales in the pure electric market increased 10% year on year, growth range fell 2% year on year, and hybrid mix fell 4% year on year. The structural share of pure electric and extended range among new forces changed from 57%: 43% in November last year to 73%: 27%; in November, the domestic retail penetration rate of new energy vehicles was 59.4%, showing steady growth in new energy against the backdrop of inclusive policies such as scrapping, replacement and renewal combined with new energy exemptions from purchase tax; from January to November 2025, autonomous fuel passenger vehicle exports fell 2.61 million, and autonomous new energy exports declined 1.78 million increased by 139%, and new energy sources accounted for 40.6% of independent exports; retail sales of Korean and French brands increased 13% and 6% year over year, becoming a highlight of growth.

In November, the national passenger car market retailed 2.22 million vehicles, down 8% year on year and 1% month on month. A total of 21.48 million vehicles have been sold since this year, an increase of 6% over the previous year. This year, the cumulative retail growth rate in the domestic car market increased by 1.2% from January-February, 15% in March-June, hovered around 6% in July-September, and fell back to a low state in October-November, showing the characteristics of a high base deceleration in the fourth quarter, which is basically in line with the “low before, medium, high, and back flat” trend judged at the beginning of the year.

Due to rapid growth in the early stages of this year, the goal of policy subsidies themselves is to stabilize the overall growth rate, so the phenomenon of steady growth at the end of the year is a reasonable trend. The high base figure for November last year, and the slight negative growth in November of this year ironed out last year's high growth. Compared with November 2022, it is still 5%, so the overall trend is still relatively normal. An important policy to regulate the growth rate this year is trade-in subsidies. As of October 22, 2025, the number of automobile trade-in subsidy applications exceeded 10 million vehicles, and the number of applications in the previous 11 months had reached 11.2 million vehicles. With the large-scale suspension of subsidies in various regions, the average daily subsidy scale was reduced to 30,000 vehicles in November, and the effect of adjusting the growth rate was obvious.

