Asian Growth Stocks With Insider Ownership And Up To 28% Revenue Growth

As global markets remain attentive to interest rate decisions and economic indicators, Asia's stock markets are capturing attention with their own unique dynamics. In this environment, growth companies with substantial insider ownership can offer intriguing investment opportunities, especially those demonstrating robust revenue growth of up to 28%.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| Knowmerce (KOSDAQ:A473980) | 30% | 33.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

We're going to check out a few of the best picks from our screener tool.

UCAP Cloud Information TechnologyLtd (SHSE:688228)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: UCAP Cloud Information Technology Co., Ltd. operates in the cloud computing sector, providing technology solutions, with a market cap of CN¥12.92 billion.

Operations: UCAP Cloud Information Technology Co., Ltd. generates its revenue from various segments, although specific segment details are not provided in the available text.

Insider Ownership: 31.3%

Revenue Growth Forecast: 28.5% p.a.

UCAP Cloud Information Technology Ltd. shows strong revenue growth potential, with forecasts indicating a 28.5% annual increase, outpacing the broader CN market. Despite a volatile share price and low future return on equity projections, its earnings are expected to grow significantly at 22.52% per year over the next three years. Recent financial results highlight improved performance with reduced net losses compared to last year, although insider trading activity remains unclear over recent months.

- Delve into the full analysis future growth report here for a deeper understanding of UCAP Cloud Information TechnologyLtd.

- Insights from our recent valuation report point to the potential overvaluation of UCAP Cloud Information TechnologyLtd shares in the market.

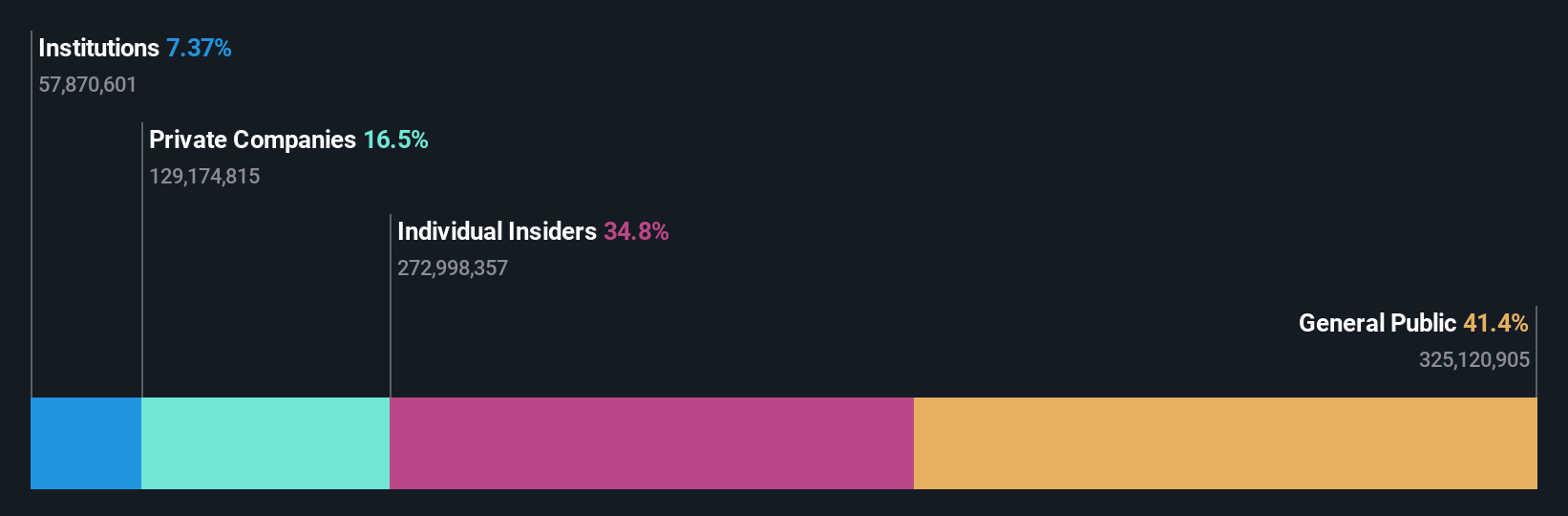

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hui Lyu Ecological Technology Groups Co., Ltd. operates in the ecological technology sector and has a market cap of CN¥15.94 billion.

