Undiscovered European Gems with Strong Potential December 2025

As the European market navigates mixed returns with the STOXX Europe 600 Index edging higher on hopes of interest rate cuts, investors are closely watching economic indicators such as inflation and GDP revisions, which reveal a resilient yet cautious environment. In this context, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities amidst evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Equita Group (BIT:EQUI)

Simply Wall St Value Rating: ★★★★☆☆

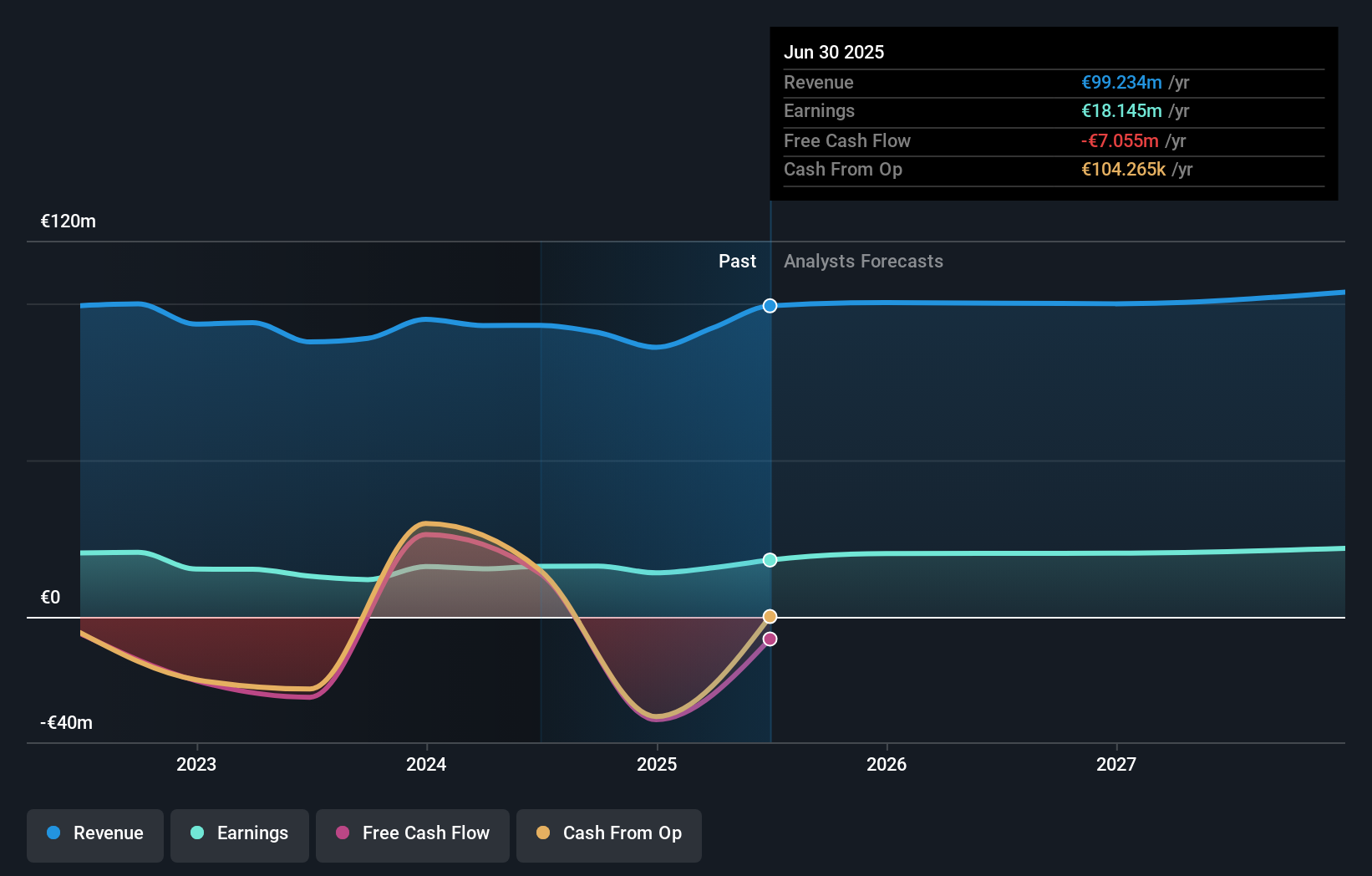

Overview: Equita Group S.p.A. offers sales and trading, investment banking, and alternative asset management services to investors, financial institutions, corporates, and entrepreneurs both in Italy and internationally, with a market cap of €298.33 million.

Operations: Equita Group generates revenue primarily from its Global Markets (€56.43 million), Investment Banking (€39.68 million), and Alternative Asset Management (€10.31 million) segments. The company's net profit margin is a key financial metric to consider when evaluating its profitability and operational efficiency.

Equita Group, a financial entity with a knack for outperforming its peers, saw earnings surge by 40.8% last year, outpacing the Capital Markets industry's 21.6%. With net income climbing to €18.68 million for the nine months ending September 2025 from €9.88 million the previous year, it showcases robust growth potential. Its price-to-earnings ratio of 13.1x is attractive compared to Italy's market average of 16.4x, suggesting good value prospects. The company has reduced its debt-to-equity ratio significantly over five years and carries more cash than total debt, highlighting financial prudence amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of Equita Group.

Assess Equita Group's past performance with our detailed historical performance reports.

Miquel y Costas & Miquel (BME:MCM)