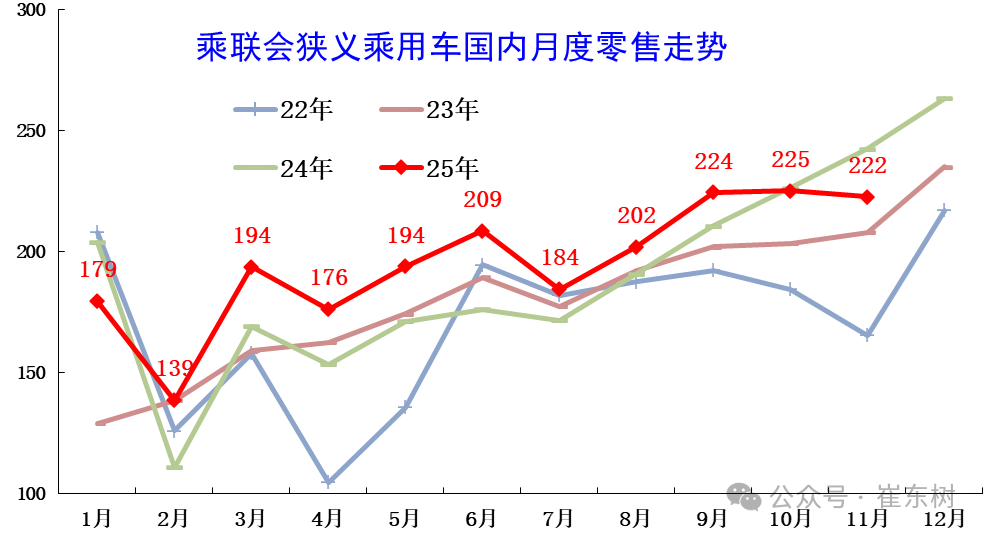

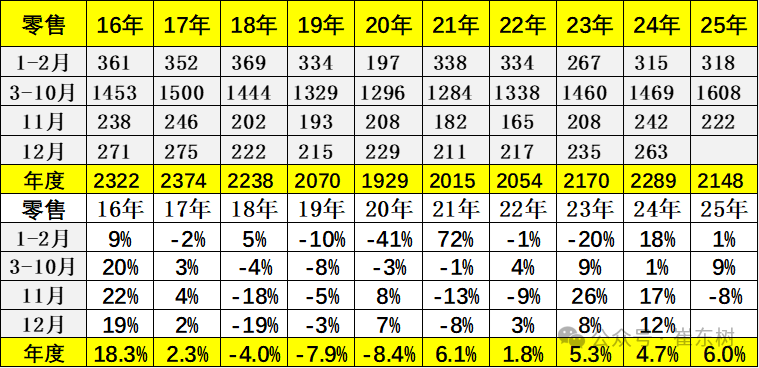

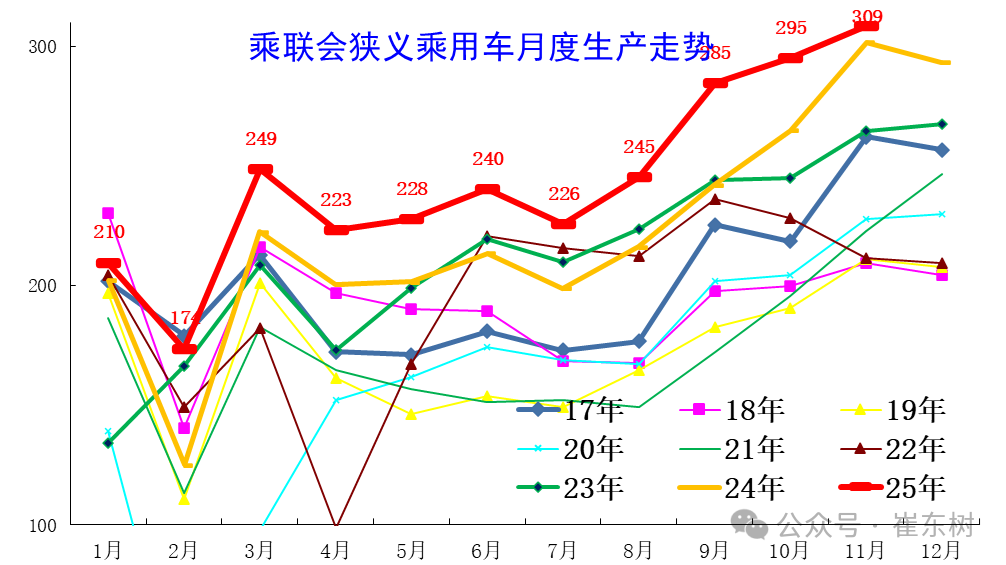

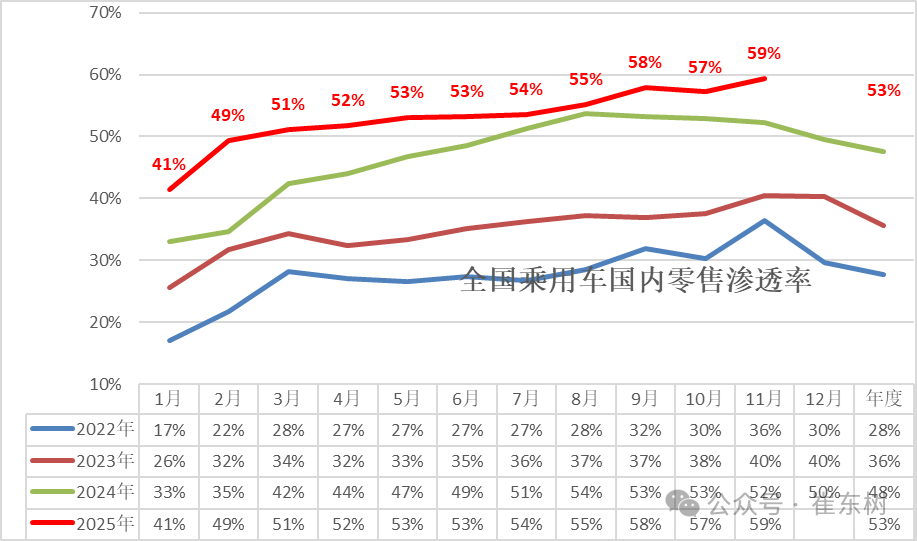

1. Passenger car retail trends in the narrow sense of the word in recent years

Domestic retail sales of passenger cars were low and high in 2024, and continued to rise in July-December. Early low to medium high characteristics of the car market in 2025. In January, due to weak factors such as before the Spring Festival, the cumulative retail growth rate of the domestic car market continued to rise from negative 12% in January to 11% in January-June. July-November showed a gradual deceleration characteristic of a high base, and the market emerged from a “low to medium high back flat” trend. Retail sales grew steadily year-on-year in July-September of this year, and underperformed in October-November under a high base.

In November, the national passenger car market retailed 2.22 million vehicles, down 8% year on year and 1% month on month. A total of 21.48 million vehicles have been sold since this year, an increase of 6% over the previous year. This year, the cumulative retail growth rate in the domestic car market increased by 1.2% from January-February, 15% in March-June, hovered around 6% in July-September, and fell back to a low state in October-November, showing the characteristics of a high base deceleration in the fourth quarter, which is basically in line with the “low before, medium, high, and back flat” trend judged at the beginning of the year.

