Slammed 32% Viviana Power Tech Limited (NSE:VIVIANA) Screens Well Here But There Might Be A Catch

Viviana Power Tech Limited (NSE:VIVIANA) shares have had a horrible month, losing 32% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 24% in the last year.

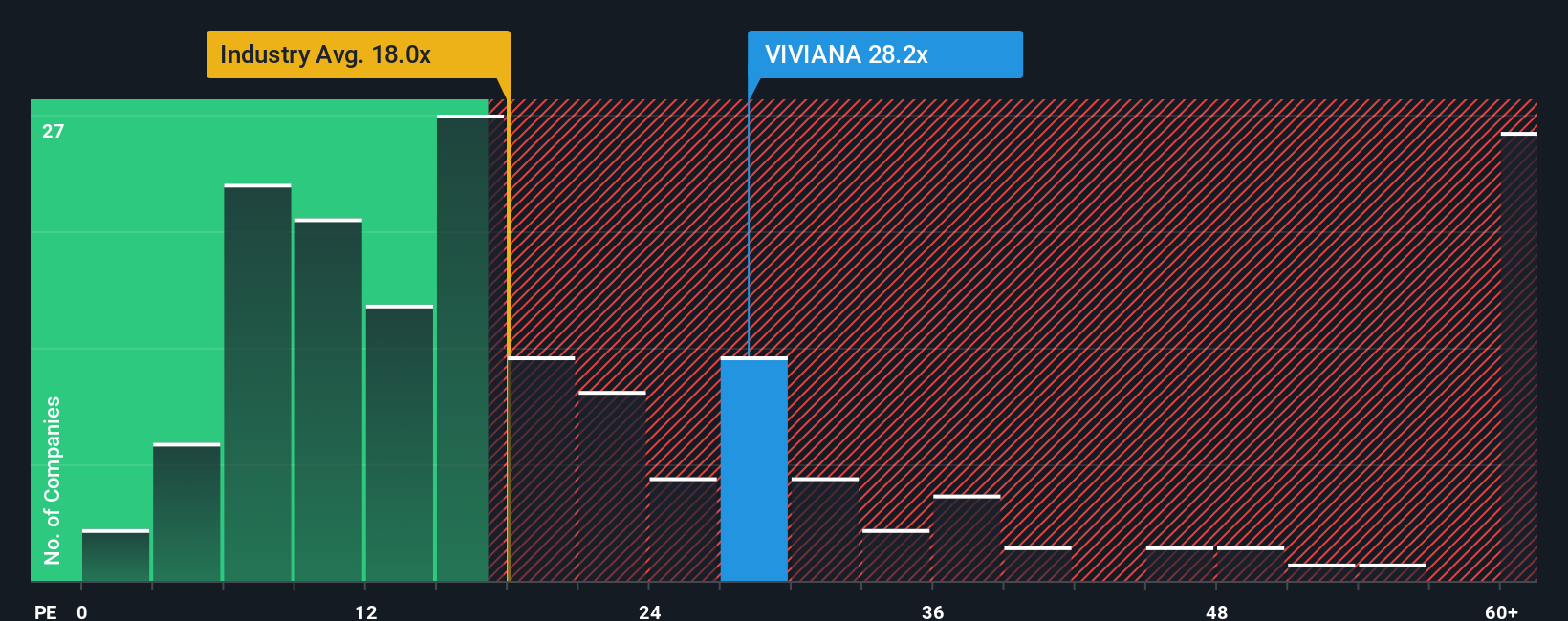

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Viviana Power Tech's P/E ratio of 28.2x, since the median price-to-earnings (or "P/E") ratio in India is also close to 26x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, Viviana Power Tech has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Viviana Power Tech

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Viviana Power Tech's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 180% last year. Pleasingly, EPS has also lifted 394% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Viviana Power Tech is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Viviana Power Tech's P/E

Viviana Power Tech's plummeting stock price has brought its P/E right back to the rest of the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Viviana Power Tech currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Viviana Power Tech has 4 warning signs (and 3 which are significant) we think you should know about.

If you're unsure about the strength of Viviana Power Tech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報