Corteva (CTVA): Reassessing Valuation After a Solid Year-to-Date Share Price Gain

Corteva (CTVA) has quietly outperformed many agriculture peers this year, and with the stock still about 10% below its past 3 months high, investors are reexamining whether recent gains fairly reflect its improving fundamentals.

See our latest analysis for Corteva.

At around $65 per share, Corteva has given investors a solid year to date share price return of roughly 16%, while its 1 year total shareholder return of about 10% suggests momentum is steady rather than explosive as markets reassess the company’s earnings resilience and crop cycle exposure.

If Corteva’s trajectory has you thinking bigger about agriculture and beyond, this is a good moment to widen the lens and explore fast growing stocks with high insider ownership.

With earnings rising faster than sales and the share price still trailing analyst targets, investors are left to weigh whether Corteva’s improving fundamentals remain underappreciated or if the market is already baking in the next leg of growth.

Most Popular Narrative Narrative: 16.2% Undervalued

The most widely followed narrative sees Corteva’s fair value above the recent 65.09 close, implying upside if long term earnings plans play out.

Advancements in Corteva's innovation pipeline, including premium trait launches (Vorceed, PowerCore), expansion of biological products, and gene editing, enable premium pricing, secure market share, and improve product mix. This translates into higher gross margins and earnings growth. Accelerated adoption of sustainable and eco-friendly agricultural inputs, supported by favorable policy shifts in gene editing and biofuels, positions Corteva for outsized growth as regulatory and consumer preferences move toward biological and reduced-chemical solutions. This can expand both revenue and addressable market over the long term.

Curious how modest revenue growth, rising margins and a richer earnings multiple together justify a higher price than today, and what assumption really drives it all?

Result: Fair Value of $77.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent crop protection price pressure and tougher environmental regulation could quickly erode margin gains and challenge assumptions behind that upside case.

Find out about the key risks to this Corteva narrative.

Another Angle on Valuation

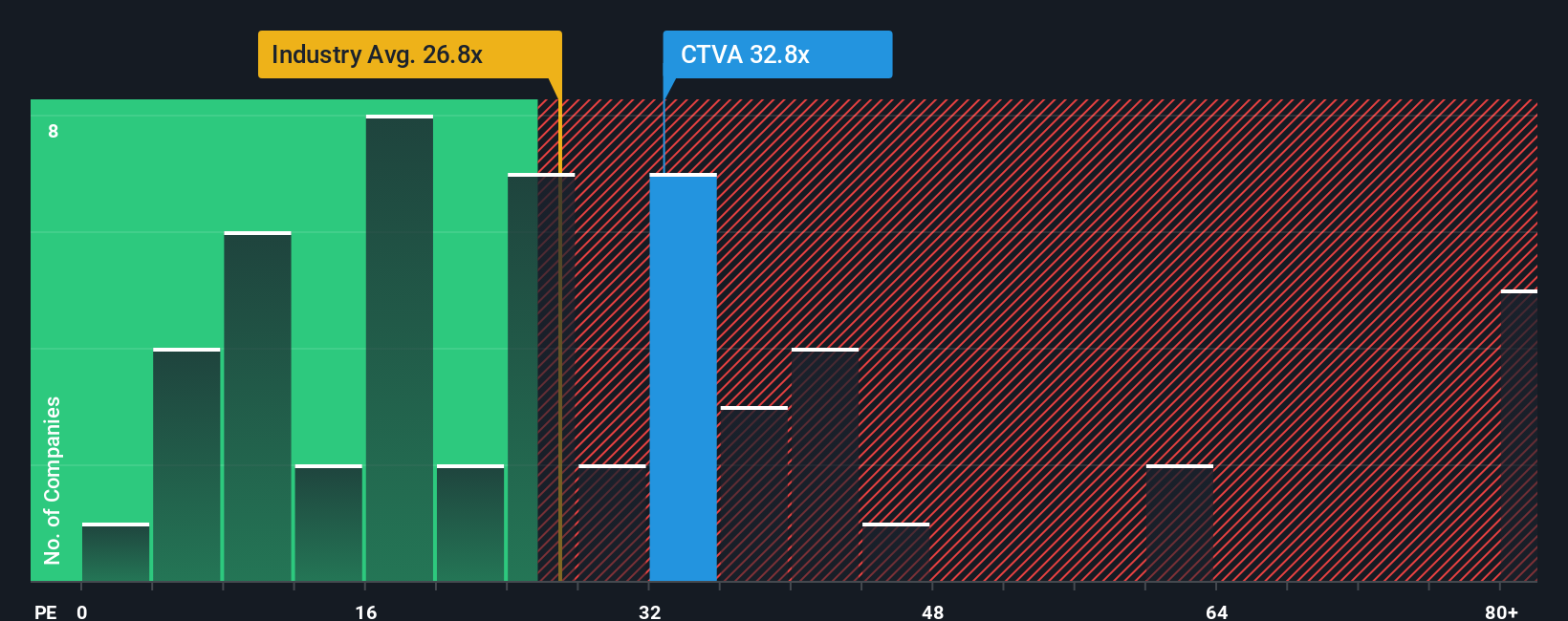

On earnings, the picture looks quite different. Corteva trades on about 26.2 times earnings, richer than both the US Chemicals sector at 23.4 times and its peer average at 13.4 times, and even above its own fair ratio of 24.8 times. This suggests limited margin for disappointment if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corteva Narrative

If you see the numbers differently or want to stress test your own thesis using our data tools, you can build a narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Corteva.

Looking for your next smart opportunity?

Before you move on, lock in your edge by scanning fresh ideas on Simply Wall St's screener so you are not the one catching up later.

- Capture potential bargains early by scanning these 903 undervalued stocks based on cash flows that markets may be mispricing based on future cash flows.

- Capitalize on structural tech shifts by reviewing these 27 AI penny stocks positioned to benefit from accelerating artificial intelligence adoption.

- Strengthen your passive income strategy by targeting these 15 dividend stocks with yields > 3% that offer attractive yields with room for sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報