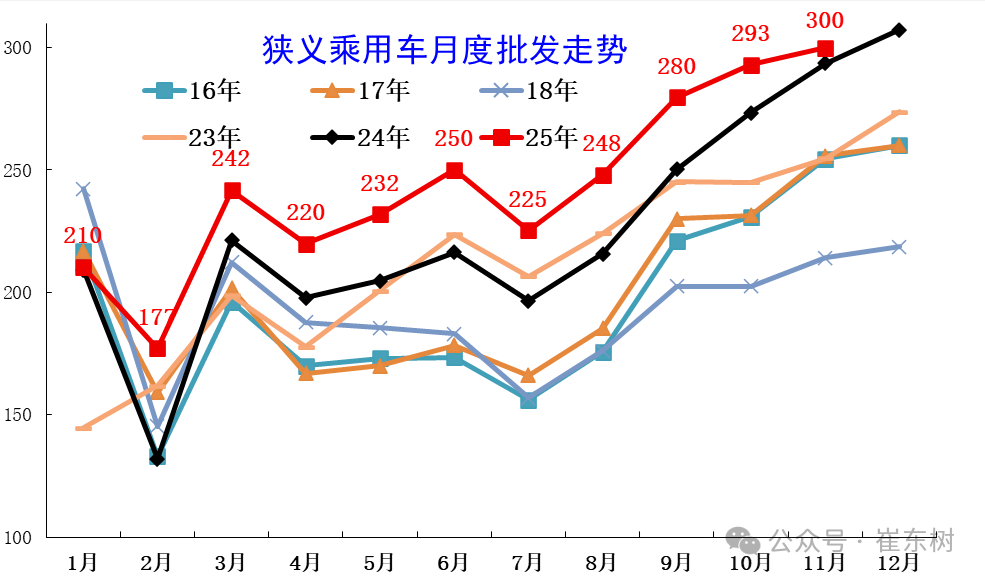

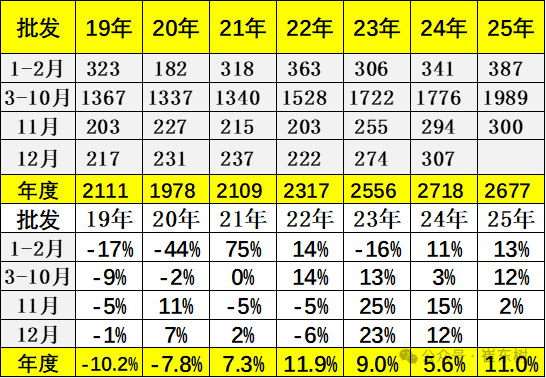

2. Passenger car wholesale trends in the narrow sense of the word in recent years

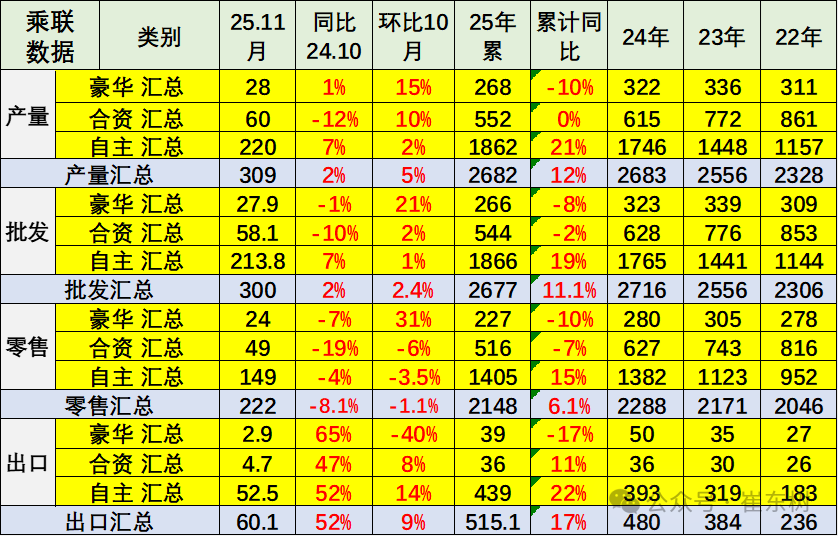

Passenger car manufacturers across the country wholesale 3 million vehicles in November, hitting a record high in the same month. Relying on increased inventory and exports, sales continued to rise sharply at the end of the year.

In November, the country's passenger car manufacturers sold 3 million vehicles, a record high for that month, up 2% year on year, up 2% month on month; from January to November, passenger car manufacturers sold 26.77 million units, up 11% year on year. Affected by retail adjustments, the year-on-year growth rate of passenger car wholesale in November was 10 percentage points higher than the retail growth rate.

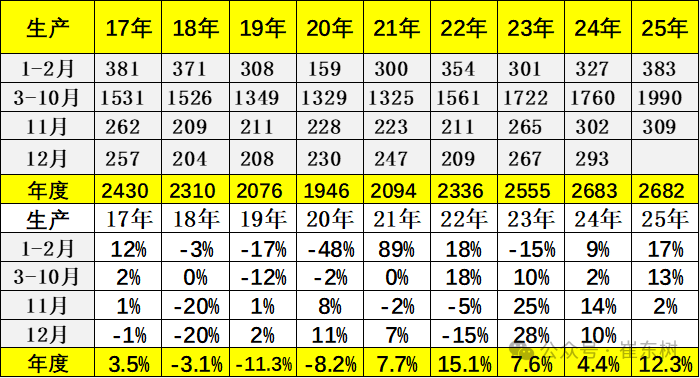

3. Passenger car production trends in the narrow sense of the word in recent years

Passenger car production continued to rise in November, and market demand was unable to keep up with the increase in production. Passenger car production in November was 3.09 million units, 70,000 units higher than the historical high of 3.02 million units in November 2024. The production trend is stable.

