Inspire Medical Systems (INSP) Is Up 14.0% After Medicare Boosts Reimbursement Rates Amid Lawsuits – Has The Bull Case Changed?

- The Centers for Medicare & Medicaid Services recently finalized 2026 rules that significantly increase reimbursement rates for Inspire Medical Systems’ obstructive sleep apnea treatment devices, prompting several analysts to upgrade their views on the company’s prospects.

- At the same time, Inspire faces securities class action lawsuits alleging it misrepresented demand and launch readiness for its Inspire V system, highlighting a tension between stronger reimbursement support and questions about execution quality.

- We’ll now examine how the sharply higher Medicare reimbursement, and resulting analyst optimism, may reshape Inspire Medical Systems’ investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Inspire Medical Systems Investment Narrative Recap

To own Inspire Medical Systems, you have to believe its implantable therapy for obstructive sleep apnea remains a differentiated solution that can grow procedure volumes and pricing over time. The sharp increase in 2026 Medicare reimbursement directly supports the near term revenue catalyst, but the Inspire V securities class actions keep execution and disclosure risk front and center, particularly around demand, center onboarding and the durability of investor confidence.

Among the recent developments, the finalized 2026 CMS rules stand out, with Medicare reimbursement reportedly rising by about US$10,000 per procedure and triggering multiple analyst upgrades. That kind of pricing support can magnify the impact of any eventual Inspire V rollout recovery, yet it also raises the stakes if launch issues, training delays or IT integration problems persist longer than investors currently expect.

However, investors should also be aware that the same Inspire V rollout now tied up in securities litigation could still...

Read the full narrative on Inspire Medical Systems (it's free!)

Inspire Medical Systems’ narrative projects $1.3 billion in revenue and $103.6 million in earnings by 2028.

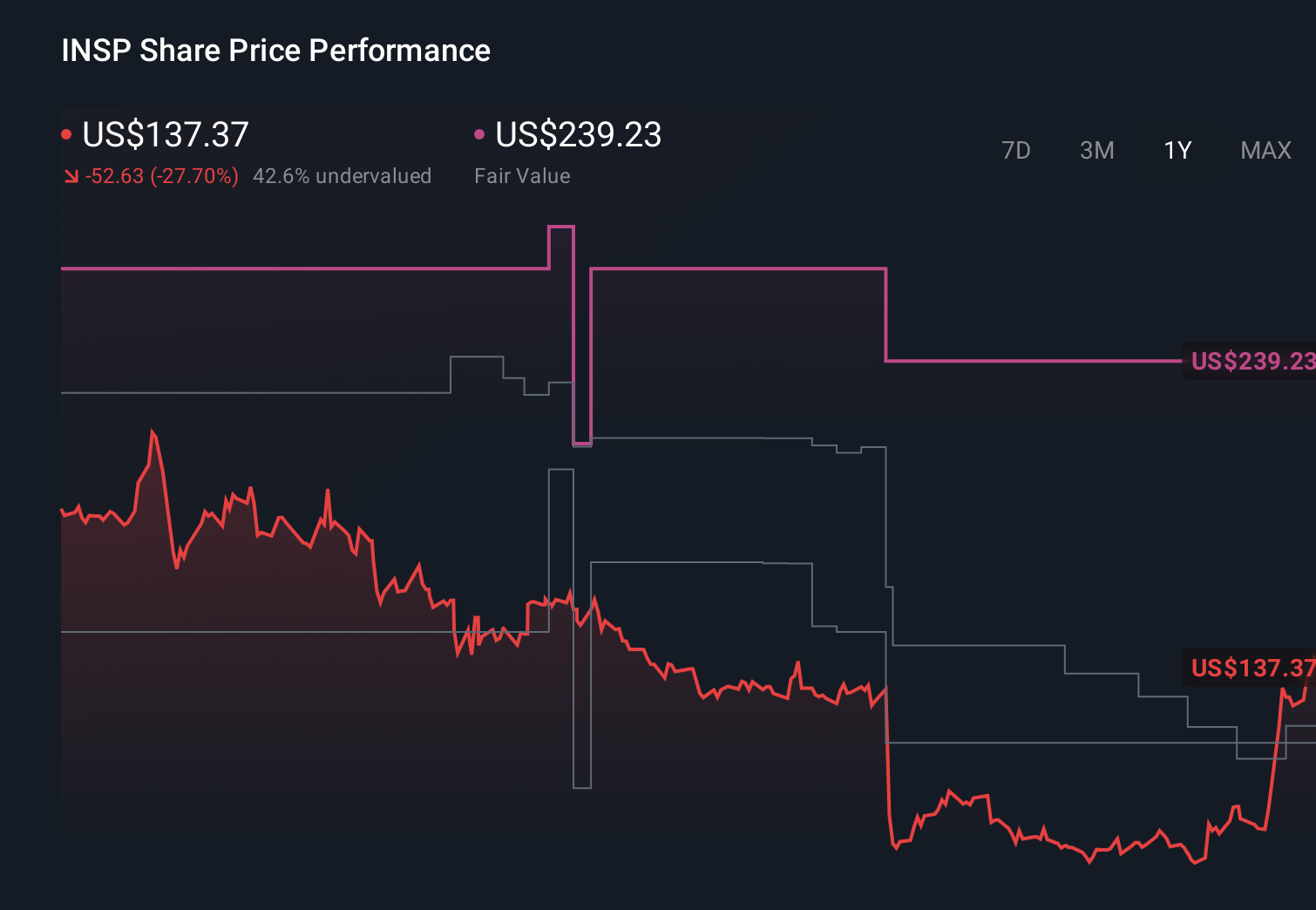

Uncover how Inspire Medical Systems' forecasts yield a $117.73 fair value, a 18% downside to its current price.

Exploring Other Perspectives

Nine Simply Wall St Community fair value estimates span roughly US$41 to US$271, showing just how far apart views on Inspire can be. You are weighing that dispersion against a story where higher Medicare reimbursement collides with unresolved questions about Inspire V execution and legal risk.

Explore 9 other fair value estimates on Inspire Medical Systems - why the stock might be worth less than half the current price!

Build Your Own Inspire Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspire Medical Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Inspire Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspire Medical Systems' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報