Yoshinoya (TSE:9861): Assessing Valuation as Board Prepares to Review Organizational Restructuring

Board meeting puts restructuring and valuation in focus

Yoshinoya Holdings (TSE:9861) has flagged a November 27 board meeting to consider organizational restructuring, a move that often precedes strategic shifts in how a business allocates capital and runs its core brands.

For shareholders, the key question is whether any restructuring could unlock more value from a company whose shares are roughly flat over the past 3 months but still down over the past year, despite steady revenue and profit growth.

See our latest analysis for Yoshinoya Holdings.

The upcoming restructuring discussion lands after a muted year for the stock, with the latest share price at ¥3,078 and a negative 1 year total shareholder return. However, the 3 year total shareholder return above 30 percent shows the longer term story is still constructive and suggests any credible turnaround plan could reignite momentum.

If this kind of potential inflection point has your attention, it might be worth scouting other consumer facing names with momentum and insider confidence using fast growing stocks with high insider ownership.

With shares drifting despite double digit profit growth and the stock now trading above analysts’ targets, investors face a key dilemma: is Yoshinoya still undervalued, or is the market already pricing in future growth?

Price-to-Earnings of 47.1x: Is it justified?

On a trailing price to earnings basis Yoshinoya trades on 47.1 times earnings relative to a last close of ¥3,078, a premium that suggests the market is paying up for its profit profile compared to peers.

The price to earnings ratio compares the current share price with the company’s earnings per share and is a common way to gauge how much investors are willing to pay for each unit of current profit. For a mature, consumer facing business like Yoshinoya, this metric is particularly useful because earnings trends and margins tend to be more stable than in early stage sectors.

Against that backdrop, Yoshinoya’s 47.1 times multiple looks demanding, especially when set against the JP hospitality industry average of 22.9 times and an estimated fair price to earnings level of 24.7 times for the company. This gap implies investors are pricing in a much stronger earnings trajectory or strategic upside than both the sector and the fair ratio suggest, leaving limited room for disappointment if growth or restructuring outcomes fall short.

Explore the SWS fair ratio for Yoshinoya Holdings

Result: Price-to-Earnings of 47.1x (OVERVALUED)

However, stretched valuation and any underwhelming restructuring outcome could quickly reverse sentiment, particularly if revenue or margin growth shows signs of slowing.

Find out about the key risks to this Yoshinoya Holdings narrative.

Another view on valuation

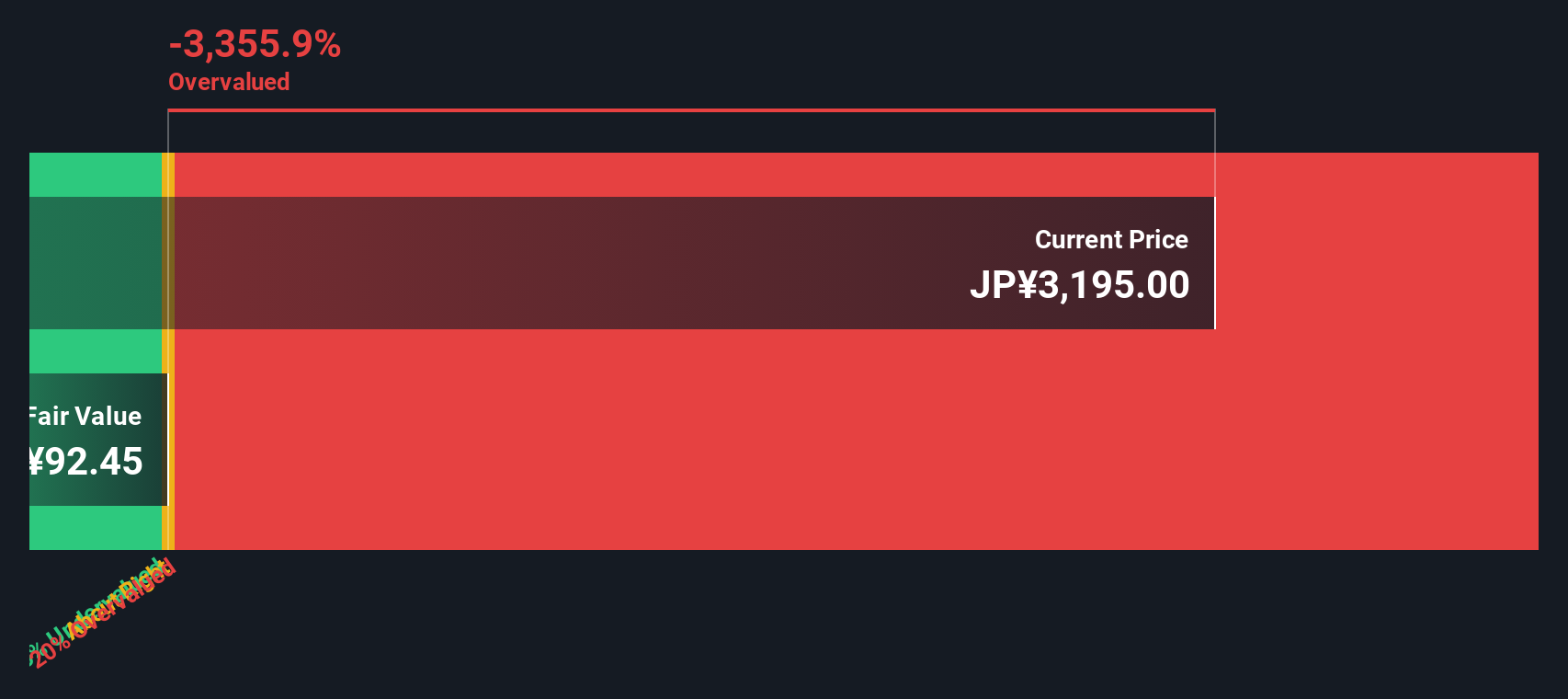

Our DCF model paints an even starker picture, putting Yoshinoya’s fair value at about ¥95.23 per share versus today’s ¥3,078. On this lens the stock looks deeply overvalued, raising the question: what exactly is the market paying up for here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yoshinoya Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yoshinoya Holdings Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Yoshinoya Holdings.

Looking for more investment ideas?

Do not stop at Yoshinoya when fresh, high conviction opportunities are waiting; use targeted screeners to pinpoint stocks that fit exactly how you invest.

- Capture potential market mispricings by running through these 903 undervalued stocks based on cash flows, which highlight companies that appear attractively priced relative to their cash flows and fundamentals.

- Explore structural shifts in medicine by focusing on these 30 healthcare AI stocks, which features businesses harnessing data and automation to support advances in diagnostics, treatment, and patient care.

- Review opportunities around digital assets by scanning these 81 cryptocurrency and blockchain stocks, which includes companies involved in the infrastructure, security, and platforms used in blockchain and related technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報