Passenger car production was 3.09 million units in November, up 2% year on year and 5% month on month. Passenger car production in January-November was 26.82 million units, a cumulative year-on-year increase of 12%.

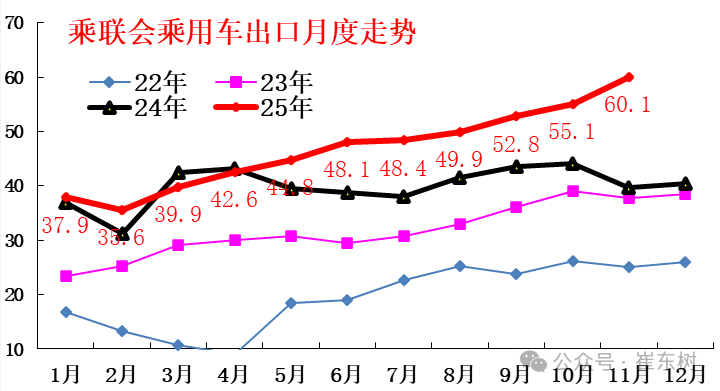

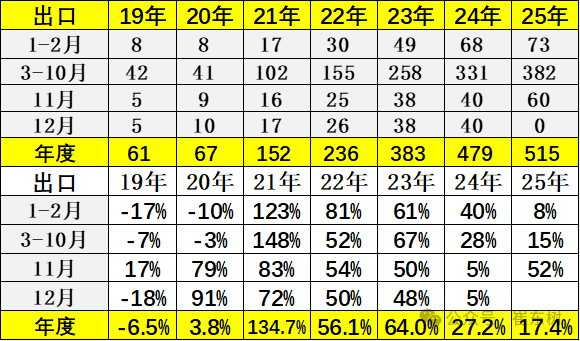

4. Passenger car export trends in the narrow sense of the word in recent years

According to China Transport Link data, the export growth trend was good in 2025, and the continuous upward trend is obvious. In November, 600,000 passenger cars (including complete vehicles and CKD) were exported.

According to Passenger Link data, passenger car exports (including complete vehicles and CKD) were 600,000 units in November, up 52% year on year, up 9% month on month; from January to November, passenger car manufacturers exported 5.15 million units, up 17% year on year.

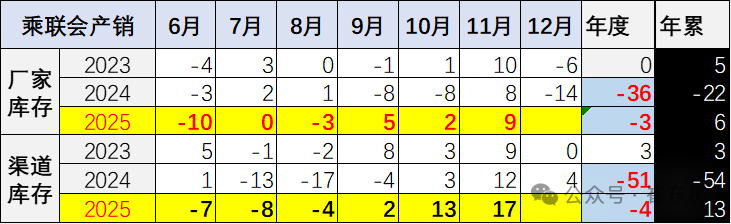

5. Characteristics of monthly changes in production and sales inventory

Due to poor retail sales by manufacturers in November, manufacturers' wholesale sales were lower than 90,000 units, while monthly domestic sales of manufacturers were higher than retail sales of 170,000 units. The overall inventory of passenger car manufacturers increased by 260,000 units in November (up 200,000 units in the same period last year). In November of this year, car companies passively added inventory. Last year was a retail-driven decline in inventory. The overall inventory of the industry increased by 190,000 units from January to November of this year (down 760,000 units from January to November last year, 80,000 in 2023, and 810,000 units in 2022).