Simply Wall St Value Rating: ★★★★★★

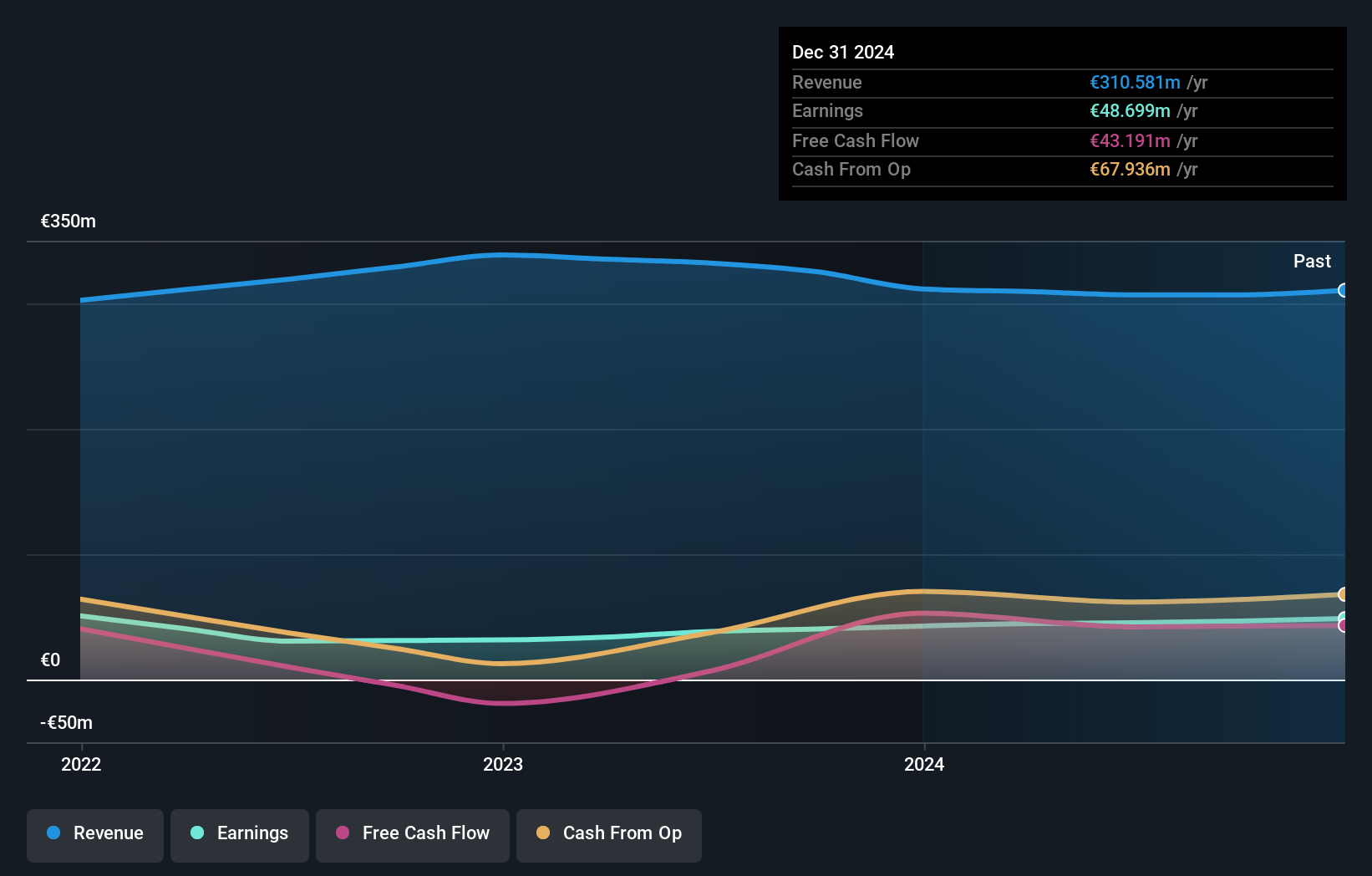

Overview: Miquel y Costas & Miquel, S.A. specializes in producing and distributing thin and special lightweight paper primarily for the tobacco industry across Spain, the European Union, OECD countries, and globally, with a market capitalization of €544.87 million.

Operations: The company's primary revenue stream is from the tobacco industry, generating €252.19 million, followed by industrial products with €97.67 million in revenue.

Miquel y Costas & Miquel, a nimble player in the European market, showcases a robust financial profile with a price-to-earnings ratio of 11.8x, which is more attractive than the broader Spanish market average of 16.9x. While earnings have seen a slight dip of 1.1% annually over five years, recent performance highlights an annual growth of 2.2%, outpacing its industry peers significantly. The net debt to equity ratio stands at a healthy 5.9%, reflecting prudent financial management over time as it decreased from 25.2% to just 13%. Their high-quality earnings and positive free cash flow further underscore their solid footing in the sector despite some challenges in net income and EPS compared to last year’s figures (€24.36 million vs €26.82 million).

Multiconsult (OB:MULTI)

