Does HORIBA (TSE:6856)–Oasis Cross-Shareholding Hint At A Deeper Shift In Governance Priorities?

- In recent disclosures, it emerged that Horiba Ltd. and Oasis Management each hold more than 5% stakes in one another, with Oasis owning 9.90% of Horiba and signaling intentions to actively engage on portfolio management and potential significant proposals.

- This uncommon cross-shareholding between a listed company and an activist investor highlights the prospect of intensified governance scrutiny and potential shifts in Horiba’s corporate priorities.

- With Oasis Management signaling possible significant proposals, we’ll examine how this emerging activist presence could reshape Horiba’s investment narrative.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

What Is HORIBA's Investment Narrative?

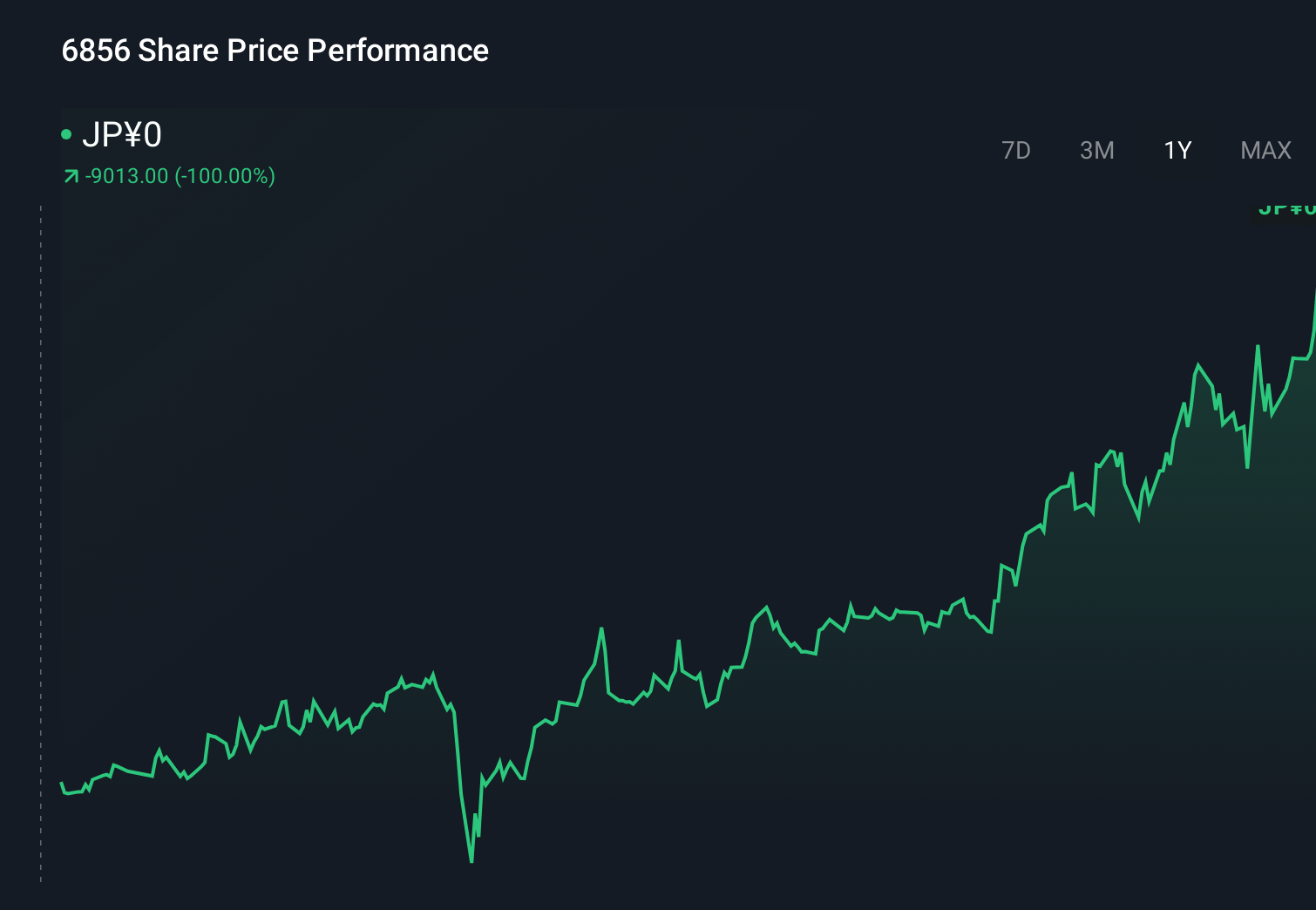

To own HORIBA, you need to believe in a solid, if unspectacular, earnings compounding story backed by high quality profits, disciplined capital returns and differentiated test and measurement technology in emissions and semiconductors. Near term, the key catalysts still look company specific: execution against 2025 guidance, Q2 and Q3 results, and how effectively HORIBA monetizes its EPA‑approved IRLAM NOx systems. The new cross‑shareholding with Oasis Management could become a swing factor at the margin. Given the already strong share price run and valuation slightly above the Japanese electronics average, any activist push on portfolio simplification, capital allocation or board composition could sharpen the focus on return on equity and governance risks, but the news alone does not yet rewrite the fundamental thesis.

However, board independence and activist pressure introduce governance questions investors should not ignore. HORIBA's shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on HORIBA - why the stock might be worth just ¥15750!

Build Your Own HORIBA Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HORIBA research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HORIBA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HORIBA's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報