Middle Eastern Dividend Stocks Including Dubai Islamic Bank P.J.S.C For Your Portfolio

As Gulf markets end mixed ahead of the anticipated U.S. Federal Reserve meeting, regional indices are showing varied responses to global economic cues, with Dubai's market appearing poised for potential gains. In this context, dividend stocks can offer a reliable income stream and stability amid fluctuating market conditions, making them an attractive option for investors looking to navigate the current economic landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.47% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.36% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.63% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.48% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.22% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.12% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.29% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.80% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.86% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

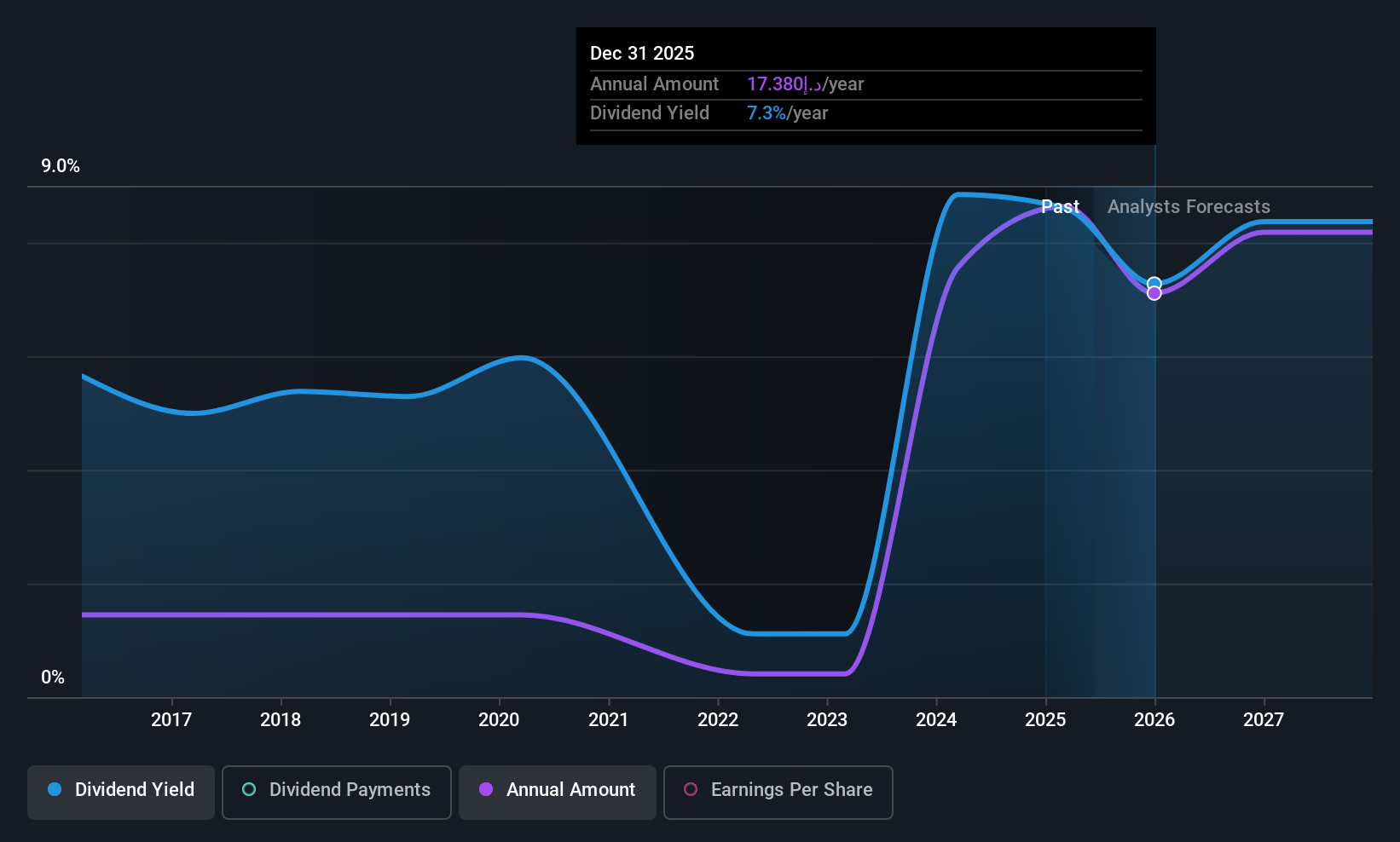

Dubai Islamic Bank P.J.S.C (DFM:DIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Islamic Bank P.J.S.C. operates in corporate, retail, and investment banking both within the United Arab Emirates and internationally, with a market capitalization of AED67.65 billion.

Operations: Dubai Islamic Bank P.J.S.C.'s revenue is primarily derived from Consumer Banking (AED4.63 billion), Corporate Banking (AED3.55 billion), Treasury operations (AED2.67 billion), and Real Estate Development (AED861.58 million).

Dividend Yield: 4.8%

