HORNBACH Holding KGaA (ETR:HBH) Takes On Some Risk With Its Use Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, HORNBACH Holding AG & Co. KGaA (ETR:HBH) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is HORNBACH Holding KGaA's Net Debt?

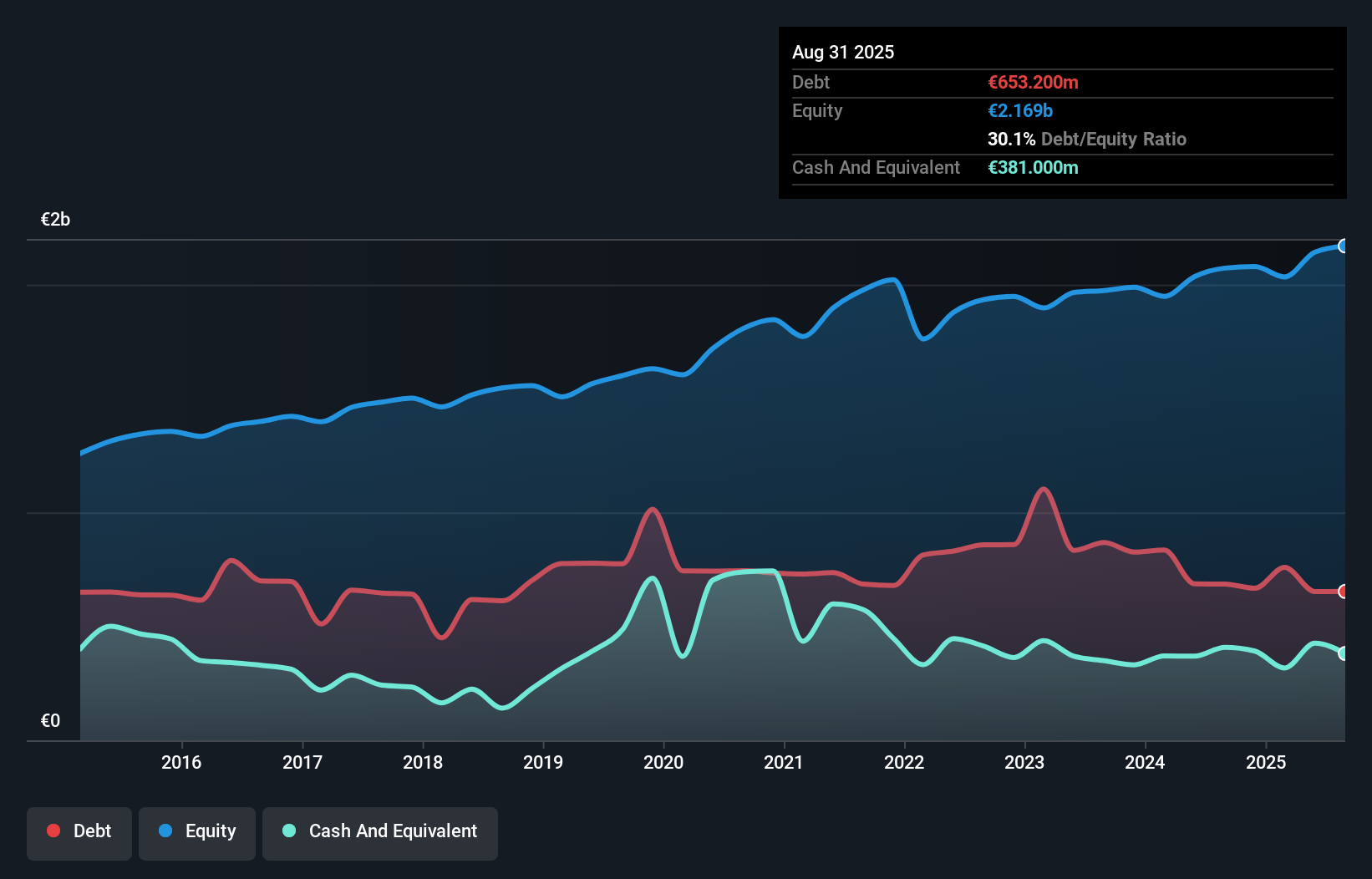

As you can see below, HORNBACH Holding KGaA had €653.2m of debt at August 2025, down from €685.5m a year prior. However, it does have €381.0m in cash offsetting this, leading to net debt of about €272.2m.

How Healthy Is HORNBACH Holding KGaA's Balance Sheet?

According to the last reported balance sheet, HORNBACH Holding KGaA had liabilities of €1.09b due within 12 months, and liabilities of €1.37b due beyond 12 months. On the other hand, it had cash of €381.0m and €90.6m worth of receivables due within a year. So it has liabilities totalling €1.98b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the €1.31b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, HORNBACH Holding KGaA would likely require a major re-capitalisation if it had to pay its creditors today.

See our latest analysis for HORNBACH Holding KGaA

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 0.70 and interest cover of 5.7 times, it seems to us that HORNBACH Holding KGaA is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Unfortunately, HORNBACH Holding KGaA's EBIT flopped 13% over the last four quarters. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if HORNBACH Holding KGaA can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, HORNBACH Holding KGaA recorded free cash flow worth a fulsome 82% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Mulling over HORNBACH Holding KGaA's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that HORNBACH Holding KGaA's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of HORNBACH Holding KGaA's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報