Operations: The company generates its revenue from various segments in the ecological technology sector, with total figures provided in millions of CN¥.

Insider Ownership: 34.8%

Revenue Growth Forecast: 28.3% p.a.

Hui Lyu Ecological Technology Groups Ltd. demonstrates robust growth potential, with recent earnings showing a substantial increase in net income to CNY 51.72 million for the nine months ended September 2025. Revenue surged to CNY 1.08 billion from CNY 353.19 million year-on-year, and future revenue is expected to grow at an impressive rate of 28.3% annually, surpassing market averages. Despite a volatile share price and low projected return on equity, insider ownership remains significant without notable trading activity recently reported.

- Navigate through the intricacies of Hui Lyu Ecological Technology GroupsLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our Hui Lyu Ecological Technology GroupsLtd valuation report hints at an inflated share price compared to its estimated value.

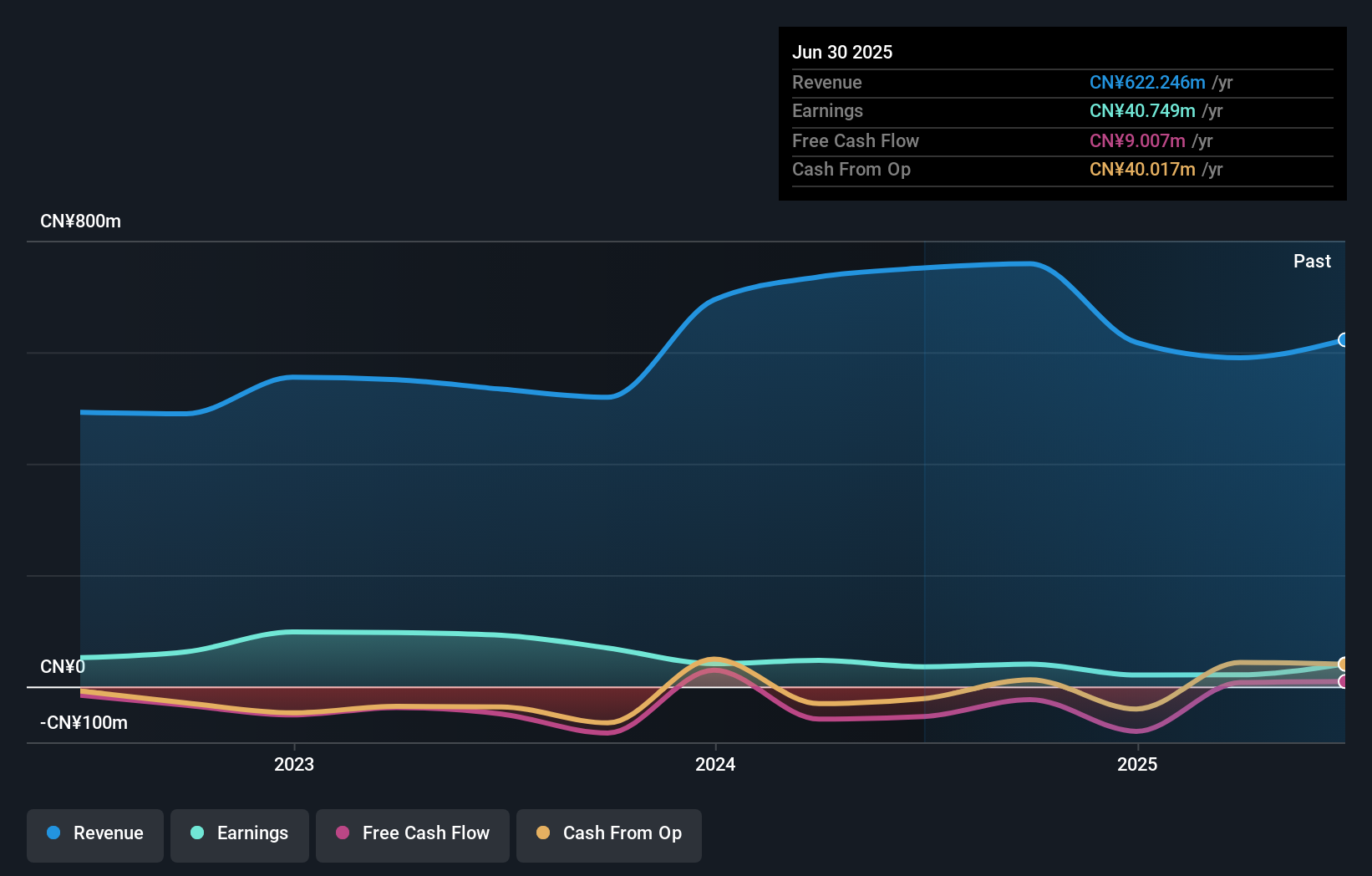

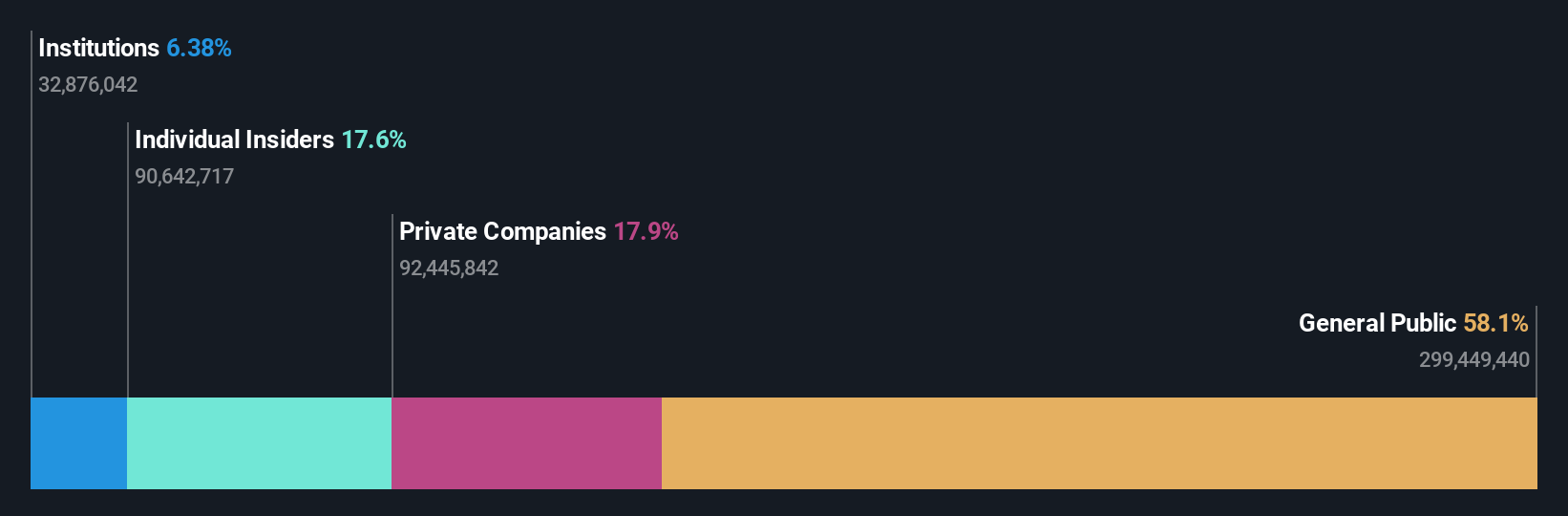

Kehua Data (SZSE:002335)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kehua Data Co., Ltd. offers integrated solutions for power protection and energy conservation both in China and internationally, with a market cap of CN¥29.02 billion.

Operations: Kehua Data's revenue segments include integrated solutions for power protection and energy conservation, serving both domestic and international markets.

Insider Ownership: 17.6%

Revenue Growth Forecast: 23.7% p.a.

Kehua Data showcases strong growth potential, with earnings for the nine months ending September 2025 rising to CNY 344.5 million from CNY 238.07 million year-on-year. Revenue increased to CNY 5.71 billion from CNY 5.39 billion, and future revenue is projected to grow at a rate of 23.7% annually, outpacing market averages. Despite recent share price volatility and a forecasted low return on equity of 17%, insider ownership remains substantial without significant trading activity reported recently.

- Click to explore a detailed breakdown of our findings in Kehua Data's earnings growth report.

- Upon reviewing our latest valuation report, Kehua Data's share price might be too optimistic.

Summing It All Up

- Embark on your investment journey to our 642 Fast Growing Asian Companies With High Insider Ownership selection here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報