Dubai Islamic Bank P.J.S.C.'s dividend payments have been volatile and unreliable over the past decade, though they have shown growth. With a payout ratio of 42.2%, dividends are well covered by earnings, which is forecasted to remain sustainable in three years at 47.6%. Despite a lower yield compared to top dividend payers in the AE market, its price-to-earnings ratio (8.8x) presents good value. However, high bad loans (2.9%) and low allowance for them (90%) pose potential risks. Recent earnings reports indicate stable net interest income growth but a slight decline in quarterly net income year-over-year.

- Dive into the specifics of Dubai Islamic Bank P.J.S.C here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Dubai Islamic Bank P.J.S.C is priced higher than what may be justified by its financials.

Mashreqbank PSC (DFM:MASQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mashreqbank PSC offers a range of banking and financial services to both individuals and corporates, with a market cap of AED48.75 billion.

Operations: Mashreqbank PSC's revenue is derived from several segments, including Retail (AED4.24 billion), Wholesale Banking (AED4.68 billion), Insurance & Others (AED3.49 billion), and Treasury and Capital Markets (AED1.30 billion).

Dividend Yield: 8.7%

Mashreqbank PSC's dividend yield is among the top 25% in the AE market, with a payout ratio of 51.8%, indicating dividends are covered by earnings and forecasted to remain so. Despite a volatile dividend history over the past decade, payments have grown. The bank trades below its estimated fair value, suggesting good relative value. Recent earnings showed stable net interest income but a slight decline in net income year-over-year, highlighting potential challenges ahead.

- Click to explore a detailed breakdown of our findings in Mashreqbank PSC's dividend report.

- Upon reviewing our latest valuation report, Mashreqbank PSC's share price might be too pessimistic.