Simply Wall St Value Rating: ★★★★☆☆

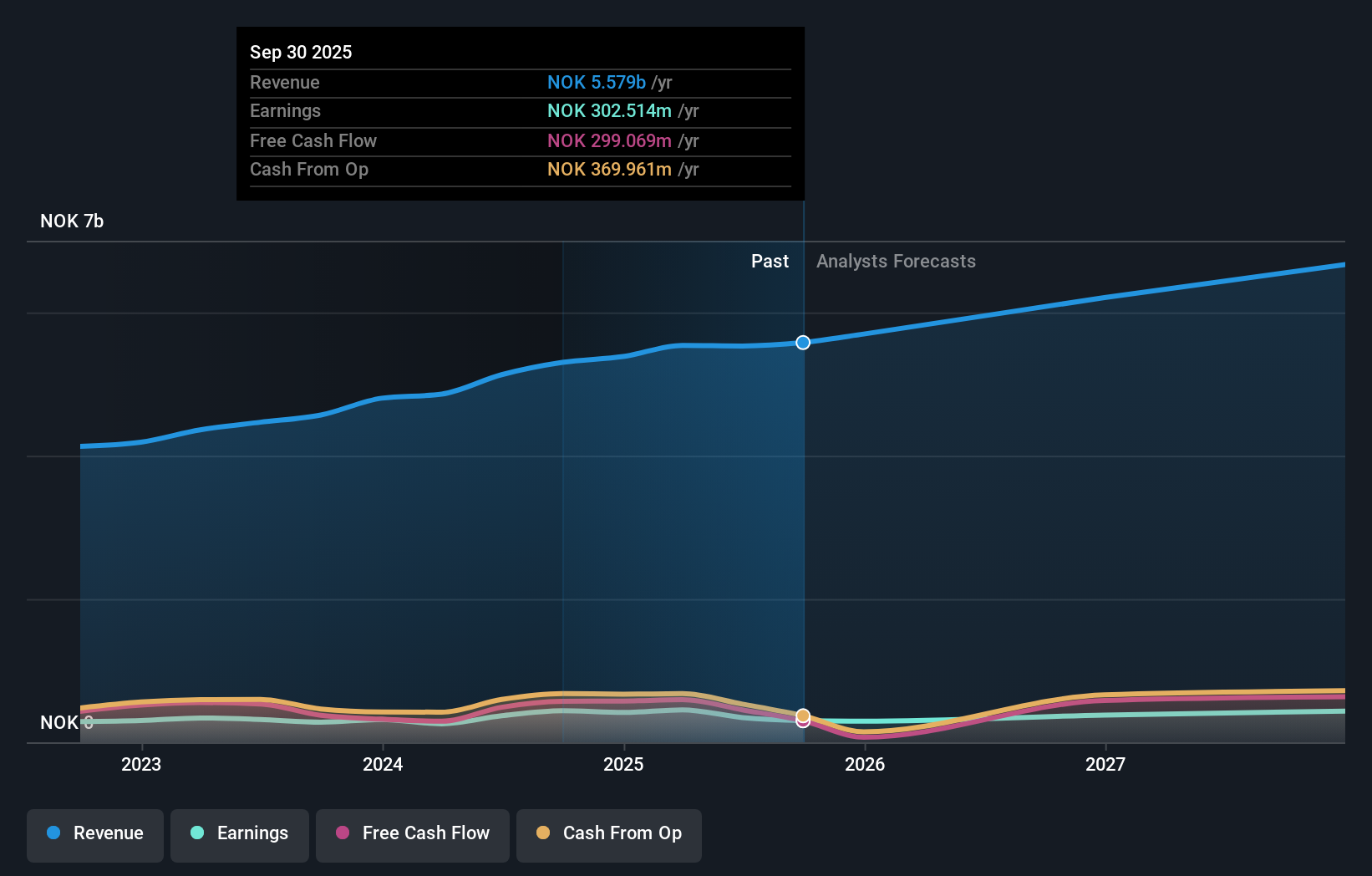

Overview: Multiconsult ASA is a company that provides engineering design, consultancy, and architecture services across Norway, Sweden, Denmark, Poland, and internationally with a market capitalization of NOK4.44 billion.

Operations: Multiconsult generates revenue primarily from its Region Norway and Region Oslo segments, contributing NOK2.30 billion and NOK2.05 billion, respectively. The Architecture segment adds another NOK788.06 million, while the International segment accounts for NOK429.80 million in revenue.

With a debt to equity ratio climbing from 0% to 73.6% over five years, Multiconsult's financial position seems stretched, yet its high-quality earnings and EBIT covering interest payments 5.2 times suggest resilience. Despite negative earnings growth of -31.2%, the company is trading at a significant discount of 63.4% below estimated fair value, hinting at potential upside if forecasts of an 18.11% annual earnings growth materialize. Recent share buybacks totaling NOK 179.63 million underscore management's confidence in its undervaluation, even as net profit margins slipped from last year's 8.3% to the current 5.4%.

Summing It All Up

- Reveal the 312 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報