6. Passenger car promotion trends in the narrow sense

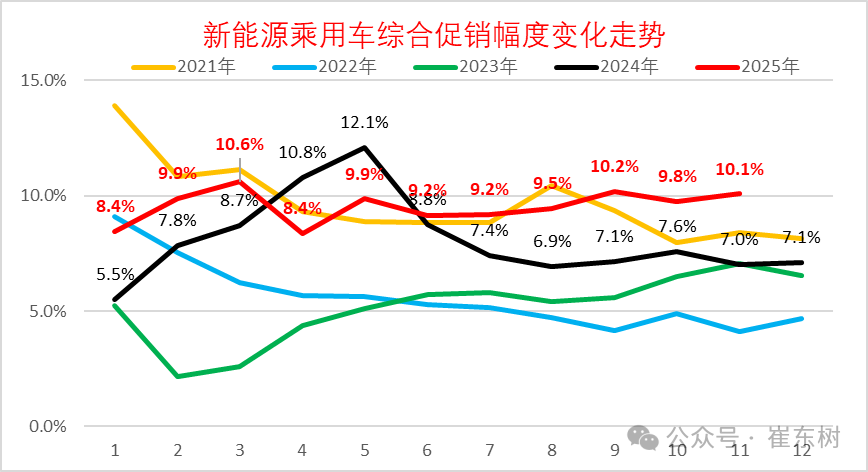

A. Promotion of new energy vehicles increased slightly

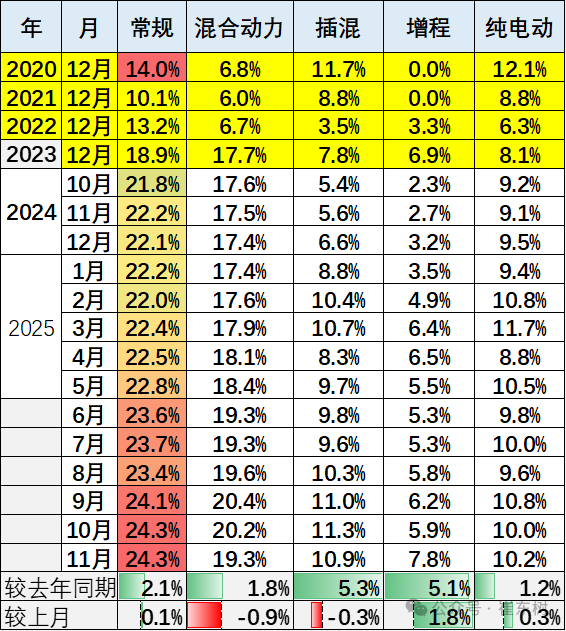

The promotion of new energy vehicles in November 2025 rose back to a medium high of 10.1%, an increase of 3.1 points over the same period, and a slight increase of 0.3 percentage points over the previous month. Promotions have been stable in recent months. With the moderation of price cuts, the promotion system has also been recycled, and it has now reached the medium to high level of normal promotion.

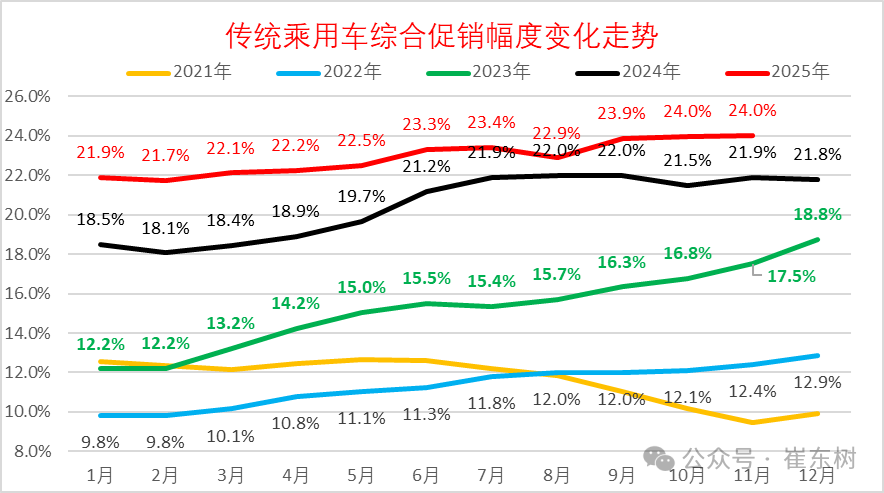

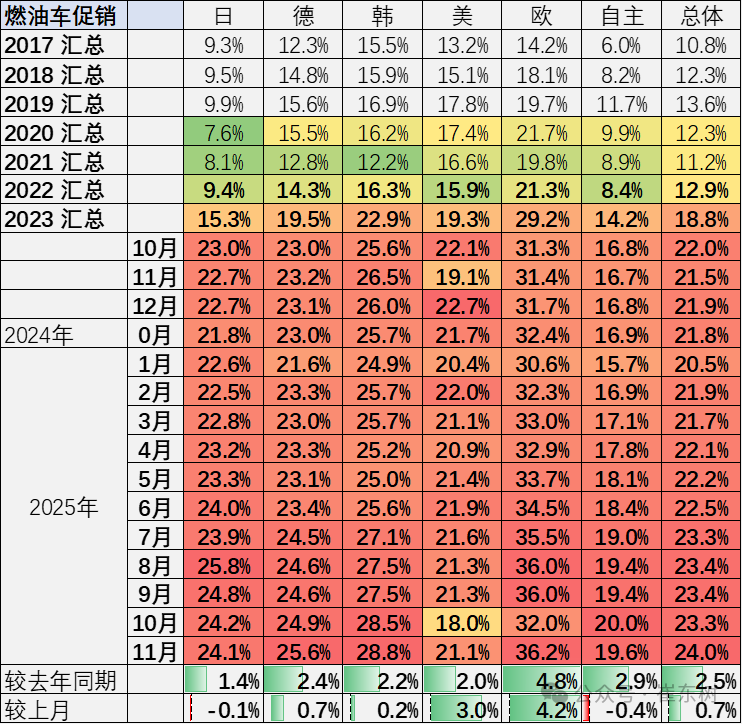

B. Fuel vehicle promotion trends

In November 2025, sales of traditional fuel vehicles stabilized at 24%, the same level as the previous month, an increase of 2.1 percentage points over the same period, and sales of fuel vehicles stabilized at around 24% for 2 consecutive months. The promotion of traditional fuel vehicles hovered at a recent high level of 22% from July to December 2024. The national subsidy policy promoted a steady trend in the fuel vehicle industry in 2025, but car company promotions began in September.