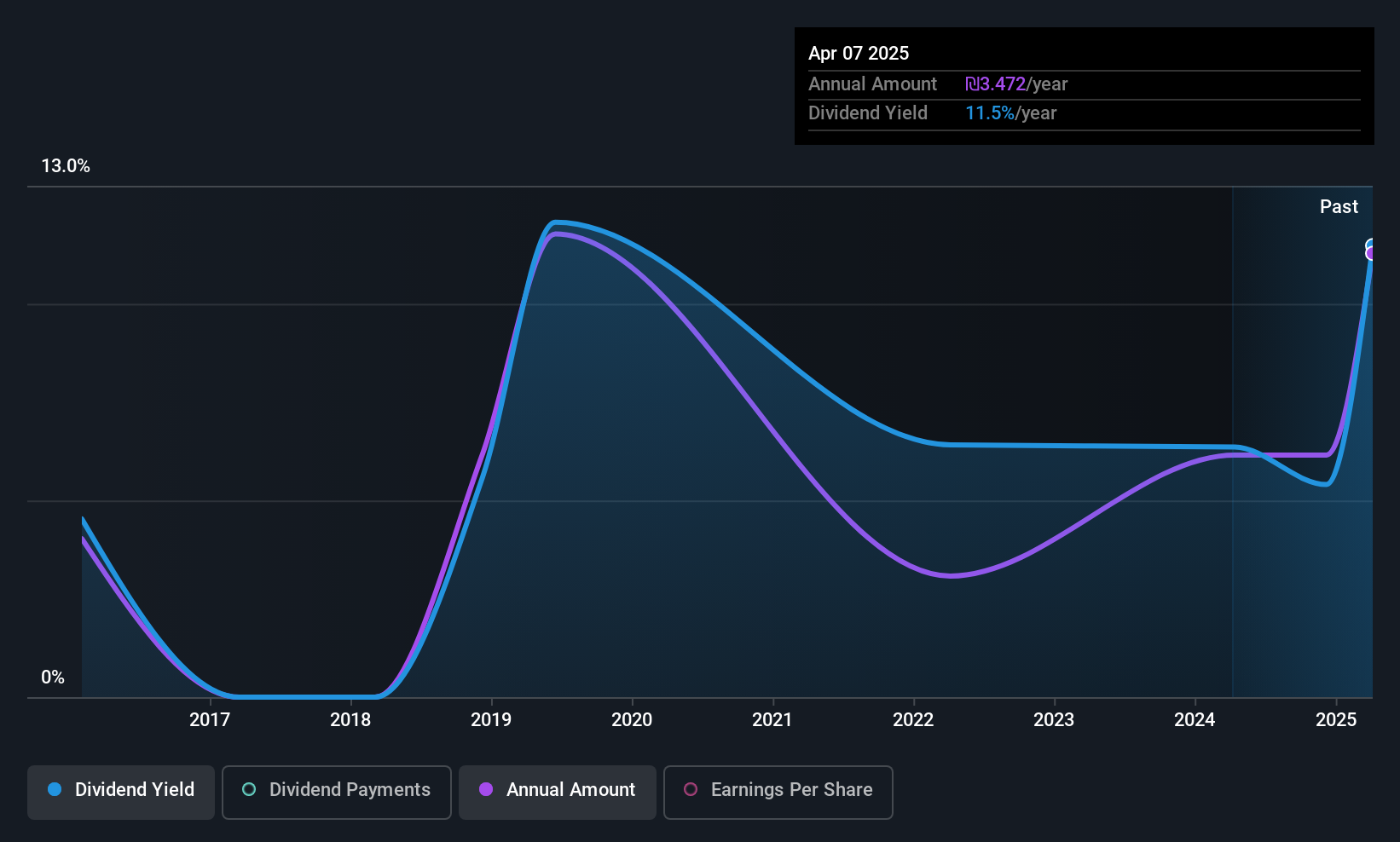

Gan Shmuel Foods (TASE:GSFI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gan Shmuel Foods Ltd. is an Israeli company that produces, markets, and sells citrus fruit, tomato, and other non-citrus fruit products with a market cap of ₪424.15 million.

Operations: Gan Shmuel Foods Ltd. generates revenue through its production and sale of citrus fruit, tomato, and other non-citrus fruit products in Israel.

Dividend Yield: 10.5%

Gan Shmuel Foods Ltd. offers a high dividend yield, ranking in the top 25% of IL market payers, with a sustainable payout ratio of 59.8%, covered by earnings and cash flows. Despite its attractive valuation—trading significantly below estimated fair value—the company's dividends have been volatile over the past decade. Recent earnings revealed decreased sales and net income for Q3, 2025, which may impact future dividend stability despite historical growth in payments over ten years.

- Get an in-depth perspective on Gan Shmuel Foods' performance by reading our dividend report here.

- According our valuation report, there's an indication that Gan Shmuel Foods' share price might be on the cheaper side.

Seize The Opportunity

- Gain an insight into the universe of 60 Top Middle Eastern Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報