The Bull Case For Eaton (ETN) Could Change Following Boyd Thermal Deal And AI Data Center Push - Learn Why

- Eaton Corporation recently reported a strong third quarter of 2025, highlighting record segment margins, robust demand in data centers, AI infrastructure, and electrification projects, and completion of the US$9.50 billion Boyd Thermal acquisition to expand its integrated AI power and liquid cooling solutions for hyperscale data centers.

- The company also raised its full-year adjusted EPS guidance to US$12.07, underscoring how higher-margin electrification and data center exposure are increasingly shaping Eaton’s earnings profile.

- We’ll now examine how the Boyd Thermal acquisition and Eaton’s stronger data center positioning could influence the company’s existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Eaton Investment Narrative Recap

To own Eaton, you need to believe that data center and electrification demand can offset pressure in weaker Vehicle and eMobility markets, while heavy investment and M&A eventually pay off in higher margins and cash flow. The Boyd Thermal deal reinforces the near term data center catalyst by broadening Eaton’s AI power and cooling offering, but it also adds integration risk and increases the company’s reliance on a data center cycle that could prove uneven.

The Boyd Thermal acquisition, completed for US$9.50 billion, ties directly into Eaton’s push to deepen its role in AI heavy, hyperscale data centers by pairing liquid cooling with its existing power distribution strengths. That fits neatly with management’s raised full year adjusted EPS guidance of US$12.07, but it also concentrates more of Eaton’s near term story on data center project timing and the company’s ability to absorb significant new capacity without prolonged margin drag.

Yet behind Eaton’s data center momentum, investors should be aware of how dependent near term growth now looks on AI driven mega projects and what happens if that demand...

Read the full narrative on Eaton (it's free!)

Eaton’s narrative projects $33.7 billion revenue and $5.8 billion earnings by 2028. This requires 9.0% yearly revenue growth and roughly a $1.9 billion earnings increase from $3.9 billion today.

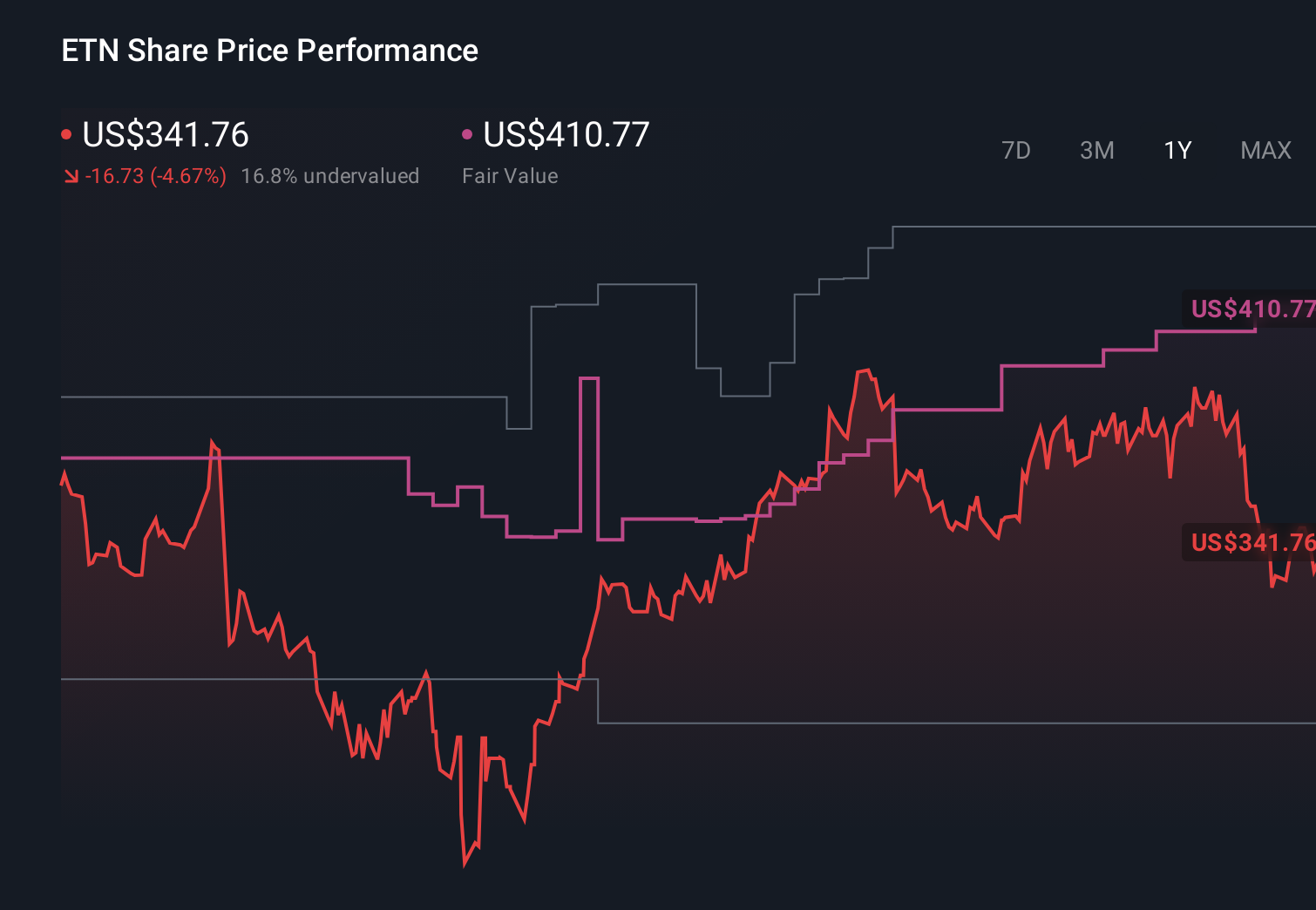

Uncover how Eaton's forecasts yield a $410.77 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span roughly US$151 to US$412 per share, underlining how far apart individual views can be. Against that spread, Eaton’s increasing dependence on AI led data center demand puts a lot of faith in one growth engine, so it is worth comparing several of these perspectives before forming your own view.

Explore 7 other fair value estimates on Eaton - why the stock might be worth as much as 20% more than the current price!

Build Your Own Eaton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eaton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eaton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eaton's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報