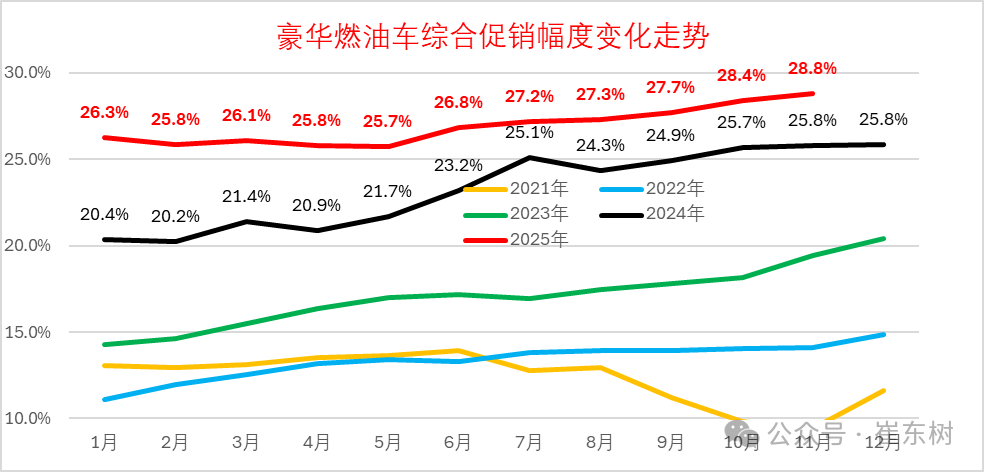

C. Luxury car promotion trends

In November 2025, luxury car promotions gradually reached a high of 28.8%, an increase of 0.4 points over the previous month and an increase of 3 percentage points over the same period. Although consumption upgrades drive strong demand for high-end cars, luxury car promotions have been relatively stable since July 2024. There was a slight increase after September 2025.

D. Mainstream joint venture vehicle promotion trends

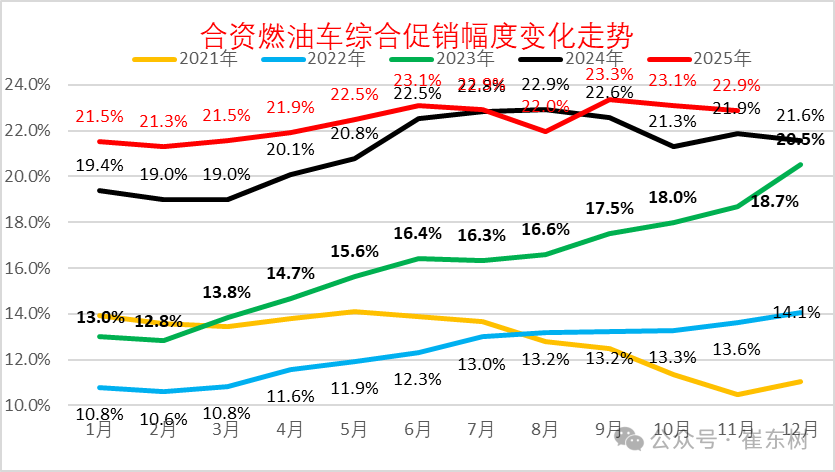

In November 2025, the promotion of joint venture fuel vehicles gradually reached a low of 22.9%, down 0.2 points from the previous month and 1 percentage point higher than the same period. Joint venture promotions have been stable recently.

The promotion of joint venture fuel vehicles rebounded from a low of 13% in 2023 to a peak of 23.3% in September 2025. With strong price cuts for new cars, there has been a slight decline in the past two months, and the promotion intensity has increased relatively steadily.

E. Autonomous fuel vehicle promotion trend

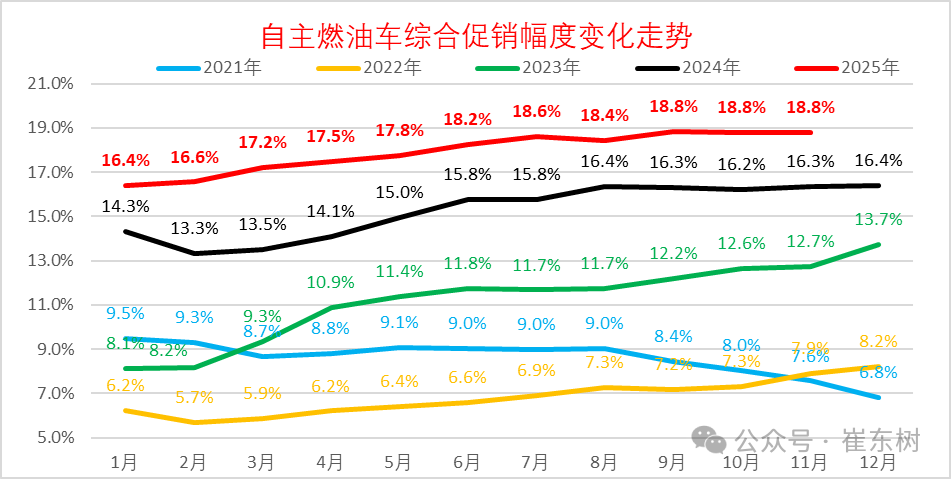

In November 2025, the promotion of autonomous fuel vehicles gradually reached a high level of 18.8%, an increase of 2.5 percentage points over the same period. Autonomous car companies' promotions increased rapidly from March to November 2024, then generally stabilized in September-December.

Due to strong autonomous new energy, the promotion of autonomous fuel vehicles gradually increased in 2025. The November promotion rose to 18.8%, which is generally stable.

F. Tracking the intensity of promotion by motivation

At the beginning of 2025, the promotion pressure for conventional fuel vehicles and hybrids was low, while the promotion of new energy was relatively intense. The November promotion for pure electric vehicles was basically the same as in October. Plug-in hybrid promotions fluctuated a lot this year, with sales up 5.3 points year on year in November, down 0.3 percentage points from month to month; pure electric promotions overall increased by about 1.2 points compared to November 2024, and remained basically flat compared to the previous month; overall promotions for extended-range models increased by about 5.1 points compared to November 2024.

Car market promotions were relatively stable in November, and dealers also promoted steadily to ensure profits. Currently, European promotions are quite large. Other joint venture car companies' promotions are basically around 25%, which is not much of a difference. Autonomous car companies became the least promoted.

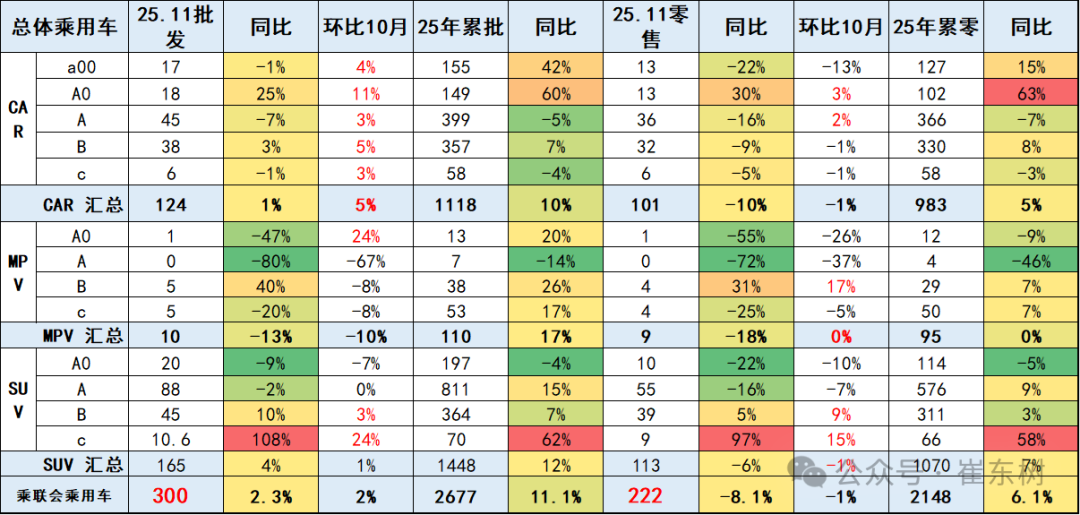

7. Growth characteristics of passenger cars in the narrow sense of the word

Passenger car retail sales fell 8% in November 2025, significantly lower than the 2% increase in wholesale sales. Due to high interest rate restrictions and the suspension of subsidies, retail sales of A-class cars and MPVs were lower in November. A0 class cars and C-class SUVs became the main retail force in November. The high-end performance of SUVs was strong. Among sedans, sales of A0 class cars mainly rebounded, and sales of A00 class cars performed well.

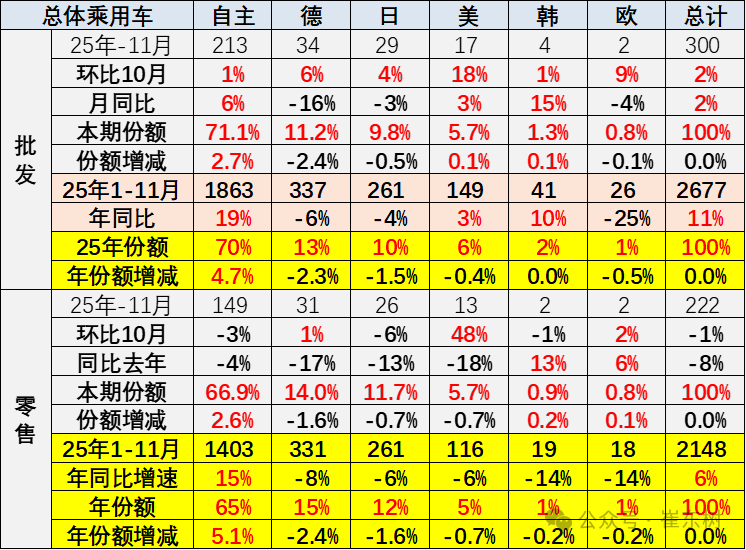

8. Growth characteristics of passenger cars by country in the narrow sense

Mainstream joint venture brands retailed 490,000 vehicles in November, down 19% year on year and 6% month on month. In November, the retail share of German brands was 14.0%, down 1.6 percentage points from the previous year; the retail share of Japanese brands was 11.7%, down 0.7 percentage points from the previous year; the retail share of the American brand market was 5.7%, down 0.7 percentage points from the previous year; the retail share of the Korean brand market was 0.9%, up 0.2 percentage points from the previous year; and the retail share of French brands increased 0.1%.

9. Characteristics of brand production and marketing in 2025

The original brand value system has changed, and the pressure on luxury brands has continued to increase recently. The production and sales trend pressure of joint ventures continues to be strong, and the advantages of the independent brand industry chain are obvious. Industry differentiation improved slightly in November, and the trend of the fuel vehicle market was weak month-on-month, putting pressure on the joint venture brand trend. In November, retail sales of 240,000 luxury cars were recorded, down 7% year on year and up 31% month on month. The retail share of luxury brands was 11% in November, an increase of 0.2 percentage points over the previous year. The traditional luxury car market is under greater pressure than joint ventures.

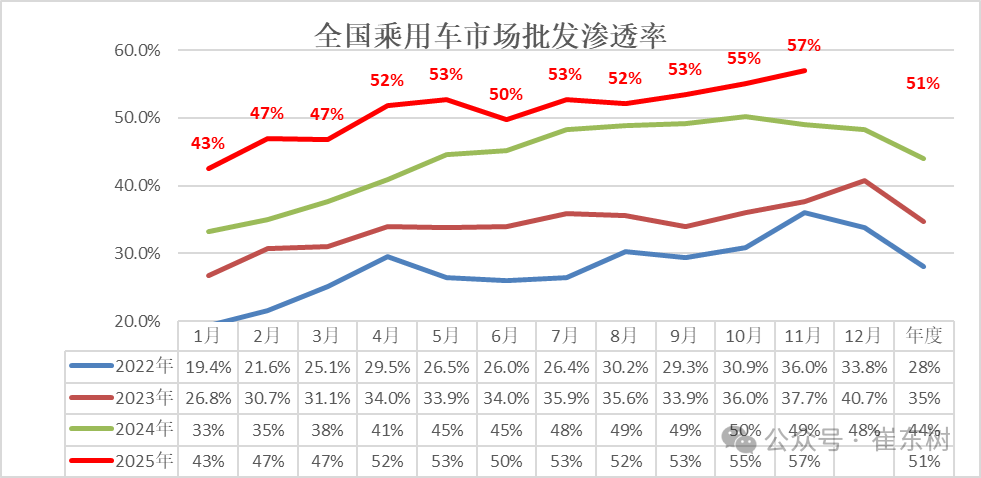

10. National New Energy Permeability Rate - Wholesale

In November, the wholesale penetration rate of NEV manufacturers was 56.9%, up 7.9 percentage points from November 2024.

In November, the penetration rate of own-brand NEVs was 72.2%; the penetration rate of NEVs among luxury cars was 42.8%; while the penetration rate of NEVs of mainstream joint venture brands was only 7.5%.

In November, wholesale sales of traditional car manufacturers fell 14% year on year, while retail sales of new energy vehicles rose 19% year on year, with a growth gap of 33 points. The fuel vehicle market has improved slightly, and exports of new energy sources have contributed greatly.

11. National New Energy Penetration Rate - Retail

In November, the overall retail sales penetration rate of new energy vehicles in China was 59%, an increase of 7 percentage points over the same period last year. The subsidy effect of the trade-in policy is relatively good, and fuel vehicles can also receive certain subsidies, so consumers are more enthusiastic about buying new energy vehicles, but regional subsidies were suspended in November, and car market growth declined relatively.

In domestic retail sales in November, the penetration rate of new energy vehicles among independent brands was 79.6%; the penetration rate of new energy vehicles among luxury cars was 38.8%; while the penetration rate of new energy vehicles in mainstream joint venture brands was only 8%.

In November, retail sales of traditional vehicles fell 22% year on year, while retail sales of new energy vehicles rose 4% year on year. The difference was 26 points. The fuel vehicle tax burden was high, and the pressure was high.

Nasdaq

Nasdaq 華爾街日報

華爾街日報